-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessWill The Loan Prime Rates Fix Lower Today?

A quick look at the BBG survey covering today’s PBoC loan prime rate (LPR) fixings points to a 5bp reduction in both the 1- & 5-Year rates, to 3.65% & 4.55%, respectively. 9 of the 23 surveyed by BBG look for such a move in the 1-Year fixing, with 6 looking for a 10bp cut and the remaining 8 looking for no change. When it comes to the 5-Year fixing it seems to be a closer call, with 9 looking for no change (the modal outcome of the survey), 8 looking for a 5bp cut and 2 looking for a 10bp cut.

- A reminder that the PBoC left the rate applied to its 1-Year MLF unchanged earlier in the week, which seemed to disappoint some (even though the median view moved to no change in rates applied to using the MLF after last week’s hotter than expected inflation data), alongside a basic rollover of the funds maturing, making it a net neutral liquidity event.

- While a move in the MLF is deemed to be a precursor for the move in the LPR fixings, it is not a prerequisite.

- Several interest rates are dealing well below LPR levels e.g. the weighted average rate for new deposits fell 10bp at the end of April, to 2.37%, according to the PBoC, and the yield on AAA-rated negotiable certificate of deposits (NCD) has fallen to ~2.30%.

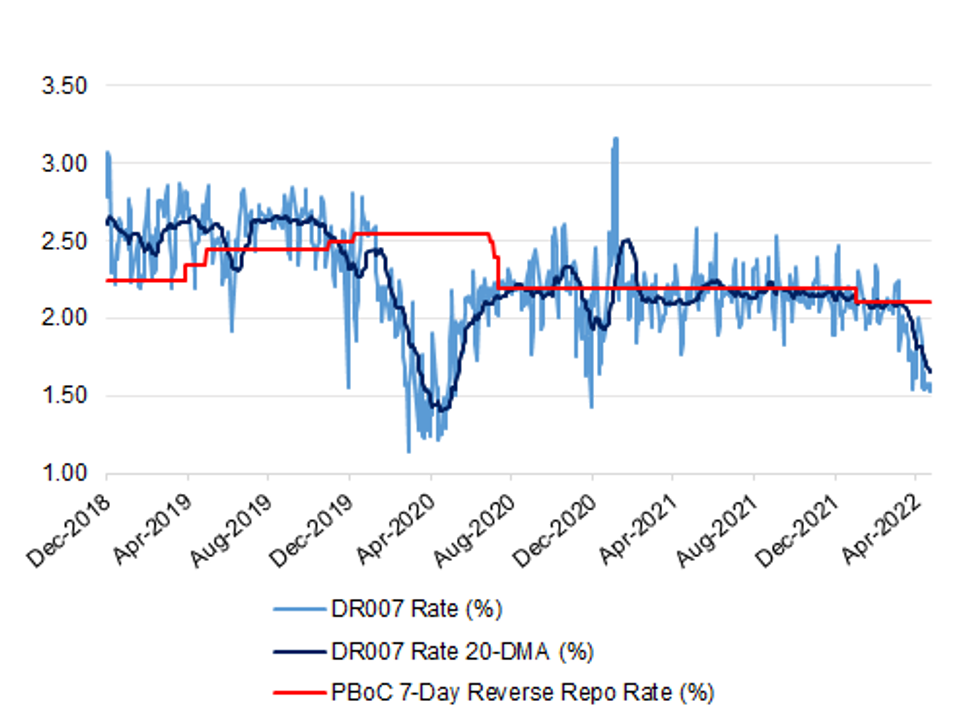

- Elsewhere, the weighted DR007 rate has pulled comfortably below the 7-day reverse repo rate, with the 20-DMA of the former running at ~1.65% vs. the latter, which stands at 2.10%.

- A reminder that April’s credit data provided a notable downside surprise, with the PBoC flagging the well-documented COVID lockdowns and rising input costs as hinderances to credit demand. Geopolitical fears may have also fed into the lack of demand for credit.

- The PBoC has reaffirmed its commitment to providing ample liquidity, with some analysts pointing to a narrowing window for policy action, given the U.S. Federal Reserve’s “expeditious” tightening cycle and the recent uptick in Chinese inflation. On the other side of the argument, some point to ever more limited transmission of lower policy rates during times when COVID lockdowns are in play & at current interest rate levels, while calling for more easing on the fiscal side.

Fig. 1: China DR007 Rate Vs. 7-Day Reverse Repo Rate (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.