-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI China Daily Summary: Tuesday, December 10

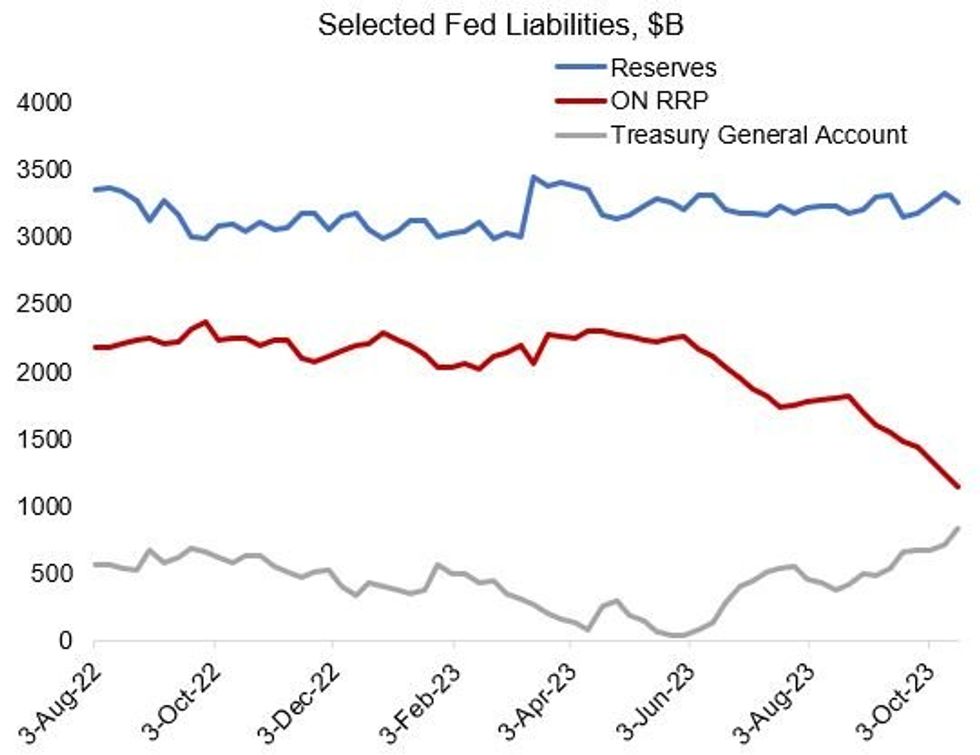

Will Reserves See More Pressure Post-Refunding? (3/3)

Treasury's Oct 30 financing requirements announcement ahead of the Nov 1 refunding announcement will provide a further indication as to the trajectory of the TGA (and potentially ON RRP and reserves) over the coming months.

- At the August refunding, Treasury pencilled in a $650B end-Sept cash balance, rising to $750B by end-Dec. That’s been met: the TGA ended Sept at $657B, and as of Oct 18 was $841B. The latter comes as Treasury somewhat unexpectedly boosted bill auction sizes.

- Under current trends, MNI expects the end-Dec cash projection to be revised up to above $800B, potentially to $850B. This likely implies larger bill issuance than looked likely to be the case earlier in the year, alongside larger than expected fiscal deficits and an apparent desire simply to run a higher cash balance in order to ensure sufficient funds on hand.

- That will also likely mean further reduction in ON RRP balances for the rest of the year. Continued inflows into government money market funds (net assets hitting a record $4.7T this month, up nearly $200B since end-May), largely by retail investors, suggests appetite to absorb new bills, notably at longer tenors than available parked overnight in ON RRP, as the Fed’s hiking cycle is increasingly seen near and end.

- Bill issuance will tail off in 2024 – it’s been unusually high in the past 4 months due to the post-debt limit Treasury cash rebuild – but ongoing issuance and QT means that it would be surprising if reserves stayed well above $3T by year-end.

- MNI’s full refunding preview – which focuses on the recommended financing schedule for the coming quarters, namely changes to nominal Treasury coupon auction sizes - will be out Oct 31 ahead of the Nov 1 announcement, but we will provide a short preview of expectations for the Oct 30 financing announcement ahead of the release.

Source: Federal Reserve, MNI

Source: Federal Reserve, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.