-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

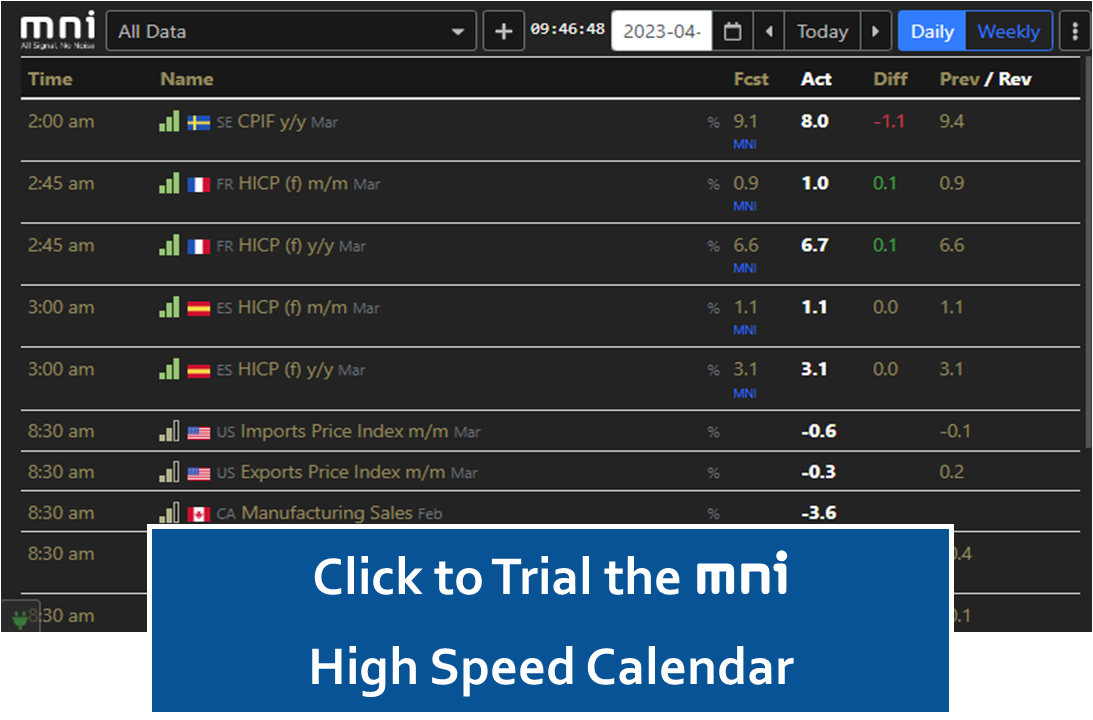

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

MNI: Fed Needs More Inflation Progress To Cut Further-Minutes

MNI UK Inflation and Labour Market Insight: Feb 2025

MNI: Canada Tariff Retaliation Seen Limited By Domestic Pain

MNI INTERVIEW: Steady Backdrop For Norway Pay Deals

REPEAT: Livestreamed Connect CBO's Phillip Swagel On Feb 24

US: Large Majority Of US Voters Expect Tariffs To Results In Higher Prices

A new surveyfrom Ipsos has found that, “An increasingly large majority (now 70%) believe that tariffs will raise prices on the goods they buy. But only one in three think it’s fair for companies to pass along the cost of tariffs in the form of higher prices.”

- Ipsos notes: “That’s a tension worth watching in a number of ways. One is the consumer side and how much people will push back on price hikes, especially as inflation stubbornly persists. The administration is already “softening its tone” on how quickly prices will come down.”

- Comes after President Donald Trump said on Tuesday he could impose a 25% tariff on automobile, semiconductor, and pharmaceutical imports as soon as April 2, when an interagency trade review is completed.

- Trump added that tariff measures could “go very substantially higher over the course of the year,” and reiterated that countries could avoid tariffs if they move manufacturing operations to the United States.

- Semafor reports: “Experts have debated the impact of Trump’s policies so far: One Natixis economist wrote that Southeast Asian countries stood to gain, Goldman Sachs’ chief economist said little had changed, while another prominent analyst warned that recent data suggested American consumers may bear the full brunt of tariffs.”

