-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN: European Gas Wars Flare Up

EXECUTIVE SUMMARY:

- VON DER LEYEN SLAMS RUSSIA GAS HALT TO BULGARIA, POLAND

- FOUR EUROPEAN GAS BUYERS ALREADY PAID FOR SUPPLIES IN RUBLES (BBG)

- RUSSIA DUMA SPEAKER BACKS GAS CUTS FOR OTHER "UNFRIENDLY" STATES

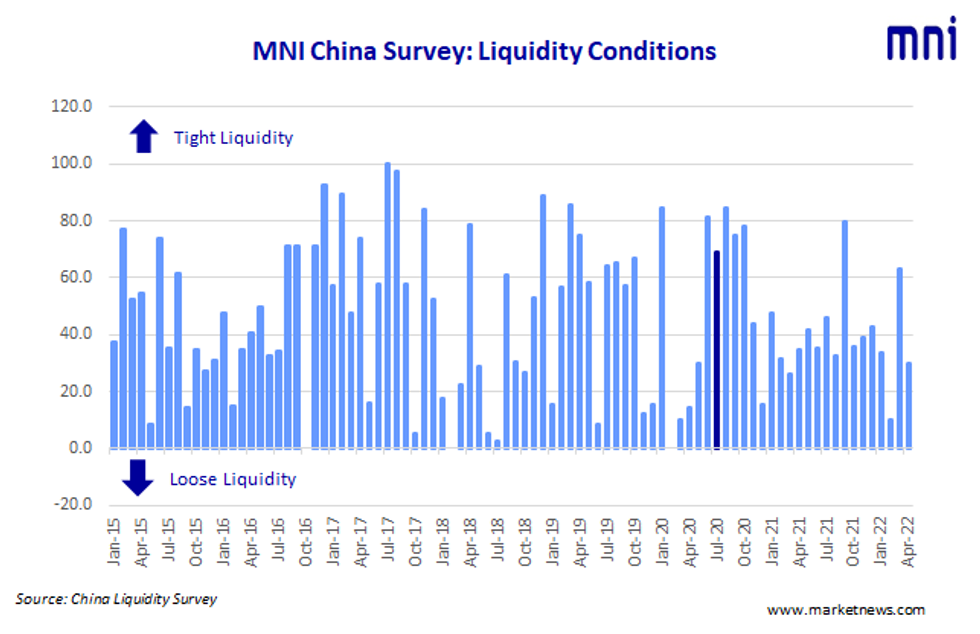

- MNI CHINA LIQUIDITY INDEX: CONDITIONS EASE IN APRIL

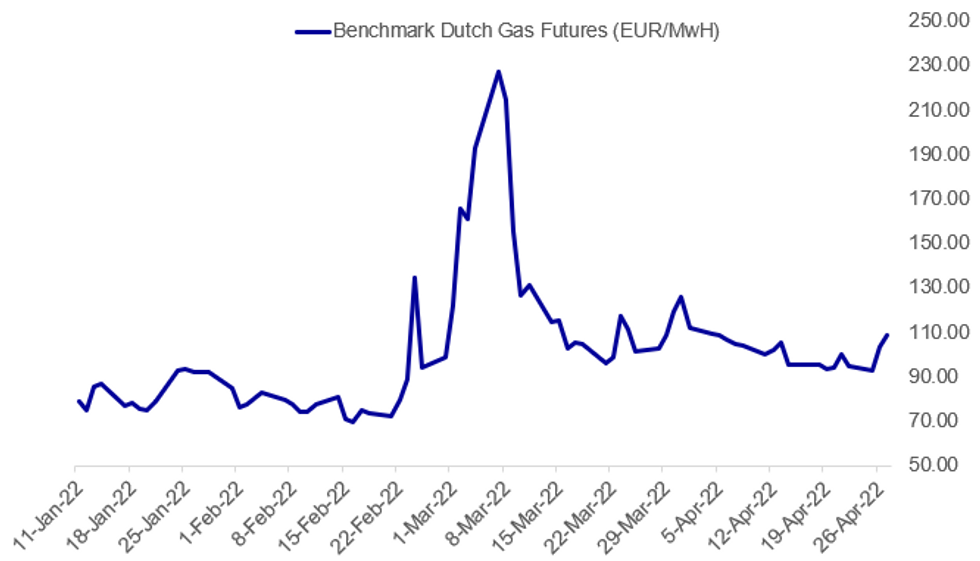

Fig. 1: Gas Prices On The Move Again

Source: BBG, MNI

Source: BBG, MNI

NEWS:

