-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD Nudges Up, USD/JPY Supported BY Higher Yield Differential

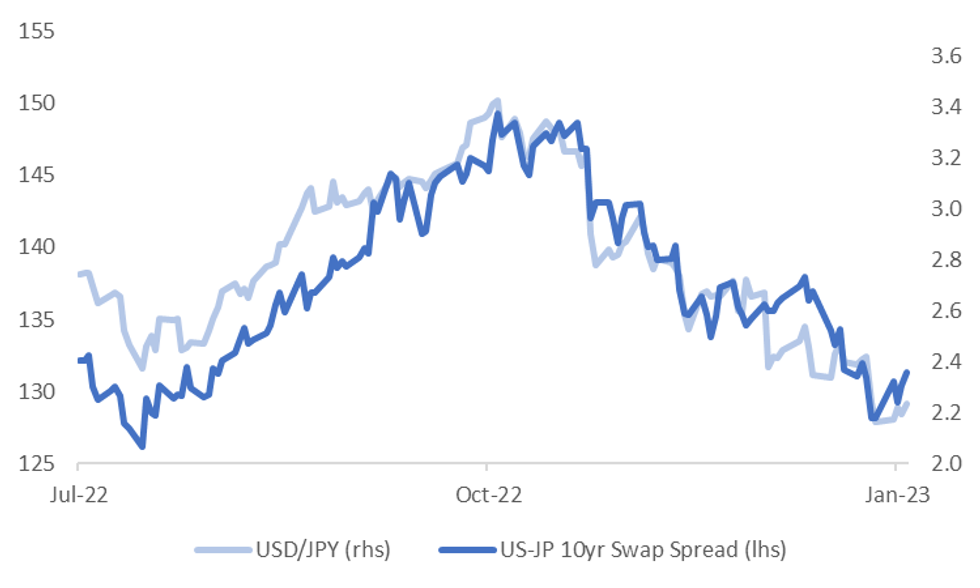

The USD indices (DXY, BBDXY) are both around 0.10% higher for Friday's session so far. This keeps us comfortably within ranges seen since the start of the year. Yen weakness has been prominent, with a firmer US cash Tsy yield backdrop helping USD sentiment.

- USD/JPY is back to the 129.15/20 levels, fresh highs going back to the Wednesday's session, when the pair was unwinding its post BoJ bounce. For the week we are up 1.10% at this stage. Yield momentum is edging back in the USD's favor, +236bps for the 10yr swap spread, we were around +218bps this time last week.

- AUD/USD got above 0.6930, but is a touch lower from these levels currently, last around 0.6920/25. Commodity prices remain supportive, iron ore up to $126/ton, but correlations haven't been as firm with the A$ this past week, with yield spreads and equities ranking higher. Next week there will be strong focus on Q4 CPI out on Wednesday.

- Trade ministers from Australia and China could also meet soon, after a further break through at this week's Davos gathering in a sign of improving relations.

- NZD/USD is around 0.6415 currently, with dips below 0.6400 supported for now. Like AUD, the focus next week will be on Q4 CPI, due out on Wednesday as well.

- Other pairs are mostly range bound so far today. Looking ahead, UK and Canadian retail sales data will be published on Friday, as well as U.S. existing home sales. There remains potential for commentary from central bankers and politicians in Davos. Most notably, ECB’s Lagarde will be participating in a panel discussion titled "Global Economic Outlook: Is this the End of an Era?," although she has already provided some steer on monetary policy settings this week.

Fig 1: USD/JPY Versus US-JP 10yr Swap Rate Differential

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.