Figure 1: To what Extent do Voters Agree with the Following Statements

Source: Ipsos

GLOBAL: Economic Data Calendar 19/02/2025

| Date | GMT/Local | Period | Country | Release | Prior | Consensus | |

| 20/02/2025 | 0030/1130 | Jan | AU | Employed Persons change m/m | 56.3 | -- | (k) |

| 20/02/2025 | 0030/1130 | Jan | AU | Labor Participation Rate | 67.1 | 67.1 | % |

| 20/02/2025 | 0030/1130 | Jan | AU | Unemployment Rate | 4 | 4.1 | % |

| 20/02/2025 | 0700/0800 | Jan | DE | PPI m/m | -0.1 | 0.6 | % |

| 20/02/2025 | 0700/0800 | Jan | DE | PPI y/y | 0.8 | 1.1 | % |

| 20/02/2025 | 1000/1100 | Dec | EU | Construction Prod y/y WDA | 1.4 | -- | % |

| 20/02/2025 | 1000/1100 | Dec | EU | Construction Production m/m | 1.2 | -- | % |

| 20/02/2025 | 1100/1100 | Feb | UK | CBI Order Books Balance | -34 | -- | |

| 20/02/2025 | 1100/1100 | Feb | UK | CBI Price Intentions Balance | 27 | -- | |

| 20/02/2025 | 1330/0830 | Jan | CA | Industrial Product Prices m/m | 0.2 | -- | % |

| 20/02/2025 | 1330/0830 | Jan | CA | Raw Material Prices m/m | 1.3 | -- | % |

| 20/02/2025 | 1330/0830 | 15-Feb | US | Continuing Claims | 1850 | 1880 | (k) |

| 20/02/2025 | 1330/0830 | 15-Feb | US | Initial Jobless Claims | 213 | 215 | (k) |

| 20/02/2025 | 1330/0830 | 15-Feb | US | Prev Continuing Claims, Rev | -- | -- | (k) |

| 20/02/2025 | 1330/0830 | 15-Feb | US | Prev Initial Jobless Claims, Rev | -- | -- | (k) |

| 20/02/2025 | 1330/0830 | Feb | US | Philadelphia Fed Mfg Index | 44.3 | 21.5 | |

| 20/02/2025 | 1500/1600 | Feb | EU | Consumer Confidence (p) | -- | -- | |

| 20/02/2025 | 1530/1030 | 14-Feb | US | Natural Gas Stocks w/w | -- | -- | Bcf |

| 20/02/2025 | 1600/1100 | 14-Feb | US | Crude Oil Stocks ex. SPR w/w | -- | -- | bbl (m) |

| 20/02/2025 | 1600/1100 | 14-Feb | US | Distillate Stocks w/w change | -- | -- | bbl (m) |

| 20/02/2025 | 1600/1100 | 14-Feb | US | Gasoline Stocks w/w change | -- | -- | bbl (m) |

| 20/02/2025 | 1630/1130 | 21-Feb | US | Bid to Cover Ratio | -- | -- | |

| 20/02/2025 | 1630/1130 | 21-Feb | US | Bid to Cover Ratio | -- | -- | |

| 20/02/2025 | 1800/1300 | Q4 | US | Bid to Cover Ratio | -- | -- | |

| 21/02/2025 | 2200/0900 | Jan | AU | Judo Bank Composite PMI (p) | -- | -- | |

| 21/02/2025 | 2200/0900 | Jan | AU | Judo Bank Manufacturing PMI (p) | -- | -- | |

| 21/02/2025 | 2200/0900 | Jan | AU | Judo Bank Services PMI (p) | -- | -- | |

| 21/02/2025 | 2330/0830 | Jan | JP | Core CPI y/y | 3 | 3.1 | % |

| 21/02/2025 | 2330/0830 | Jan | JP | Core/Core CPI y/y | 2.4 | 2.5 | % |

| 21/02/2025 | 2330/0830 | Jan | JP | Headline CPI y/y | 3.6 | 4 | % |

| 21/02/2025 | 0001/0001 | Feb | UK | GfK Consumer Confidence | -22 | -- | |

| 21/02/2025 | 0030/0930 | Feb | JP | Jibun Bank Flash Composite PMI | -- | -- | |

| 21/02/2025 | 0030/0930 | Feb | JP | Jibun Bank Flash Manufacturing PMI | -- | -- | |

| 21/02/2025 | 0030/0930 | Feb | JP | Jibun Bank Flash Services PMI | -- | -- | |

| 21/02/2025 | 0700/0700 | Jan | UK | Central Govt Net Cash Requirmt | 19.41 | -- | GBP (b) |

