-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - USD Firmly Bid Ahead of FOMC Mins

MNI US OPEN - Trump’s Envoy Says Hostage Deal With Hamas Close

World Industry Decelerates In September, Mixed Outlook For EM vs DM (1/2)

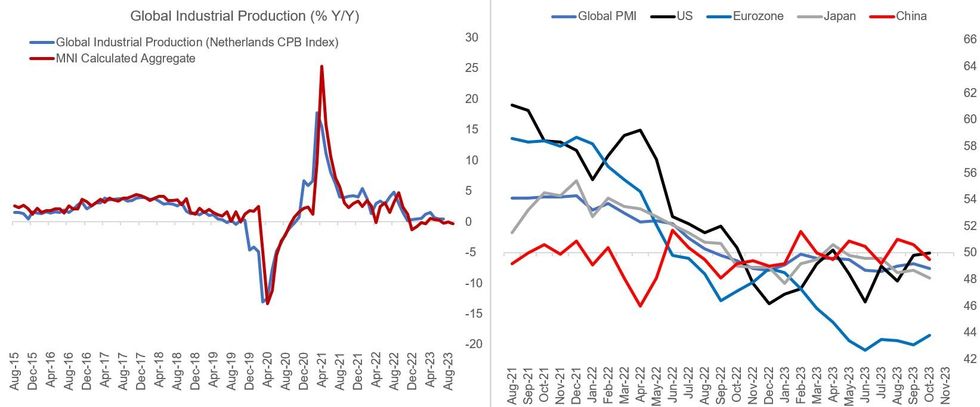

Global industrial production decelerated in September, even as trade volumes picked up, per the Netherlands CPB release out earlier today.

- Global IP volumes (by production weights) peaked in February this year and have only slowly recovered from Q2 lows - thanks mostly to emerging market production picking up as advanced economies have sputtered.

- September's 0.2% M/M rise in global IP was a slowdown from 0.6% in August but the 4th month in 5 of sequential expansion. Strength has been led by emerging markets which have on aggregate seen IP expand in 4 of the past 5 months, including 0.5% M/M in September (a deceleration from 0.9% prior), let by China (+1.0% vs +1.3% prior).

- Among developed economies, where IP dipped for the 3rd month in 5 (at -0.1% vs +0.3% prior), the Eurozone was the weakest link in September at -1.0% M/M (vs +0.4% prior), taking over the reins as biggest dragger from Japan which saw a 3rd consecutive monthly contraction but a smaller one than in August (-0.2% vs -0.5%).

- The CPB's estimate is close to MNI's tracking estimate of global IP, which indicates a further strength in emerging market IP in October (led by emerging Asia) based on early data, with some weakness Y/Y in the US (eurozone data is out next month).

- Global manufacturing PMIs paint a more mixed picture, relapsing slightly in October to 48.8 vs a nascent rise in the previous 2 months (Sept was 49.2), so the manufacturing sector is still in mild contraction - though it was actually EMs that led the way lower, down 0.8pp to 50.1 on weaker China and India figures, with DMs ticking up 0.1pp to 47.5. November flash figures for Europe were more encouraging but still contractionary (and the US's relapsed into <50 territory).

- Overall there doesn't appear to be much momentum in global industry as a whole, with more signs of life out of EM for now - though Eurozone industry has begun showing signs of bottoming.

Source: CBP, MNI, S&P Global/Markit

Source: CBP, MNI, S&P Global/Markit

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.