-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI ASIA OPEN: Twitter Buyout Spurs Late Index Rally

EXECUTIVE SUMMARY

- ELON MUSK TO BUY TWITTER FOR $54.20/SHR IN CASH, Bbg

- TWITTER: TWITTER WILL BECOME A PRIVATELY HELD COMPANY, Bbg

- BEIJING EXPANDS COVID TESTING TO ENTIRE CITY FROM APRIL 26-30, Bbg

US TSYS: Carry-Over Pushback on 75Bp Hike; Demand Shock on China Zero Covid

Rate futures trading higher after the bell - well off midday highs that saw 30YY hit 2.8552 low (2.8936% last), yield curves flatter in the short end (2s10s -3.133 at 19.388) as bonds managed to outpace the strong front end bid (2YY slipped to 2.5209 low, 2.6236% last)

- Carry-over short end support after Cleveland Fed Pres Mester pushed back on any need to hike more than 50bp late last Friday -- odds of 75bp hikes evaporating on the day. No comment from Fed with speakers in blackout through the May 4 FOMC.

- Underlying support trigger: Market putting more weight on the demand hit rather than the inflationary pressure from further supply side disruptions on widespread Covid lockdowns prospects in China (panic selling: Shanghai CSI 300 -4.15% to 3851.80, Hang Seng -3.86% to 19809.0).

- The 2-Yr yield is down 5.2bps at 2.6152%, 5-Yr is down 9.1bps at 2.84%, 10-Yr is down 9.4bps at 2.8044%, and 30-Yr is down 6.9bps at 2.8756%.

OVERNIGHT DATA

- CHICAGO FED NATIONAL ACTIVITY INDEX AT 0.44 VS 0.54 PRIOR

- U.S. APRIL DALLAS FED MANUFACTURING INDEX AT 1.1

- U.S. APRIL DALLAS FED GENERAL BUSINESS ACTIVITY AT 1.1

MARKETS SNAPSHOT

Key late session market levels:

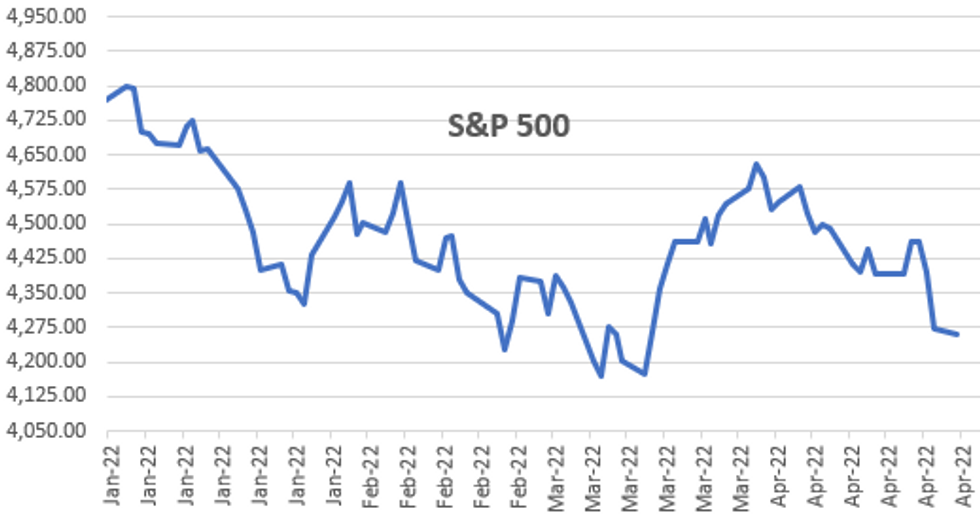

- DJIA up 63.87 points (0.19%) at 33874.93

- S&P E-Mini Future down 4 points (-0.09%) at 4263.25

- Nasdaq up 53.2 points (0.4%) at 12891.53

- US 10-Yr yield is down 9.4 bps at 2.8044%

- US Jun 10Y are up 25.5/32 at 119-23.5

- EURUSD down 0.0081 (-0.75%) at 1.0708

- USDJPY down 0.52 (-0.4%) at 127.98

- Gold is down $30.92 (-1.6%) at $1900.74

- EuroStoxx 50 down 82.42 points (-2.15%) at 3757.59

- FTSE 100 down 141.14 points (-1.88%) at 7380.54

- German DAX down 217.92 points (-1.54%) at 13924.17

- French CAC 40 down 132.04 points (-2.01%) at 6449.38

US TSY FUTURES CLOSE

- 3M10Y -7.96, 197.331 (L: 192.732 / H: 203.753)