| 21/02/2025 | 0700/0700 | Jan | UK | PSNB Ex-Financial Intervention | 17.81 | 20.5 | GBP (b) |

| 21/02/2025 | 0700/0700 | Jan | UK | Public Sector Net Borrowing | 17.81 | -- | GBP (b) |

| 21/02/2025 | 0700/0700 | Jan | UK | Public Sector Net Cash Rqrmnt | 19.88 | -- | GBP (b) |

| 21/02/2025 | 0700/0700 | Jan | UK | Retail Sales m/m | -0.3 | 0.3 | % |

| 21/02/2025 | 0700/0700 | Jan | UK | Retail Sales y/y | 3.6 | 4 | % |

| 21/02/2025 | 0700/0700 | Jan | UK | Retail Sales(ex-fuel) m/m | -0.6 | -- | % |

| 21/02/2025 | 0700/0700 | Jan | UK | Retail Sales(ex-fuel) y/y | 2.9 | 3 | % |

| 21/02/2025 | 0745/0845 | Feb | FR | Manufacturing Sentiment | 95 | -- | |

| 21/02/2025 | 0815/0915 | Feb | FR | S&P Global Services PMI (p) | -- | -- | |

| 21/02/2025 | 0815/0915 | Feb | FR | S&P Global Manufacturing PMI (p) | -- | -- | |

| 21/02/2025 | 0830/0930 | Feb | DE | S&P Global Services PMI (p) | -- | -- | |

| 21/02/2025 | 0830/0930 | Feb | DE | S&P Global Manufacturing PMI (p) | -- | -- | |

| 21/02/2025 | 0900/1000 | Jan | IT | HICP (f) m/m | -- | -- | % |

| 21/02/2025 | 0900/1000 | Jan | IT | HICP (f) y/y | -- | -- | % |

| 21/02/2025 | 0900/1000 | Feb | EU | S&P Global Services PMI (p) | -- | -- | |

| 21/02/2025 | 0900/1000 | Feb | EU | S&P Global Manufacturing PMI (p) | -- | -- | |

| 21/02/2025 | 0900/1000 | Feb | EU | S&P Global Composite PMI (p) | -- | -- | |

| 21/02/2025 | 0930/0930 | Feb | UK | S&P Global Manufacturing PMI (f) | -- | -- | |

| 21/02/2025 | 0930/0930 | Feb | UK | S&P Global Services PMI (p) | -- | -- | |

| 21/02/2025 | 0930/0930 | Feb | UK | S&P Global Composite PMI (p) | -- | -- | |

| 21/02/2025 | 1330/0830 | Dec | CA | Retail Sales (ex-autos) m/m | -0.7 | -- | % |

| 21/02/2025 | 1330/0830 | Dec | CA | Retail Sales m/m | 0 | 1.6 | % |

| 21/02/2025 | 1330/0830 | 20-Feb | US | Corn Net Sales | -- | -- | MT (k) |

| 21/02/2025 | 1330/0830 | 20-Feb | US | Corn Weekly Exports | -- | -- | MT (k) |

| 21/02/2025 | 1330/0830 | 20-Feb | US | Soy Net Sales | -- | -- | MT (k) |

| 21/02/2025 | 1330/0830 | 20-Feb | US | Soy Weekly Exports | -- | -- | MT (k) |

| 21/02/2025 | 1330/0830 | 20-Feb | US | Wheat Net Sales | -- | -- | MT (k) |

| 21/02/2025 | 1330/0830 | 20-Feb | US | Wheat Weekly Exports | -- | -- | MT (k) |

| 21/02/2025 | 1330/0830 | Dec | CA | Retail Sales (ex-autos) m/m | -0.7 | -- | % |

| 21/02/2025 | 1330/0830 | Dec | CA | Retail Sales m/m | 0 | 1.6 | % |

| 21/02/2025 | 1445/0945 | Feb | US | S&P Global Manufacturing PMI (p) | 51.2 | 51 | |

| 21/02/2025 | 1445/0945 | Feb | US | S&P Global Services Index (p) | 52.9 | -- | |

| 21/02/2025 | 1500/1000 | Jan | US | Existing Home Sales | 4.24 | 4.14 | (m) |

| 21/02/2025 | 1500/1000 | Q4 | US | Service Revenue | 2.2 | -- | % |

| 21/02/2025 | 1500/1000 | Feb | US | U. Mich Consumer Expectations | 67.3 | -- | |

