-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUSD, Still Beaming

The DXY pushed close to 105.00 during the NY session, which is fresh cyclical high. We are weaker today as equities show some stability, but week to date gains stand at +1.00%, following last week's 0.68% gain. This would mark the 6th straight week of USD gains. Last week we noted that the USD was benefiting from the smile theory. See this linkfor more details and also see, MNI Global Macro Outlook - May 2022: USD Breakout Implications.

- Last week's post FOMC dip in the USD is now a distant memory. It continues to enjoy broad based support.

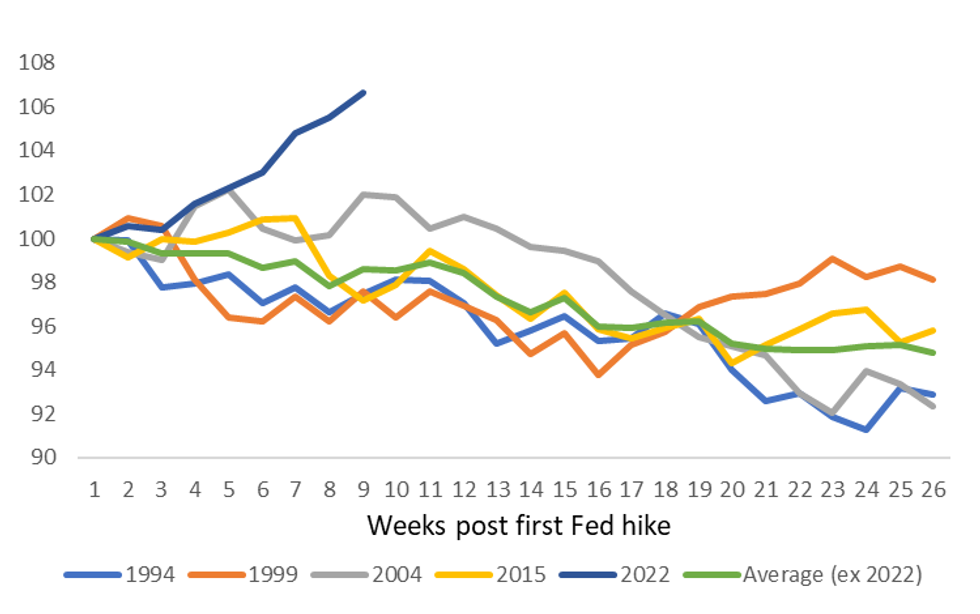

- The DXY has now added ~6.5% since the first Fed hike of the current tightening cycle, clearly bucking the normal trend, see the first chart below

Fig 1: DXY Performance Post The Onset Of Fed Tightening Cycles

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

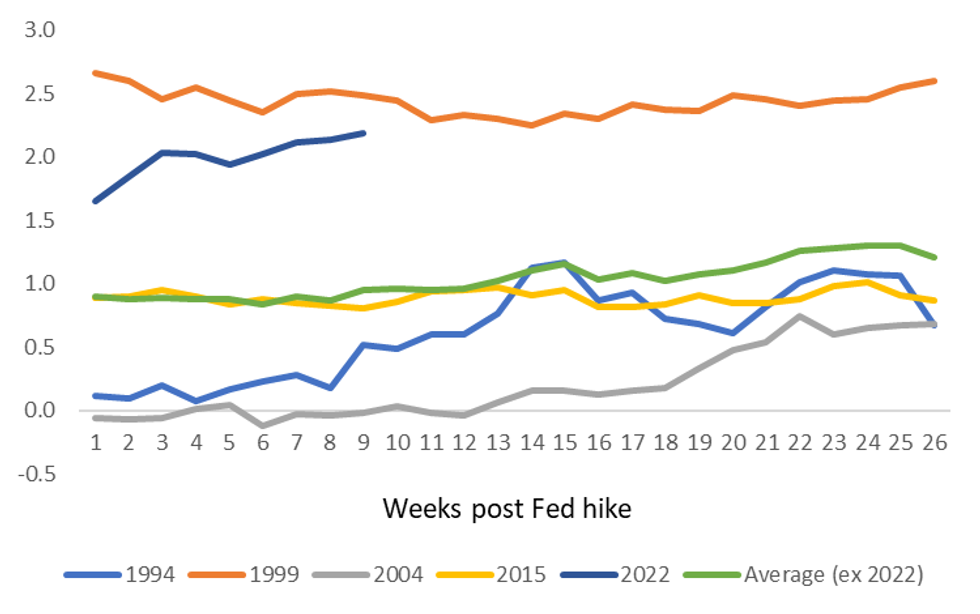

There has been a plateauing in Fed hiking expectations, which has seen USTs move off recent highs. Still, the general direction has remained favorable, see the second chart below. On a 2 year basis, the spread has moved 12bps in the USDs favor in the past week against the EUR, 18bps against GBP, but -14bps against JPY.

- This has been reflected in relative FX performance over the past week, with the USD gaining more against EUR and GBP, while easing modestly against JPY. As we noted yesterday, a flatlining of US Fed tightening expectations risked taking away a key source of support for USD/JPY.

- U.S. monetary policy tightening should still lead the way in the near-term, at least vs. G3 counterparts. This was one of pillars of USD support we noted last week.

Fig 2: Yield Differential Still In USD's Favour (2yr tenor, unweighted average against G3)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

The other key driver of USD outperformance, continued risk aversion in equities/concerns around the global slowdown, also remains in place.

- Global growth forecasts haven't moved a great deal further to the downside in the past week, at least according to the Bloomberg consensus, although risks clearly remain to the downside.

- This, coupled with continued equity market risk aversion, has arguably had a bigger influence on higher beta G10 FX performance over the past week e.g. AUD & NZD.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.