-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessVirus Wave Weighs On Growth Outlook, Gov't Prepares New Stimulus Package

Spot USD/THB last trades +0.070 at THB31.173, testing the neckline of the double top pattern charted recently. A clean break here would open up Apr 26 high of THB31.493 & Apr 12 high of THB31.575, with bulls cognisant of the golden cross formed a few days back. Conversely, bears look for a fall through Mar 26 low of THB31.060, towards the 50-DMA at THB30.890.

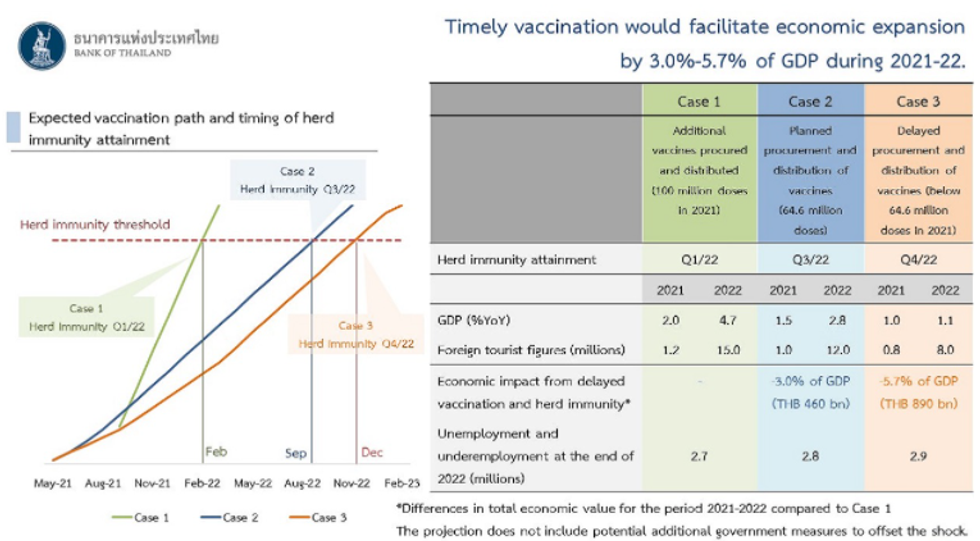

- The BoT unanimously decided to leave the main policy rate unchanged at the historical low of 0.50%, looking through multiplying coronavirus cases and resultant restrictions. However, they recognised fresh risks to the current growth outlook and said GDP may rise just 1-2% Y/Y (depending on when Thailand achieves herd immunity, which will affect reopening tourism) rather than 3% projected earlier.

- Worth noting that the BoT announcement came on the heels of a decent beat in Thai Apr CPI, which registered at +3.41% Y/Y after 13 straight months of deflation. Base effect, expiry of gov't utility subsidies and pork supply shortage boosted the headline index.

- Also on Wednesday, the gov't gave a preliminary nod to a new stimulus package, which includes extensions of two cash handouts programmes by a month, which would cost THB85.5bn as well as THB140bn in spending for co-payment & e-voucher schemes. PM Prayuth said that second-phase measures will be implemented "once the outbreak is contained possibly during July-December," will cost ~THB225bn, cover north of 51mn people and generate THB473bn in the economy.

- Worth noting that the cabinet also ok'd cuts in electricity and water charges for most users during May & June, which may weigh on the coming CPI readings.

- The BoT's consumer confidence gauge comes out later today, after business sentiment index released yesterday fell to 46.0 in Apr from 50.1. Looking further afield, focus moves to Friday's update on foreign reserves.

- USD/THB 1-Month NDF trades +0.015 at THB31.154 at typing, with the 50-DMA at THB31.082 providing firm support despite the recent formation of a double top pattern. Bulls keep an eye on yesterday's peak at THB31.263.

Fig. 1: Estimated Relationship Between Vaccination Path & Economic Expansion

Source: Bank of Thailand

Source: Bank of Thailand

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.