-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Through First Support

MNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

Yen Surge Continues, JPY TWI Up 3% In past Month But Short Of Previous Rebounds

Yen outperformance on crosses continues in the G10 FX space. USD/JPY is back to the low 154.80 region. We are sub all the key EMAs except the 200-day, which is near 152.40, while the100-day is back higher at 155.68. We are also sub the simple 100-day MA (155.33), the first breach of this support level since March of this year. The June 4 low at 154.55 seems the next logical downside target from a near term standpoint.

- There a number of support points for yen at the moment. Positioning has been short yen for a while, while long higher beta plays like AUD and NZD (per CFTC).

- We have the BoJ next week. 1 week vols, which now capture this event are rising. Whilst market expectations are not for a rate hike, curbed bond buying by the central bank could be in focus. Intervention risks linger in the backdrop as well.

- Broader global trends are also more favorable for JPY. Data surprises have been skewed to the downside, raising questions around the global growth outlook. This has been a factor in the slump in global commodity prices, particularly metals.

- Concerns around the China growth story is also part of this backdrop, with the Third Plenum and the recent rate cuts not doing much to aid China related asset sentiment. Proxy currencies like AUD, which are exposed to the China backdrop, have suffered as a result.

- NZD/JPY has fallen more than AUD/JPY though, as the RBNZ is closer to easing than the RBA.

- Uncertainty around the US political outlook may also be another factor, while global equity sentiment has moved off its recent highs, with key earnings results in the US this week (particularly in the tech space) another watch point.

- Outside of some of the macro drivers outline above, the market will also watch for signs of stretch in technical indicators. While crosses like NZD/JPY have moved into oversold territory (based off RSI (14)), with AUD/JPY also following suit, it's noteworthy the JPY trade weighted index (per Deutsche Bank) is still very depressed from an historical standpoint.

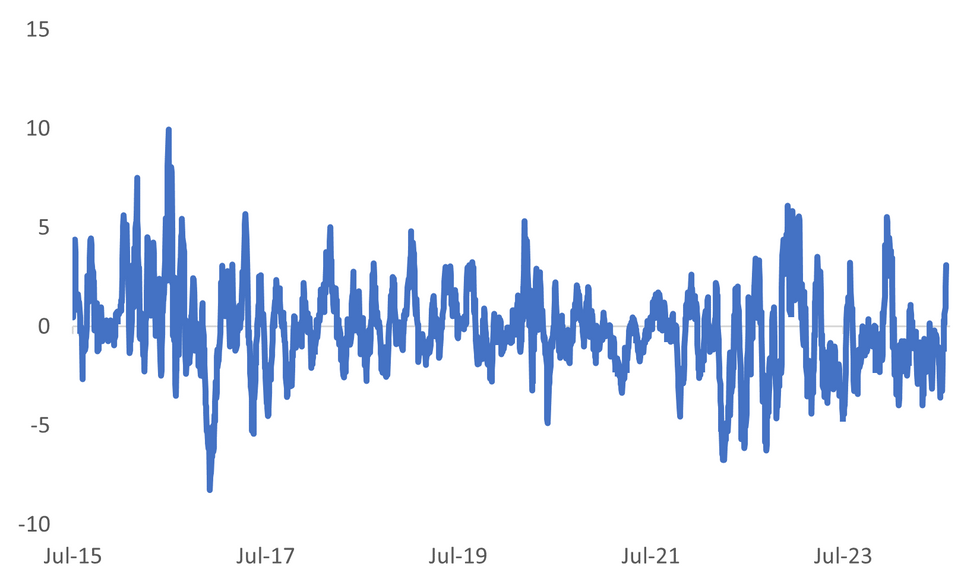

- The index is +3% higher in the past month, see the chart below. Typically, short term surges in the JPY TWI run out of momentum in the 5-10% region.

Fig 1: JPY TWI - Rolling 1 Month Changes

Source: DB/MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.