EU / RUSSIA / ENERGY: European Commission President Ursula von der Leyen has issued a statement condemning the actions of Russia in halting gas supplies to Poland and Bulgaria over their refusal to pay for gas supplies in roubles.

- Link: https://ec.europa.eu/commission/presscorner/detail...

- Von der Leyen stated that the suspension "...is yet another attempt by Russia to use gas as an instrument of blackmail."

- VdL: "We are prepared for this scenario. We are in close contact with all Member States.We have been working to ensure alternative deliveries and the best possible storage levels across the EU. Member States have put in place contingency plans for just such a scenario and we worked with them in coordination and solidarity."

- VdL: "Europeans can trust that we stand united and in full solidarity with the Member States impacted in the face of this new challenge. Europeans can count on our full support."

- Comes as wires report that Greek Prime Minister Kyriakos Mistotakis is holding an emergency meeting on energy following the Gazprom gas halt. Greece relies on Russian gas for around 40% of its annual energy needs.

EU/RUSSIA/ENERGY (BBG): Ten European gas companies have opened the accounts at Gazprombank needed to meet Russia’s demand to pay in rubles and 4 have already made payments, according to a source close to Russia gas giant Gazprom. Russia offered buyers compromise payment mechanism that would have avoided EU sanctions breach. Poland, Bulgaria refused; payments were due Apr. 26 so supplies were cut off when they refused to pay in rubles. Other cutoffs won’t come immediately as next payments are due in the second half of May.

EU/RUSSIA/ENERGY (BBG): Germany said it’s discussing the decision by Russia’s Gazprom PJSC to halt gas flows to Poland and Bulgaria with European Union partners, and although it views the move with concern, security of supply is currently guaranteed. “All in all, gas flows are currently at a stable level but we are monitoring the situation very closely,” the economy ministry in Berlin said Wednesday in an emailed statement. The government is in “close contact” with energy companies and suppliers and the country’s gas crisis team is closely monitoring the situation, the ministry said. “No bottlenecks have been identified to date,” it added. “If there are further developments during the day, we will inform you accordingly.”

RUSSIA / ENERGY (BBG): Russia should cut off natural gas supplies to other “unfriendly” states that refuse its demand to pay in rubles, Vyacheslav Volodin, speaker of the State Duma, writes in Telegram post. Duma supports decision to cut off gas to Poland, Bulgaria for failing to pay in rubles as Russia demanded. “The leaders of these countries didn’t want to. Let them explain to their citizens how they will cope with this and in whose interests they were acting when they made this decision”. “We should do the same with other countries that are unfriendly to us”

ECB (BBG): While a termination of Russian gas supplies would have an immediate negative effect, “the risk of an economic contraction in the euro area on the whole is more likely to be small,” European Central BankGoverning Council member Madis Muller says at press conference in Tallinn. “If there’s no recession and consequently no clear slowdown of inflation, then on the basis of the current outlook I don’t see a reason to review what has already been said about current monetary policy plans on ending asset purchases and potential interest rate increases”.

RBA/AUSTRALIA: Australia's CPI inflation surged to an annualized 5.1% in the first quarter of this year and analysis by the Australian Bureau of Statistics shows that many of the energy factors driving the CPI are also impacting underlying inflation, which is now at 3.7%. Underlying inflation is the Reserve Bank of Australia's preferred measure of inflation and at 3.7% it is now well above the RBA's 2% to 3% target range

DATA:

MNI China Liquidity Index™– Falls To 30.0 in April

Liquidity conditions across China’s interbank markets eased in April, boosted by the central bank cutting banks’ reserve requirement ratio in order to boost a slowing economy, the latest MNI Liquidity Condition Index shows.

