-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: Cautious Tone Persists

EXECUTIVE SUMMARY:

- UK BORROWING EXCEEDS FORECASTS, SUNAK PLEDGES TO BRING UNDER CONTROL

- MICROSOFT, ALPHABET AMONG EARNINGS REPORTS RELEASED TODAY

- SEC CHIEF FLOATS SLASHING BOND-TRADE REPORTING TIME TO 1 MINUTE

- BANK OF JAPAN OFFERS TO BUY UNLIMITED JGBS WEDS AND THURS

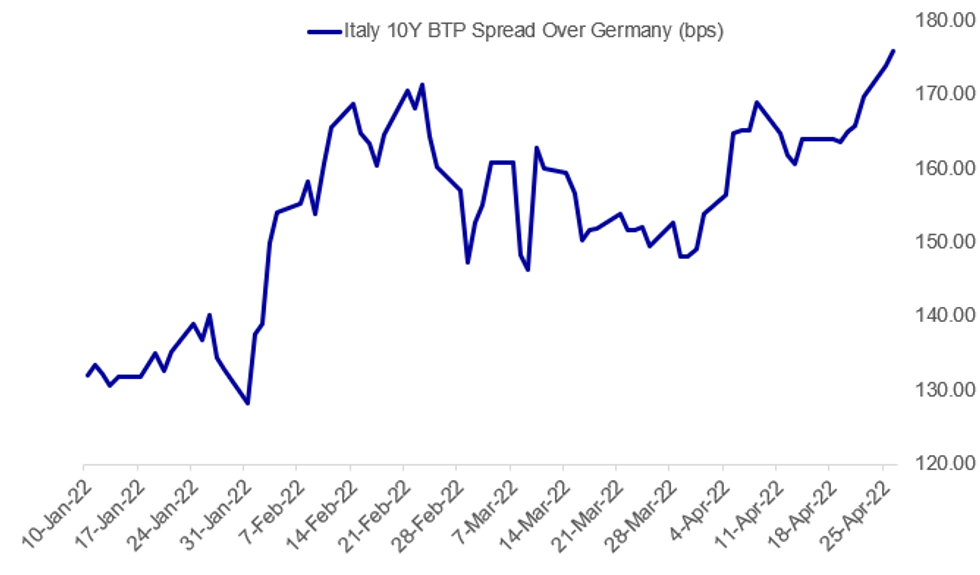

Fig. 1: BTP Spreads Continue Rising

Source: BBG, MNI

Source: BBG, MNI

NEWS:

UK (BBG): U.K. Chancellor of the Exchequer Rishi Sunak pledged to bring borrowing under control to “avoid saddling future generations with debt” after official figures showed debt servicing costs rocketed. Government borrowing more than halved in the fiscal year through March as Covid-19 support programs were phased out and tax receipts recovered strongly, the Office for National Statistics said Tuesday. The bill for servicing the government’s debt jumped 77% to 69.9 billion pounds ($89 billion) because of higher inflation and interest rates. In March alone, the interest bill was 2.9 billion pounds, 1 billion pounds higher than a year earlier. “Public debt is at the highest levels since the 1960s, and rising inflation is pushing up our debt interest costs, which mean we must manage public finances sustainably to avoid saddling future generations with further debt,” Sunak said in a statement.

U.S. STOCKS (DJ): U.S. stock futures edged down ahead of a wave of earnings reports from major technology and blue-chip firms as investors contended with fears about slowing growth. Results are due before the opening bell from PepsiCo, United Parcel Service, Discovery, General Electric, 3M and Raytheon Technologies. Microsoft, Google-parent Alphabet, General Motors, Visa and Mondelez International are set to give updates after markets close.

SEC / BONDS (BBG): U.S. Securities and Exchange Commission Chair Gary Gensler wants to slash the amount of time that traders have to report many bond transactions as part of a bid to increase visibility into fixed-income markets. Gensler on Tuesday said that more transparency was needed across global bond markets, and that disclosures had generally failed to keep up with technological changes. In remarks to be delivered at City Week in London, the SEC chief said data should be sent faster to the Financial Industry Regulatory Authority’s Trace reporting system and cover more types of securities. “Currently, a trade has to be reported as soon as practicable but no later than within 15 minutes of the time of execution,” he said, also referring to how transactions involving municipal securities are reported to regulators. “Why couldn’t the outer bound be shortened to no later than, for example, 1 minute?”