| 21/02/2025 | 1500/1000 | Feb | US | U. Mich Consumer Sentiment | 67.8 | -- | |

| 21/02/2025 | 1500/1000 | Feb | US | U. Mich Current Economic Conditions | 68.7 | -- | |

| 24/02/2025 | 0900/1000 | Feb | DE | IFO Business Climate Index | -- | -- | |

| 24/02/2025 | 1000/1100 | Jan | EU | HICP (f) m/m | -- | -- | % |

| 24/02/2025 | 1000/1100 | Jan | EU | HICP (f) y/y | -- | -- | % |

| 24/02/2025 | 1000/1100 | Jan | EU | HICP Core (f) m/m | -- | -- | % |

| 24/02/2025 | 1000/1100 | Jan | EU | HICP Core (f) y/y | -- | -- | % |

| 24/02/2025 | 1330/0830 | Q4 | CA | Corporate profits | -- | -- | % |

| 24/02/2025 | 1400/1500 | Feb | BE | BNB Business Confidence | -- | -- | |

| 24/02/2025 | 1530/1030 | Feb | US | Dallas Fed manufacturing index | -- | -- | |

| 25/02/2025 | 0700/0800 | Q4 | DE | GDP (f) q/q | -- | -- | % |

| 25/02/2025 | 0700/0800 | Q4 | DE | GDP (f) y/y wda | -- | -- | % |

| 25/02/2025 | 1000/1000 | Feb | UK | Bid to Cover Ratio | -- | -- | % |

| 25/02/2025 | 1100/1100 | Feb | UK | CBI Retail Sales Expected Balance | -- | -- | |

| 25/02/2025 | 1100/1100 | Feb | UK | CBI Retail Sales Reported Balance | -- | -- | |

| 25/02/2025 | 1330/0830 | Feb | US | Philadelphia Fed Nonmfg Index | -- | -- | |

| 25/02/2025 | 1355/0855 | 22-Feb | US | Redbook Retail Sales y/y (month) | -- | -- | % |

| 25/02/2025 | 1355/0855 | 22-Feb | US | Redbook Retail Sales y/y (week) | -- | -- | % |

| 25/02/2025 | 1400/0900 | Dec | US | Case-Shiller Home Price Index | -- | -- | |

| 25/02/2025 | 1400/0900 | Dec | US | FHFA Home Price Index m/m | -- | -- | % |

| 25/02/2025 | 1400/0900 | Dec | US | Prior Revised HPI % Chge mm SA | -- | -- | % |

| 25/02/2025 | 1400/0900 | Dec | US | FHFA Home Price Index m/m | -- | -- | % |

| 25/02/2025 | 1400/0900 | Dec | US | Prior Revised HPI % Chge mm SA | -- | -- | % |

| 25/02/2025 | 1400/0900 | Q4 | US | FHFA Quarterly Home Prices q/q | -- | -- | % |

| 25/02/2025 | 1400/0900 | Q4 | US | FHFA Quarterly Home Prices q/q | -- | -- | % |

| 25/02/2025 | 1500/1000 | Feb | US | Conference Board Confidence | -- | -- | |

| 25/02/2025 | 1500/1000 | Feb | US | Previous Consumer Confidence Index Revised | -- | -- | |

| 25/02/2025 | 1500/1000 | Feb | US | Richmond Fed Mfg Index | -- | -- | |

| 25/02/2025 | 1530/1030 | Feb | US | Dallas Fed services index | -- | -- | |

| 26/02/2025 | 0030/1130 | Jan | AU | Monthly CPI, all groups m/m sa | -- | -- | % |

| 26/02/2025 | 0030/1130 | Jan | AU | Monthly CPI, all groups y/y sa | -- | -- | % |

| 26/02/2025 | 0030/1130 | Q4 | AU | Construction Work Done q/q | -- | -- | % |

| 26/02/2025 | 0700/0800 | Jan | SE | PPI m/m | -- | -- | % |

| 26/02/2025 | 0700/0800 | Jan | SE | PPI y/y | -- | -- | % |

| 26/02/2025 | 0700/0800 | Feb | DE | GFK Consumer Climate | -- | -- | |

| 26/02/2025 | 0700/1500 | Feb | CN | MNI China Money Mkt Index(MMI) | -- | -- | |

