-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI: PBOC Net Injects CNY90.3 Bln via OMO Tuesday

MNI US OPEN: Washington On Stagflation Watch

EXECUTIVE SUMMARY:

- BIDEN WILL ASK CONGRESS TO PAUSE GAS TAX AMID RECORD PUMP PRICES

- FED CHAIR POWELL TO GIVE CONGRESSIONAL TESTIMONY AMID FEARS OVER DOWNTURN

- UK INFLATION AT 40-YR HIGH, BUT WITHIN EXPECTATIONS

- BOJ EYES AUTUMN MOVE IF YEN STEADIES, PRICES RISE

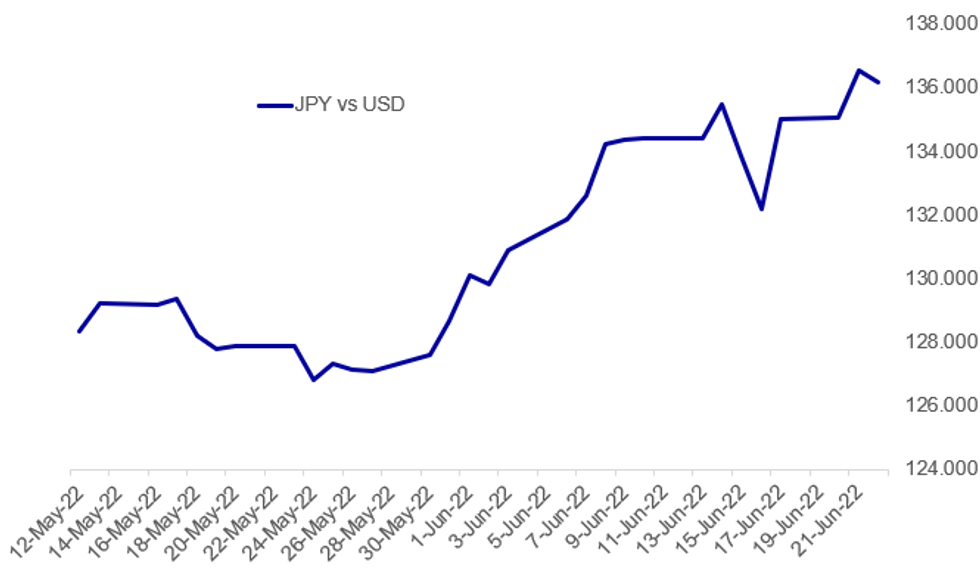

Fig. 1: Yen Steadies

Source: BBG, MNI

Source: BBG, MNI

NEWS:

U.S. (RTRS): U.S. President Joe Biden on Wednesday will call on Congress to pass a three-month suspension of the federal gasoline tax to help combat record pump prices, according to a senior administration official. The president will also call on states to temporarily suspend state fuel taxes, which are often higher than federal rates, the official said, and he will challenge major oil companies to come to a meeting with his energy secretary later this week with ideas on how to bring back idled refining capacity. Biden and his advisers have been discussing the issue for months amid increasing pressure to take action to address record-high gas prices that have weighed down the president's poll ratings and cast a dark cloud over Democrats' chances of retaining congressional power in November's elections. A suspension of the 18.4 cents a gallon federal gasoline tax and 24.4 cent diesel tax would require congressional approval, likely making Biden's support behind the effort largely symbolic.

U.S. / FED (BBG): ederal Reserve Chair Jerome Powell will deliver his semi-annual testimony on monetary policy to Congress this week -- he’s addressing the Senate Banking Committee on Wednesday and the House Financial Services Committee on Thursday. The dominant topic will be inflation and the Fed’s efforts to control it as well as recession risks.