- 2Y10Y -3.831, 18.69 (L: 18.324 / H: 24.672)

- 2Y30Y -1.517, 25.79 (L: 25.222 / H: 34.542)

- 5Y30Y +2.435, 3.388 (L: 0.173 / H: 9.853)

- Current futures levels:

- Jun 2Y up 6.5/32 at 105-15.625 (L: 105-09.375 / H: 105-22)

- Jun 5Y up 16.25/32 at 112-30.5 (L: 112-12.5 / H: 113-10.25)

- Jun 10Y up 25/32 at 119-23 (L: 118-26.5 / H: 120-06)

- Jun 30Y up 1-21/32 at 141-24 (L: 139-28 / H: 142-12)

- Jun Ultra 30Y up 1-28/32 at 162-27 (L: 160-16 / H: 163-18)

US 10Y FUTURES TECH: (M2) Corrective Bounce

- RES 4: 123-04 High Mar 31 and a key resistance

- RES 3: 122-12+ High Apr 4

- RES 2: 120-25/121-09 20-day EMA / High Apr 14 and key resistance

- RES 1: 120-06 High Apr 18

- PRICE: 120-00+ @ 1200ET Apr 25

- SUP 1: 118-08 Low Apr 22

- SUP 2: 118-02+ 0.618 proj of the Mar 7 - 28 - 31 price swing

- SUP 3: 117-22+ Low Nov 8 2018 (cont)

- SUP 4: 116-28 0.764 proj of the Mar 7 - 28 - 31 price swing

Treasuries have started the week on a firmer note. Short-term gains though are considered corrective and the primary downtrend remains intact. Fresh cycle lows last week confirmed a resumption of the primary downtrend and an extension of the price sequence of lower lows and lower highs. MA studies continue to point south. A resumption of the trend would open 118-02+ next, a Fibonacci projection. Initial firm resistance is at 121-09.

US EURODOLLAR FUTURES CLOSE

- Jun 22 +0.050 at 98.125

- Sep 22 +0.085 at 97.340

- Dec 22 +0.135 at 96.910

- Mar 23 +0.155 at 96.680

- Red Pack (Jun 23-Mar 24) +0.130 to +0.165

- Green Pack (Jun 24-Mar 25) +0.095 to +0.115

- Blue Pack (Jun 25-Mar 26) +0.095 to +0.10

- Gold Pack (Jun 26-Mar 27) +0.105 to +0.115

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements

- O/N +0.0400 to 0.33043% (-0.00343 total last wk)

- 1M -0.00543 to 0.69800% (+0.10900 total last wk)

- 3M +0.01115 to 1.22486% (+0.15100 total last wk) ** Record Low 0.11413% on 9/12/21

- 6M -0.00500 to 1.81871% (+0.26700 total last wk)

- 12M -0.05500 to 2.55171% (+0.38514 total last wk)

STIR: FRBNY EFFR for prior session:

- Daily Effective Fed Funds Rate: 0.33% volume: $74B

- Daily Overnight Bank Funding Rate: 0.32% volume: $260B

US TSYS: Repo Reference Rates

- Secured Overnight Financing Rate (SOFR): 0.27%, $901B

- Broad General Collateral Rate (BGCR): 0.30%, $335B

- Tri-Party General Collateral Rate (TGCR): 0.30%, $322B

- (rate, volume levels reflect prior session)