The Liquidity Condition Index stood at 30.0 in April, easing from 63.3 in March, with 40.0% of traders reporting an improvement in conditions. The higher the index reading, the tighter liquidity appears to survey participants.

- The Economy Condition Index stood at 26.7, recovering from March's slide to 21.7, despite Covid concerns.

- The PBOC Policy Bias Index remained below 50 for an 10th consecutive month.

- The Guidance Clarity Index was little changed, as respondents again claim to understand the signals from the PBOC.

The MNI survey collected the opinions of 30 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions.

Interviews were conducted April 11 – April 22.

Click below for the full press release:

MNI China Liquidity Index -2022-04 presser.pdf

For full database history and full report on the MNI China Liquidity Index™, please contact:sales@marketnews.com

MNI: FRANCE APR CONSUMER SENTIMENT 88 (FCST 92); MAR 90r

French Consumer Sentiment Dips Further

FRANCE APR CONSUMER SENTIMENT 88 (FCST 92); MAR 90r

- Consumer sentiment inched down by a further two points in April, to the lowest reading since December 2018 (movement of the yellow vests). The consensus was looking for a one-point recovery.

- This is well below the long-term average of 100, with consumers highlighting a stark decrease in the propensity to make large purchases, more so than the dip seen last month.

- Some recovery was seen in expectations of future household financial situations, albeit remaining low. The index of households expecting further acceleration of prices saw an optimistically sharp decline.

MNI: GERMANY MAY GFK CONSUMER CONFIDENCE -26.5; APR -15.7r

GfK Consumer Confidence Dives to Historic Low

GERMANY MAY GFK CONSUMER CONFIDENCE -26.5; APR -15.7r

- German consumer sentiment deteriorated by 10.8 points to a historic all-time low of -26.5 in the May outlook, beating the previous Spring 2020 low at the pandemic onset.

- Economic and income expectations as well as propensity to buy saw stark declines. Both the Ukraine war and soaring inflation of 7.3% y/y in March have outweighed optimism from easing pandemic restrictions.

- Income expectations dropped to a 20-year low, with German consumers seeing the danger of recession as "high" as the economy continues to slow amidst soaring energy prices, ongoing supply chain issues and material shortages.

- Just under 2% economic growth is expected for 2022.

- German consumer confidence has been substantially harder hit than the eurozone aggregate, where April saw a slight uptick (albeit starkly pessimistic). The notable impact of the Ukraine war on Germany's energy-intensive manufacturing industry's growth outlook underpins this divergence.

- The April reading was revised down by 0.2 points.

MNI: SWEDEN MAR UNEMPLOYMENT 8.2%

MNI: SWEDEN MAR PPI +5.5% M/M, +24.5% Y/Y; FEB +19.3% Y/Y

FIXED INCOME: Off of yesterday's highs

- Treasuries have seen larger moves than Bunds or gilts this morning, reversing some of the rally seen earlier in the week.

- There haven't really been any headline drivers. The situation appears to be more that investors need to take a breather and there is little appetite to push prices higher, for now at least.

- However, this isn't the case with peripheral spreads which have widened this morning (albeit are now off their highs of the day). There has been focus on headlines this morning surrounding whether European countries are paying for Russian gas in euros or Rubles. Initial rumours that Austria had paid in RUB have been denied by the Chancellor and since then Bloomberg headlines have suggested that four European gas buyers have already paid in RUB (but it isn't clear if this is in violations of sanctions or not). The EU is meeting today to dicsuss gas supply, so there may be more headlines out later.

- It's a relatively light calendar today with US trade, inventory and pending home sales data due. Tomorrow the calendar heats up with Spanish and German inflation data and the first print of US Q1 GDP.

- TY1 futures are up 0-2 today at 120-03+ with 10y UST yields up 4.0bp at 2.763% and 2y yields up 7.0bp at 2.585%.