BOJ (MNI INSIGHT): The Bank of Japan could adjust its easy monetary policy around the autumn if the yen stabilises at a lower level around 140 to the dollar, sending inflation to temporary peaks near 3% and driving wage hikes into 2023, MNI understands. For full article contact sales@marketnews.com

ECB (BBG): Experts on the European economy don’t expect the region to endure stagflation akin to the 1970s and characterized by quickly rising prices amid output that barely rises or even contracts, according to analysis by the European Central Bank. While growth forecasts were cut and price expectations raised following Russia’s invasion of Ukraine, economic activity is still seen increasing next year and inflation is expected to slow below 2% in the second half of 2023, ECB researchers said Wednesday in a report. “Current expert forecasts remain far from a stagflation scenario,” it said. “However, uncertainty has increased,” leading to a greater range of estimated outcomes.

ECB (BBG): The European Central Bank signaled that lenders have just over two years to meet its expectations for managing risks related to climate change. “I see it as reasonable that banks can be fully compliant with all our expectations by the end of 2024 at the latest,” said Frank Elderson, the deputy head of the ECB’s supervisory board. “At the same time, we remain open to listen to arguments of banks that may render this not feasible in individual cases.”

SRI LANKA (AP): Sri Lanka’s prime minister says its debt-laden economy has “collapsed” after months of shortages of food, fuel and electricity, and the South Asian island nation cannot even purchase imported oil.“We are now facing a far more serious situation beyond the mere shortages of fuel, gas, electricity and food. Our economy has completely collapsed. That is the most serious issue before us today,” Prime Minister Ranil Wickremesinghe told Parliament.

DATA:

UK Inflation At 40-Yr High, But Within Expectations

UK CPI inflation edged higher in May, rising to 9.1% -- the highest level since 1982, according to the Office for National Statistics. The increase will not be a surprise to financial markets, as it is in line with analysts expectations -- although the monthly 0.7% increase was just above forecasts.

"Although at historically high levels, the annual inflation rate was little changed in May," ONS Chief Economist Grant Fitzner said, pointing to continued steep food price rises and the record high cost of petrol.

Core CPI, highlighted recently by the Bank of England as a particular concerned as it was outpacing most peer economies, slowed modestly to 5.9% from 6.2% in April. Factory gate inflation, the measures of input and output costs for UK industry, again rose to record highs, with May Input PPI rising 2.1% to 22.1% y/y.

The number will not be a surprise to the BOE who saw inflation ticking higher, but there is little respite for policymakers, who still see inflation rising to just above 11% early in Q4.

FIXED INCOME: Gilts still outperforming but Bunds playing catch up

- Gilts were the early outperformers in core FI space after inflation data which was marginally weaker than economists' expectations but led to a reassessment of market pricing, reducing the probability of 75bp hikes from the Bank of England. Lower oil prices have also led to core fixed income generally moving higher (yields lower) with 10y Bunds almost having caught up to the moves seen in gilts, but both outperforming US Treasuries.

- The focus will now begin to turn to Powell's semi-annual testimony where markets will be watching for any clues on the Fed's near-term plans (50bp, 75bp or 100bp in July?) and also on longer-term expectations and the probability of the Fed's policy inducing a recession.

- We will also hear from Fed's Barkin, Evans and Harker while Canadian CPI will be closely watched north of the border.

- TY1 futures are up 0-16 today at 116-09+ with 10y UST yields down -4.7bp at 3.231% and 2y yields down -4.7bp at 3.151%.

- Bund futures are up 1.13 today at 144.46 with 10y Bund yields down -9.2bp at 1.675% and Schatz yields down -6.6bp at 1.067%.

- Gilt futures are up 0.80 today at 111.58 with 10y yields down -10.2bp at 2.550% and 2y yields down -12.3bp at 2.175%.

FOREX: JPY Stages Solid Bounce, But Outlook Remains Fragile

- USD/JPY is retreating off this week's multi-decade cycle high, putting the rate back below the Y136.50 in what's likely to be only a brief respite. USDJPY broke to new cycle highs this week, with price clearing short-term resistance at 135.59, Jun 15 high. The break higher confirms a resumption of the primary uptrend and maintains the bullish price sequence of higher highs and higher lows.

