-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

Rupiah Buffeted By Internal And External Headwinds

In the past 5 trading sessions, IDR is down 0.80% against the USD, the worst performer within the major EM Asia FX bloc.

- Spot USD/IDR is looking to break above 14700, while the 1 month NDF is already through this level. This is the highest level observed since late 2020.

- Yesterday's much better than expected trade figures, a surplus of $7560mn, versus $4000mn expected, provided little relief.

- The market is likely looking forward, with May data to be more heavily impacted by the palm oil export ban and softer China demand for commodities.

- In any event, the bumper trade surplus in April did little to arrest the slide in BI's FX reserves in the month. Valuation effects were no doubt in play during the month but headline FX reserves have now declined by more than $10bn since last November. Headline FX reserves are now back to $135.7bn, which represents the lowest level seen since November 2020.

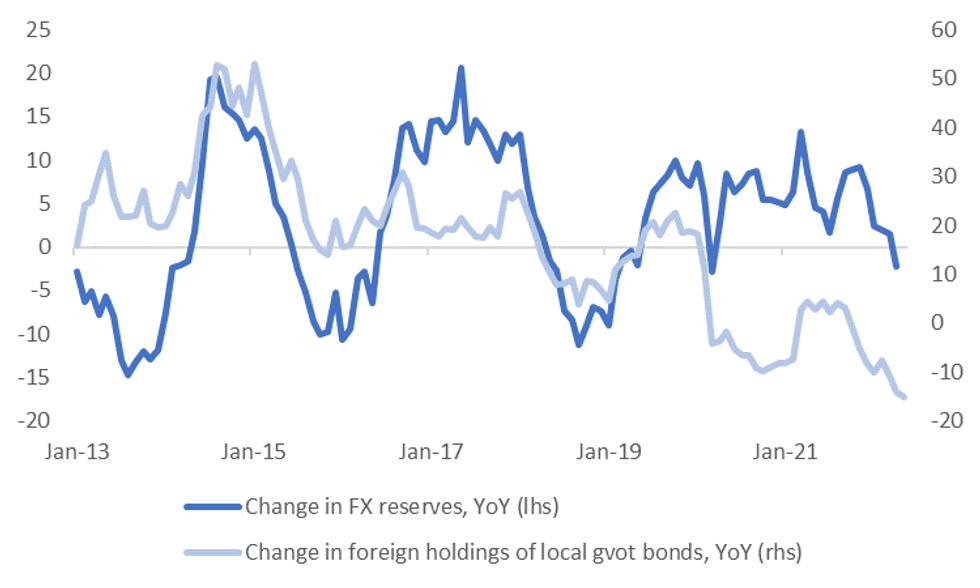

- The directional correlation between FX reserve changes and change in foreign holdings of local bonds remains strong, see the first chart below. Foreign investors continue to reduce holdings of local bonds, down 7 out of the past 8 months and are on track to fall further in May.

Fig 1: Change In BI FX Reserves And Change In Foreign Holdings Of Local Bonds

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

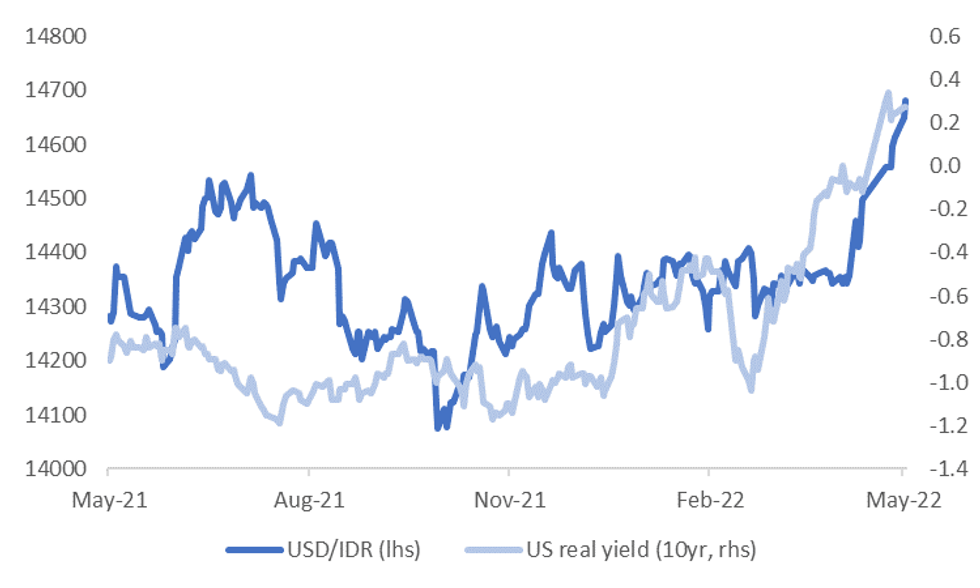

- The correlation between USD/IDR and US real yields has also been rising, see the second chart below. If anything US real yield moves tend to lead IDR moves, particularly since the start of the year.

- Historically, IDR has been very sensitive to US monetary policy shifts, as the country has relied on external funding for its current account deficit position. However, booming commodity prices and weaker imports (as domestic demand still recovers from the Covid shock) has seen Indonesia enjoy a current account surplus for much of the past 2 years.

- This provides some buffer to rising Fed rates and capital outflow pressures. However, the market consensus is for the current account position to slip back into modest deficit in 2022. Hence it could provide less support as we move further into the year.

Fig 2: USD/IDR And U.S. Real 10yr yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.