JAPAN: Japan's Sumitomo Life Insurance plans to increase holdings of unhedged foreign bonds by several hundred billion yen, while reducing the balance of hedged foreign bonds by a similar amount due to rising hedging costs this fiscal year, Toshio Fujimura, general manager of Investment Planning Department at Sumitomo Life, told reporters on Tuesday. The balance of domestic bond holding will likely drop by JPY100 billion due to the redemptions, although the company plans to buy super long-term Japanese government bonds when yields rise, Fujimura said. The company increased the balance of domestic bonds by about JPY180 billion to JPY14.52 trillion due to purchases of super long-term JGBs during the last fiscal year

JAPAN: Japan's Nippon Life Insurance plans to increase domestic bonds holdings, such as hedged foreign corporate and yen corporate bonds as well as 30-year Japanese government bonds this fiscal year, Akira Tsuzuki, senior general manager of the finance and investment planning department, told reporters on Tuesday. Nippon Life also plans to lower the balance of hedged foreign bond holdings because of higher hedging-costs, after increasing the balance by JPY720 billion to JPY6.34 trillion last fiscal year.

BANK OF JAPAN: The Bank of Japan said on Tuesday that it will conduct an unlimited purchase of Japanese government bonds at a fixed-rate on Wednesday and Thursday. The advance announcement reflects a strong message to market that the BOJ will prevent the 10-year bond yield from rising above 0.250%, the upper end of the preferred range. The 10-year bond closed at 0.245% on Tuesday.

MOLDOVA/RUSSIA: Russia's state-run Tass reporting that the Security Council of the breakaway Moldovan region of Transnistria has declared a 'terrorist attack' has been inflicted on one of its military units in the village of Parcani. Earlier, comments from head of the so-called Donetsk People's Republic Denis Pushlin hit wires, stating "After reaching the borders of the Donetsk region, it is necessary to start the next stage of the operation, taking into account what is happening in Transnistria and the shelling of the regions of the Russian Federation bordering Ukraine."

DATA:

MNI: UK MAR PSNCR GBP-2.42 BN

UK 21/22 CGNCR (EX-NRAM, BB & NR) GBP 129.2 BN

MNI BRIEF: UK 2021/22 Borrowing Exceeds OBR Forecasts

UK public sector borrowing hit GBP151.81 billion in the 2021/22 fiscal year, well above the Office for Budget Responsibility's estimate of GBP127.8 billion, according to data released by the Office for National Statistics on Tuesday. It was the third highest fiscal year borrowing on record, behind the GBP318 billion borrowed in the 2020/21 fiscal year and the GBP157.8 billion borrowing in 2009/10, during the depths of the financial crisis.

The debt-to-GDP ratio rose to 96.2% from 93.9% previously, although the debt ratio excluding Bank of England declined to 83.1% from 83.8% a year earlier. Borrowing, as a percentage of GDP, fell to 6.4% from 14.8% last year.

CGNR, excluding exceptional items, declined to GBP129.205 billion from GBP334.494 billion. The March outturn declined to GBP18.677 billion from GBP20.752 billion a year earlier. The Debt Management Office will use the FY number to amend the current Gilt borrowing remit. Debt interest payments soared 77% y/y to GBP69.9 billion.

Source: ONS

FIXED INCOME: Bunds / gilts challenge yesterday's highs while GGBs selloff

- Core fixed income has been grinding higher this morning in what feels like it has been a generally risk-off session in fixed income and FX markets, but has seen European equities actually move higher (with US and Asian equities generally lower).

