-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI Podcasts -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

MNI Research

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

-

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessYen Keeps Falling After U.S./Japan 2-Year Yield Spread Prints Cycle Highs

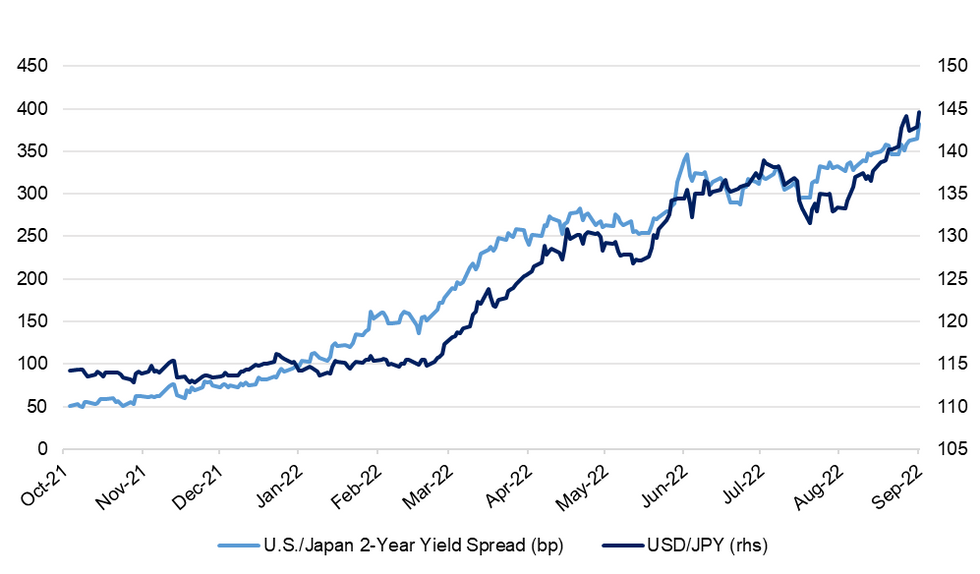

Upside surprises in the latest batch of U.S. CPI data put a bid into USD/JPY Tuesday, albeit the yen was resilient against the rest of G10 FX bloc owing to its safe-haven status. The rate has extended gains this morning, approaching recent cycle highs of Y144.99.

- U.S. Tsy yields soared as participants added hawkish FOMC bets in response to expectation-beating inflation report, which came after a NY Fed expectations survey that stoked hopes for moderation in price pressures. The market is now pricing ~84bp of tightening into Sep FOMC dated OIS, with the implied terminal rate sitting at new cycle highs.

- Hawkish Fed repricing brings the contrast with persistently dovish BoJ back to the fore, driving a fresh round of widening in U.S./Japan yield differentials. 10-Year gap grew ~5.5bp Tuesday, while 2-Year spread rose ~18.3bp and reached levels last seen in 2007.

- Despite the upswing in USD/JPY, the yen was the third-best performer in G10 FX space after the USD and CHF as risk sentiment soured. The equity space was broadly weaker, as was the commodity complex (note that Japan is a net commodity importer).

- Option skews halted their recent decline led by the short end of the curve, as one-month tenor bounced from multi-week lows to snap a sharp four-day losing streak. One-year risk reversal pushed higher, narrowing in on cyclical highs.

- Spot USD/JPY last trades at Y144.81, up 23 pips on the day, after topping out at Y144.96 this morning. The recent cycle high/round figure of Y144.99/145.00 provide the initial layer of resistance, a break here would open the 2.618 proj of Aug 2 - 8 - 11 swing at Y145.28. Bears look for a dip towards Sep 9 low of Y141.51.

- Core machine orders and final industrial output headline the Japanese data docket today.

Fig. 1: U.S./Japan 2-Year Yield Spread vs. USD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.