-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

Will Offshore Equity Inflows Rollover?

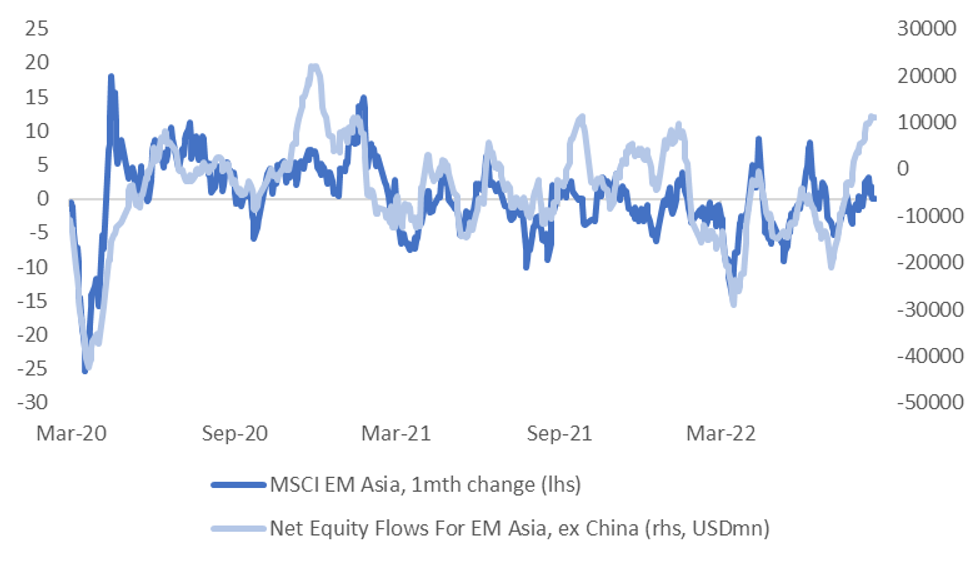

In the past trading month, net equity flows have been strong for major EM Asia economies (ex China). The first chart below plots the rolling 1 month sum of net inflows across India, South Korea, Taiwan, Indonesia, Thailand, the Philippines and Malaysia. The other line on the chart is the rolling 1 month rate of change for the EM Asia MSCI index.

- There are a few observations to be made. Firstly, in recent years, net inflow momentum hasn't got much beyond the $10bn mark over a rolling 1 month sum. Late in 2020 was the exception.

- Inflow momentum typically has a fairly strong positive correlation with underlying equity market performance, which has just started to falter slightly for the region. The MSCI EM Asia index is now down on levels that prevailed a month ago.

Fig 1: EM Asia Net Equity Flows (Ex China) & MSCI EM Asia

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

- It might be difficult to expect a further sharp rise in net equity inflow momentum, given headwinds to the global growth outlook (recessionary fears) and the Fed still with work to do from an inflation standpoint.

- The table below presents the net inflow picture by country for the past trading month. India is the standout, followed by South Korea.

- Even for countries like Thailand, net inflows look much better relative to averages for 2022 in the past month. The Philippines and Taiwan have seen net outflows, although in Taiwan's case the pace of net outflows is much lower compared to trough points in 2022.

- A rollover in net equity inflow momentum may add pressure to what is already a stressed FX backdrop for some of these markets.

- USD/KRW is breaking higher to levels last seen in 2009, while USD/INR is threatening to move above 80.00.

Table 1: Net Equity Inflows By EM Asia Economy (Ex China), Past Month

| Country | USDmn |

| India | 7397.7 |

| South Korea | 2723.4 |

| Thailand | 1432.6 |

| Indonesia | 439.3 |

| Malaysia | 359.3 |

| Philippines | -131.3 |

| Taiwan | -681.9 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.