- Bund futures are up 0.02 today at 155.50 with 10y Bund yields down -1.1bp at 0.801% and Schatz yields down -1.9bp at 0.123%.

- Gilt futures are down -0.11 today at 119.56 with 10y yields up 0.7bp at 1.802% and 2y yields up 0.5bp at 1.497%.

FOREX: Gas Flow Fallout Contained to Regional FX So Far

- Gas flows across eastern Europe have been the focus of trade so far after reports late yesterday that Poland had been cut off from Russian gas supply proved true this morning, with Bulgarian access also being severed as the countries refused to pay RUB for Russian energy exports. The development has prompted an emergency meeting of EU energy ministers, who are set to debate the current sanctions rules that may prompt more nations to drop Russian supply entirely ahead of the next payment deadlines on May 15th.

- For now, the market response has been contained to regional currencies (PLN holds the bulk of yesterday's sharp losses), with AUD, NZD and SEK mildly firmer this morning, while JPY, EUR trade lower.

- GBPUSD traded to a fresh cycle low this morning, clearing 1.2974, Apr 13 low, as well as 1.2676 last printed in September 2020. The trend is in technically oversold territory: the 14d RSI is now at 22 - the lowest point since March 2020 and the initial wave of lockdowns that followed COVID.

- In a reversal of yesterday's outperformance, JPY is the poorest performing currency in G10, helping USD/JPY climb back toward the Y128.00 level. USDJPY remains in an overarching consolidation phase as bulls pause after the recent rally. This sideways activity highlights the formation of a bull flag, reinforcing bullish conditions with the uptrend still intact. The focus on 129.44 next, a Fibonacci projection.

- US trade balance data and pending home sales numbers for March are the data highlights Wednesday. Central bank speakers include ECB's Lagarde and Bank of Canada's Macklem after the market close.

EQUITIES: Limited Bounce After Tuesday's Rout

- Asian equities closed mixed: Japan's NIKKEI closed down 313.48 pts or -1.17% at 26386.63 and the TOPIX ended 17.75 pts lower or -0.94% at 1860.76. China's SHANGHAI closed up 71.856 pts or +2.49% at 2958.282 and the HANG SENG ended 11.65 pts higher or +0.06% at 19946.36

- European stocks are a little higher, with the German Dax up 32.86 pts or +0.24% at 13792.02, FTSE 100 up 17.92 pts or +0.24% at 7403.09, CAC 40 up 9.58 pts or +0.15% at 6421.85 and Euro Stoxx 50 up 12.25 pts or +0.33% at 3733.34.

- U.S. futures are a little higher but still well below Tuesday's open: Dow Jones mini up 324 pts or +0.98% at 33484, S&P 500 mini up 34.5 pts or +0.83% at 4205.25, NASDAQ mini up 110.5 pts or +0.85% at 13127.

COMMODITIES: Energy Prices Rise As Russia-EU Gas Tensions Flare

- WTI Crude up $0.7 or +0.69% at $102.4

- Natural Gas up $0.02 or +0.28% at $6.869

- Gold spot down $11.49 or -0.6% at $1893.78

- Copper up $4.6 or +1.03% at $451.1

- Silver up $0.01 or +0.04% at $23.4873

- Platinum down $7.42 or -0.8% at $916.73

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 27/04/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/04/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/04/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 27/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/04/2022 | 2230/1830 |  | CA | BOC's Macklem testifies at Senate | |

| 28/04/2022 | 0130/1130 | ** |  | AU | Trade price indexes |

| 28/04/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/04/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/04/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2022 | 0700/0900 |  | EU | ECB de Guindos Presents Annual Report 2021 | |

| 28/04/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 28/04/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2022 | 0800/1000 |  | EU | ECB publishes May economic bulletin | |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Consumer Confidence |

| 28/04/2022 | 0800/1000 | ** |  | IT | ISTAT Business Confidence |

| 28/04/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/04/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/04/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/04/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 28/04/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/04/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/04/2022 | 1400/1600 |  | EU | ECB Elderson Panels ECOSOC UN Forum | |

| 28/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 28/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/04/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.