-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

Woolworths (WOWAU 28s; Baa2, BBB; S) {WOW AU Equity}

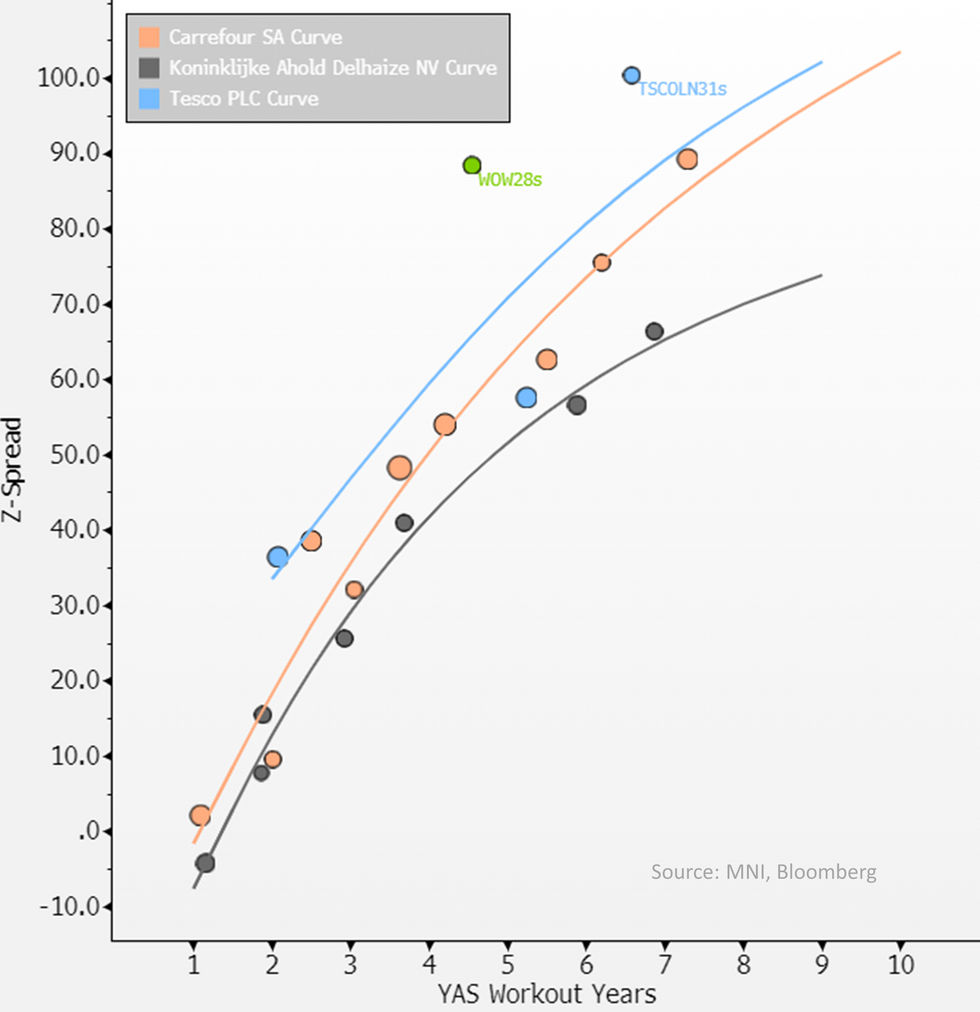

Not many bonds trade so range-bound RV tends to look like a free-lunch at the wides; this time its pushing 3yr highs on spread vs. Tesco - equal parts Tesco29s being bid well tight & WOWAU28s facing sellers/moving wider. We've touched on Tesco29 tightness previously - 31s/flatteners screen cheap here/at wides. WOW28s sell off is our focus below. We have a strong screen cheap view on the WOWAU28s, 3Q results come tomorrow - not a mover for credit/us.

- Concerns we've heard are focused on the 1) ACCC (competition body) & Senate Inquiry into Aussie grocery pricing among the two majors Woolworths (~35% market share) & Coles (28% ) & 2)recent CEO departure which followed what the media termed a "train-wreck" interview.

- We see little impact from senate inquiry (often yield nothing & tend to be for the cameras) & the CEO departure - on latter mgmt clarified in Feb earnings "we started the process really last year” & replacement CEO is internal & seems highly regarded. Arguably a positive rotating the face of senate inquiry/political backlash out of the co.

- On the impact of ACCC inquiry - hard to ascertain - any is likely to be shared equally by the two majors. Aussie Food is 75% of WOW revenues but over 90% on EBIT given higher margins - which is what's in focus right now. Its other segments are NZ business & BIG W - the (challenging) general discount retailer.

- Net ACCC changes may compress margins - positive is WOW is coming off high 6% base (Coles at 4.8%) vs. the mid 5's its run in previous years on consistent reinvestment into the business efficiencies.

- Federal election is expected to be a year away so hard to see relief from that but easing inflation is likely to help move public & political focus away from them.

Stepping back we question how much of above is relevant for credit particularly on a 4y/'28 line. Woolworths generates AUD $65b+ (€40b+) in sales/yr and FCF of A$1-2b/yr (~€600m-€1.2b) - that's against A$2.9b (€1.8b) in net debt levered 2.5x at the end of 1H24 - Moody's sees a significant 1.3x headroom on ratings - its only held off on a upgrade given mgmt not explicitly committing to keeping leverage within Baa1 rating thresholds.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.