-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessYuan Benefits From More Forceful PBoC Action

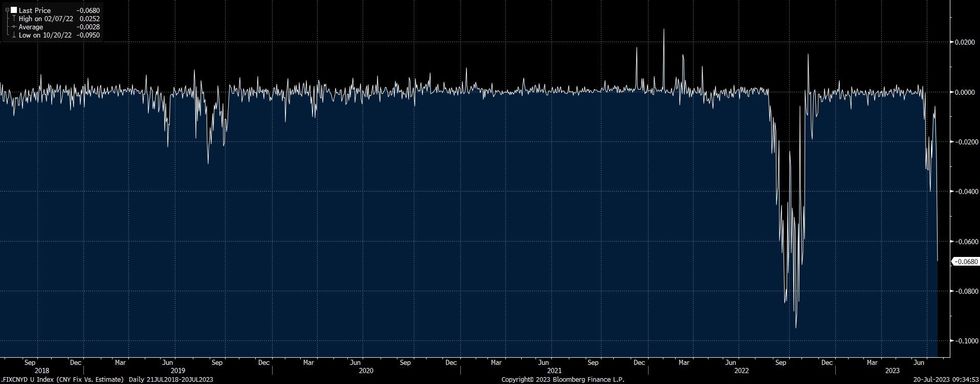

MNI (London) - USD/CNH showed a little more than 600 pips below its Wednesday high in Asia-Pac hours, as the redback benefitted from a much stronger-than-expected lean in the USD/CNY mid-point fixing (resulting in a 680-pip mid-point/BBG survey differential, the widest spread seen since last year’s yuan tumult).

Fig.1: Differential Between USD/CNY Mid-Point Fixing & BBG Survey Median

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- The PBoC also tweaked limits to allow companies to borrow more overseas, opening the door to the potential for an uptick in capital inflows, providing further support to the yuan.

- Flows also factored into the move, with RTRS flagging USD sales vs. CNH on the part of state-owned banks.

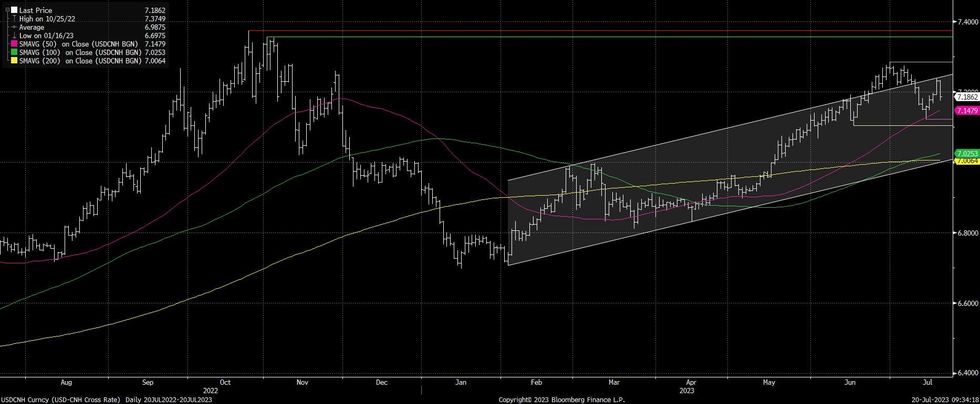

- Still, moves below CNH7.1800 have been limited, with spot last dealing around CNH7.1860

- Also on the wider China fundamentals front, BBG sources reported that the Chinese authorities are reportedly considering easing home buying restrictions in the country’s big cities, which would represent the latest leg of support for that sector if enacted.

- This comes on the back of the multi-point plan to boost household consumption released earlier this week, while continued headline flow re: more favourable treatment of private businesses has since followed.

- Technically, the 50-DMA provides the initial area of support in USD/CNH, while the recent lows and highs provide the horizontal lines of interest.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- Net northbound HK Stock Connect flows were essentially flat and have been tilted towards selling since the multi-month high in net inflow terms registered last week.

- The CSI 300 index has faded from the recent stimulus speculation-induced highs, with the lack of forceable action leaving the index at the lowest levels seen since late June (focus remains on this month's Politburo meeting re: a potential stimulus announcement).

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.