- At the time of writing Bund and gilt futures are approaching, but have not yet breached yesterday's highs. Peripheral spreads are all wider on the day led by GGBs. There doesn't seem to be an obvious move although we note that Greek 10-year yields have moved above 3% so there are possibly some technicals in play. Also, some investors may have been expecting a bigger upgrade from S&P last week to investment grade now that Greece has finished paying off the IMF (rather than the one notch upgrade to BB+ stable).

- Treasuries are higher since yesterday's close, but still below yesterday's intraday high.

- The only notable data release today will be durable goods.

- TY1 futures are up 0-7 today at 119-26+ with 10y UST yields down -3.6bp at 2.787% and 2y yields down -2.9bp at 2.600%.

- Bund futures are up 0.25 today at 155.14 with 10y Bund yields down -1.0bp at 0.825% and Schatz yields down -0.1bp at 0.138%.

- Gilt futures are up 0.03 today at 119.21 with 10y yields down -0.3bp at 1.836% and 2y yields down -2.0bp at 1.525%.

FOREX: Minor Corrective Bounce in AUD/USD

- Despite a late rally on Wall Street Monday, a broad risk-off feel remains present in markets, with US 10y yields only briefly rising back above 2.80%, before fading into the NY crossover. The price action in bond and equity markets is working in favour of the JPY and greenback, which hold the majority of the week's gains, although AUD is the outperformer so far.

- Having fallen near 7% from the monthly high, AUD/USD was approaching technically oversold levels, prompting a minor corrective bounce back to the $0.7200 handle. Nonetheless, the pair remains below the week's best levels which hold as first resistance at $0.7261.

- Elsewhere, the spectre of a potentially extended lockdown across a number of Chinese cities is continuing to work against commodities prices and perceived demand. WTI and Brent crude futures remain in negative territory, keeping oil-tied FX on the backfoot. As a result, NOK is the poorest performer in G10 at present, with USD/CAD similarly not far off yesterday's high at 1.2777.

- Preliminary US durable goods orders are the data highlight Tuesday ahead of consumer confidence (seen rising for a second month) and new home sales. There are no Fed speakers as the FOMC remain inside the pre-meeting media blackout period, which keeps focus on the ECB. de Cos and Villeroy are both due to speak today.

EQUITIES: Steadying Ahead Of Busy Earnings Slate

- Asian stocks closed mixed: Japan's NIKKEI closed up 109.33 pts or +0.41% at 26700.11 and the TOPIX ended 1.99 pts higher or +0.11% at 1878.51. China's SHANGHAI closed down 42.086 pts or -1.44% at 2886.426 and the HANG SENG ended 65.37 pts higher or +0.33% at 19934.71

- European equities are a little higher, with the German Dax up 162.61 pts or +1.17% at 14046.13, FTSE 100 up 44.46 pts or +0.6% at 7410.23, CAC 40 up 41.11 pts or +0.64% at 6454.95 and Euro Stoxx 50 up 40.03 pts or +1.07% at 3785.1.

- U.S. futures are a little lower but off overnight's worst levels, with the Dow Jones mini down 80 pts or -0.24% at 33883, S&P 500 mini down 7.5 pts or -0.17% at 4285.25, NASDAQ mini down 15.5 pts or -0.11% at 13520.25.

COMMODITIES: WTI Fades Overnight Gains, Still Below $100

- WTI Crude down $0.53 or -0.54% at $98.58

- Natural Gas up $0.25 or +3.81% at $6.812

- Gold spot up $4.88 or +0.26% at $1897.72

- Copper up $1.6 or +0.36% at $447.45

- Silver up $0.06 or +0.27% at $23.6195

- Platinum down $0.35 or -0.04% at $919.99

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/04/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 26/04/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/04/2022 | 1245/0845 |  | CA | BOC Deputy Lane panel talk | |

| 26/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/04/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/04/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/04/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/04/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/04/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 27/04/2022 | 2301/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 27/04/2022 | 0130/1130 | *** |  | AU | CPI inflation |

| 27/04/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 27/04/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/04/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 27/04/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/04/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/04/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/04/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/04/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/04/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 27/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/04/2022 | 2230/1830 |  | CA | BOC's Macklem testifies at Senate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.