- The greenback also trades well, with the USD benefiting from the general rolling over of equity prices after Tuesday's corrective bounce.

- A downleg in oil prices has undermined sentiment somewhat, with WTI and Brent futures off around 5% apiece as Biden is set to call on Congress to suspend the Federal fuel tax in an effort to help with record high oil prices. Commodity-tied currencies are suitably lower, with AUD and NZD among the poorest performers Wednesday.

- Oil weakness is dragging on European oil & gas names, while the likes of ExxonMobil and Chevron are trading markedly lower pre-market. This puts US futures on track for a lower open of 1.5-2.0% later today.

- Canadian CPI data for May is the focus going forward, with the Y/Y rate seen accelerating to 7.3% from 6.8% previously. Eurozone consumer confidence data also crosses as well as speeches from Fed's Powell - delivering his semi-annual testimony, Barkin, Evans and Harker.

EQUITIES: Tuesday's Gains Swiftly Retreat

- Asian markets closed weaker: Japan's NIKKEI closed down 96.76 pts or -0.37% at 26149.55 and the TOPIX ended 3.55 pts lower or -0.19% at 1852.65. China's SHANGHAI closed down 39.517 pts or -1.2% at 3267.202 and the HANG SENG ended 551.25 pts lower or -2.56% at 21008.34.

- European stocks are down sharply, with the German Dax down 269.73 pts or -2.03% at 13033.41, FTSE 100 down 91.81 pts or -1.28% at 7060.73, CAC 40 down 109.5 pts or -1.84% at 5857.06 and Euro Stoxx 50 down 67.54 pts or -1.93% at 3428.96.

- U.S. equities are retracing Monday's gains, with the Dow Jones mini down 406 pts or -1.33% at 30119, S&P 500 mini down 58.75 pts or -1.56% at 3709, NASDAQ mini down 204.5 pts or -1.77% at 11372.75.

COMMODITIES: Lower Across The Board On Recession Fears

- WTI Crude down $5.09 or -4.65% at $104.49

- Natural Gas down $0.14 or -2.07% at $6.668

- Gold spot down $6.36 or -0.35% at $1825.92

- Copper down $13.45 or -3.32% at $391.55

- Silver down $0.34 or -1.56% at $21.3244

- Platinum down $8.44 or -0.9% at $934.03

LOOK AHEAD:

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 22/06/2022 | 1230/0830 | *** |  | CA | CPI |

| 22/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 22/06/2022 | 1300/0900 |  | US | Richmond Fed President Tom Barkin | |

| 22/06/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 22/06/2022 | 1440/1040 |  | CA | BOC Deputy Rogers "fireside chat" | |

| 22/06/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 22/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 22/06/2022 | 1600/1200 |  | US | Richmond Fed's Tom Barkin | |

| 22/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 22/06/2022 | 1730/1330 |  | US | Fed's Patrick Harker and Tom Barkin | |

| 23/06/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/06/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/06/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/06/2022 | 0600/0800 | ** |  | SE | PPI |

| 23/06/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/06/2022 | 0715/0915 |  | FR | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/06/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/06/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/06/2022 | 0800/1000 | *** |  | NO | Norges Bank Rate Decision |

| 23/06/2022 | 0800/1000 |  | EU | ECB Economic Bulletin | |

| 23/06/2022 | 0800/1000 |  | EU | Flash Manufacturing, Services PMI | |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/06/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/06/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 23/06/2022 | 1100/0700 | * |  | TR | Turkey Benchmark Rate |

| 23/06/2022 | - |  | EU | ECB Lagarde at European Council Meeting | |

| 23/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 23/06/2022 | 1230/0830 | * |  | US | Current Account Balance |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/06/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/06/2022 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 23/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 23/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 23/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for TIPS 5 Year Note |

| 23/06/2022 | 1800/1400 | *** |  | MX | Mexico Interest Rate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.