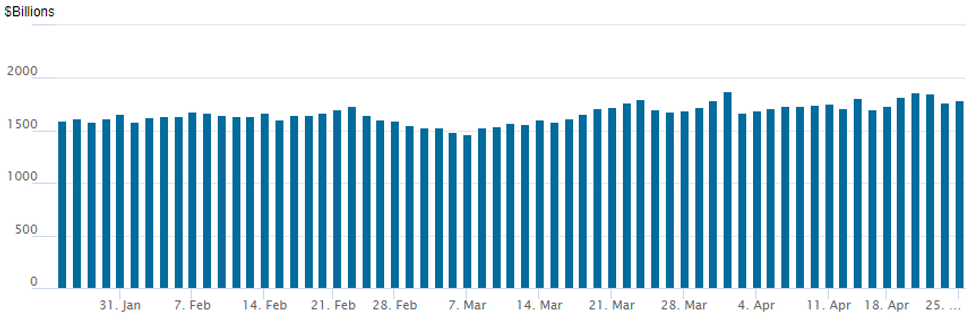

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to 1,783.609B w/ 8 counterparties from prior session 1,765.031B. Compares to all-time high of $1,904.582B on Friday, December 31.

PIPELINE

Slow start to the new week:- Date $MM Issuer (Priced *, Launch #)

- 04/25 $Benchmark Cintas Corp investor calls

- Expected to launch Tuesday:

- 04/25 $2.275B Carvana 8NC3 10%a

- 04/25 $1B Kommuninvest 3Y SOFR+27a

EGBs-GILTS CASH CLOSE: Decisively Risk-Off

The trading week began with clear-cut risk-off price action, with yields tumbling as stocks and commodities fell sharply.

- Concerns over extended and widening lockdowns in China saw the German and UK curves aggressively bull steepen.

- The bond rally accelerated late in the session as equities relapsed following a modest afternoon rebound. Closing 5Y German yields saw their 2nd biggest drop since 2011 (Mar 1st was the biggest).

- Periphery spreads widened; BTPs closed at the richest to Bunds since June 2020.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is down 13.7bps at 0.146%, 5-Yr is down 16.3bps at 0.589%, 10-Yr is down 13.5bps at 0.837%, and 30-Yr is down 8.4bps at 0.985%.

- UK: The 2-Yr yield is down 16.1bps at 1.553%, 5-Yr is down 13.5bps at 1.625%, 10-Yr is down 12.2bps at 1.841%, and 30-Yr is down 9.1bps at 1.947%.

- Italian BTP spread up 4.1bps at 173.9bps / Spanish up 2.2bps at 98.7bps

FOREX: Historical Safe Havens In Demand Amid Commodity/Risk Selloff

- Both the US Dollar and Japanese Yen faired the best amid G10 currencies on Monday as the commodity complex came under significant pressure to start the week and lent support to historical safe havens.

- Oil prices have taken a considerable leg lower, with Brent and WTI prices off over 5%. Ongoing fears of a weeks-long ultra-strict lockdown being imposed in Beijing, in a similar scenario to that currently taking place in the megacity of Shanghai, is weighing on the outlook for demand.

- In turn, this has contributed to ongoing weakness in the Chinese Yuan. Spot USD/CNH pierced the CNH6.55 figure on its way to fresh one-year highs at 6/6092, while its implied volatilities soared to fresh cycle highs across the curve.

- Early in NY trade, the PBOC cut the FX RRR by 1ppt, in a partial reversal of their last policy move using the tool in December last year (where they raised the FX RRR by 2ppts). The mechanics behind today's policy move mean they lessen the incentive for commercial banks to hold more in FX reserves. The move could be a response to the broad USD/CNY rally we've had over the past week or so and put the top in during Monday’s session

- Furthermore, waning risk sentiment across global markets weighed heavily on the likes of AUD and GBP in addition to near two percent declines for both SEK and NOK.

- Ongoing uncertainties relating to the Ukraine warfare is keeping EURUSD vulnerable and the pair has cleared support at 1.0758, the Apr 14 low and a short-term bear trigger. This confirms a resumption of the downtrend and an extension of the bearish price sequence of lower lows and lower highs. 1.0727 has also been breached, the Apr 24, 2020 low and this signals scope for a move towards 1.0636 next, the Mar 23 2020 low and the next major support.

- A light data docket on Tuesday is headlined by US durable goods and consumer confidence data. Focus will then turn to Australian CPI on Wednesday and Thursday’s Bank of Japan meeting.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 26/04/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 26/04/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/04/2022 | 1245/0845 |  | CA | BOC Deputy Lane panel talk | |

| 26/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/04/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/04/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/04/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/04/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/04/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.