| 26/02/2025 | 0745/0845 | Feb | FR | Consumer Sentiment | -- | -- | |

| 26/02/2025 | 0800/0900 | Jan | ES | PPI m/m | -- | -- | % |

| 26/02/2025 | 0800/0900 | Jan | ES | PPI y/y | -- | -- | % |

| 26/02/2025 | 1200/0700 | 21-Feb | US | MBA Mortgage Applications w/w | -- | -- | % |

| 26/02/2025 | 1330/0830 | Annual | CA | Capital,repair spending survey | -- | -- | % |

| 26/02/2025 | 1500/1000 | Jan | US | New Home Sales | -- | -- | (m) |

| 26/02/2025 | 1500/1000 | Jan | US | Previous New Home Sales Revised (millions) | -- | -- | (m) |

| 26/02/2025 | 1530/1030 | 21-Feb | US | Crude Oil Stocks ex. SPR w/w | -- | -- | bbl (m) |

| 26/02/2025 | 1530/1030 | 21-Feb | US | Distillate Stocks w/w change | -- | -- | bbl (m) |

| 26/02/2025 | 1530/1030 | 21-Feb | US | Gasoline Stocks w/w change | -- | -- | bbl (m) |

US: Treasury Sec Bessent To Skip G20 Summit In South Africa - NYT

The New York Times reportsthat US Treasury Secretary Scott Bessent is expected to skip a G20 summit of finance ministers and central bankers in South Africa, next week. Should Bessent decline to attend the conference, it would forgo a key opportunity for Trump's Treasury team to meet with counterparts from China, Russia, India, and Brazil. Skipping the meeting appears to signal that the Trump administration sees little value in the kind of multilateralism championed by the G20.

- The Times notes that skipping, "such a major economic gathering is highly unusual for a Treasury secretary, particularly one who was just confirmed to his post three weeks ago... It follows a boycott of a similar meeting of foreign ministers this week in Johannesburg by Secretary of State Marco Rubio. Mr. Rubio said he was skipping the meetings because he had no interest in wasting taxpayer money an “coddling” anti-Americanism."

- The report comes amid a major diplomatic rupture between Washington and Pretoria over a new land expropriation law and legal actions related to the war in Gaza, culminating in a threat to suspend South Africa's participation in the African Growth and Opportunity Act.

- Semafor reported yesterday: "South Africa is preparing to dispatch a delegation of government and business leaders to Washington in an attempt to retain the country’s preferential access to the world’s largest economy — but only after similar trips to China and Europe."

US-CHINA: NYT-'Trump Eyes Bigger, Better Trade Deal With China'

(MNI) London - As noted earlier (see 'CHINA: Trump China Trade Deal Headlines Gelping Pressure USD, Boost Equities', 1546GMT) NYT reports that according to current and former White House officials US President Donald Trump is looking at the potential for a new trade agreement with China. NYT: "Mr. Trump has expressed interest in a deal that would include substantial investments and commitments from the Chinese to buy more American products".

- The article claims that alongside trade talks, Trump would also look to discuss major geopolitical and security subjects such as nuclear weapons in face-to-face meetings with Chinese President Xi Jinping.

- NYT: "Advisers and analysts say the governments would have to overcome many obstacles to reach a deal, and that the Trump administration has not yet settled on what it wants from China. "

- The stance of China on any such overtures will be in question. There is likely to be notable wariness from Beijing given the Trump administration's inclination to shift its stance at short notice. NYT: "It’s not clear what the Chinese would ask for in return, though many analysts believe Mr. Xi would try to get relief from some of the tariffs Mr. Trump has imposed on the country, as well as export controls that have limited China’s access to advanced technology."

- Taking a more cooperative stance on China, while assailing the US' erstwhile allies in Europe with threats of tariffs and drawing down defence commitments, comes in line with the more 'transactional' policy expected under the Trump administration.

MNI REAL-TIME COVERAGE

AUSSIE 3-YEAR TECHS: (H5) Monitoring Resistance

STIR: RBNZ Dated OIS Pricing Modestly Firmer Than Pre-RBNZ Decision Levels

Timely & Actionable Insight on Central Bank Policy

Timely & Actionable Insight on FX & FI Markets

Timely & Actionable Insight on Emerging Markets

Sample MNI

Chicago Business Barometer™ - Advances to 39.5 in January

MNI NEWSLETTERS

MNI US MARKETS ANALYSIS - UK CPI Should Do Little to Sway BoE

MNI US OPEN - Tariff Talk Eyed in FOMC Minutes Release

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.