-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

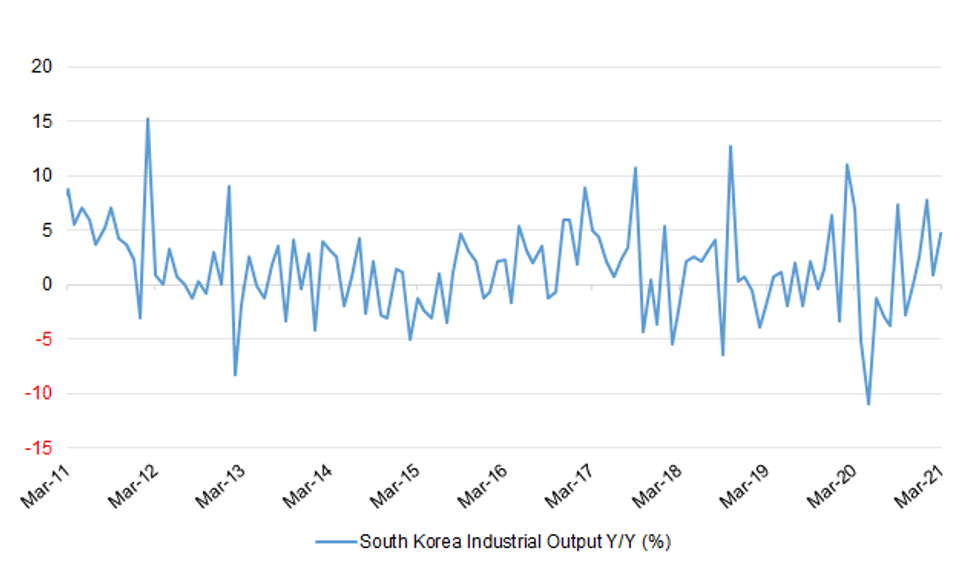

Free AccessWon Trades Firmer After IP Data, South Korea Extends Social Distancing Rules

Spot USD/KRW re-opened on a softer footing following the release of the March industrial production report out of South Korea. The pair last trades at KRW1,107.85, marginally lower on the day.

- South Korea's industrial output rose 4.7% Y/Y (BBG est. was +4.5%), but shrank 0.8% M/M (BBG est. was -0.5%).

- Yonhap reported, citing acting PM Hong, that South Korea has extended the current social distancing measures by three weeks.

- South Korea reached another milestone in its inoculation campaign as it vaccinated more than 3mn people yesterday. The authorities aim at achieving herd immunity by November.

- White House spox Psaki said that South Korean Pres Moon will visit DC for talks with U.S. Pres Biden on May 21.

- The latest poll by Embrain Public/Kstat Research/Korea Research/Hankook Research on support for presidential hopefuls saw Gyeonggi Province Gov Lee was leading ex-Prosecutor General Yoon, albeit only by 1pp. Pres Moon's approval rating was at 38%, with 56% of respondents expressing disapproval.

- Looking ahead, South Korea's latest trade data hit the wires on Saturday. Next week, focus turns to Markit M'fing PMI (Monday), CPI (Tuesday) & BoP current account balance (Friday).

- Vice FinMin Lee said April CPI, which is due next week, is expected to top 2% Y/Y owing to the base effect. Nonetheless, Lee said annual inflation shouldn't exceed the 2% target.

- Bears need a fall through yesterday's low of KRW1,105.75, before taking aim at Feb 22 low of KRW1,103.40. Bulls look for a rebound above Apr 23 high of KRW1,120.80.

Fig. 1: South Korea Industrial Output Y/Y (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.