-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - CNH Slippage Puts Rate in Range of Record Lows

MNI China Daily Summary: Tuesday, December 31

Wage Growth Plateauing (And Broadening) At a High Level (2/2)

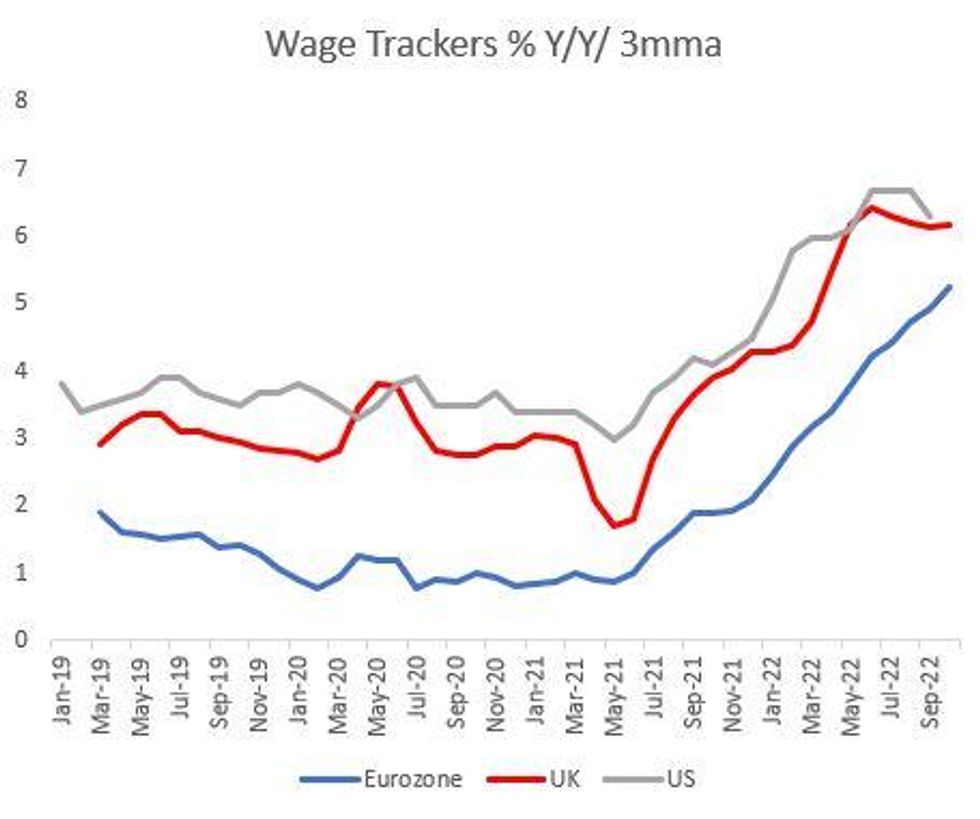

The rise of wage growth above pre-pandemic levels is obviously a concern for central bankers who generally see overly tight labor markets as an obstacle to getting inflation back to target.

- While Fed Chair Powell said last week he didn't see a wage-price spiral, he noted "wages aren't coming down. They're just moving sideways at an elevated level". Similarly, ECB Pres Lagarde noted in late October that incoming data "indicate that the growth of wages may be picking up".

- Multiple indicators, including the CBI's new dataset, point to Eurozone wage growth plateauing at a high rate (Lagarde may be looking at more backward-looking data). Their report also cites the Atlanta Fed's US Wage Tracker, which is similar but tracks individuals' wages rather than wages in job postings.

- Comparing the measures (see chart), the trans-Atlantic trend is clear: current wage growth is far higher than pre-2021, though is still struggling to keep pace with inflation at/near double-digits.

- There is little sign of a significant slowdown in Europe, and forward looking indicators suggest that US wage growth is set to remain above pre-pandemic levels well into 2023. An acceleration in Eurozone wage growth may prove more reliant on negotiated settlements; ongoing German metalworker union talks could be a near-term bellwether in this respect.

Sources: Atlanta Fed, CBI, MNI

Sources: Atlanta Fed, CBI, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.