-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Eurozone Inflation Insight – November 2024

MNI ASI OPEN: Fed Bostic Still Confident of Waning Inflation

MNI ASIA MARKETS ANALYSIS: Tsy Curves Twist Flatter

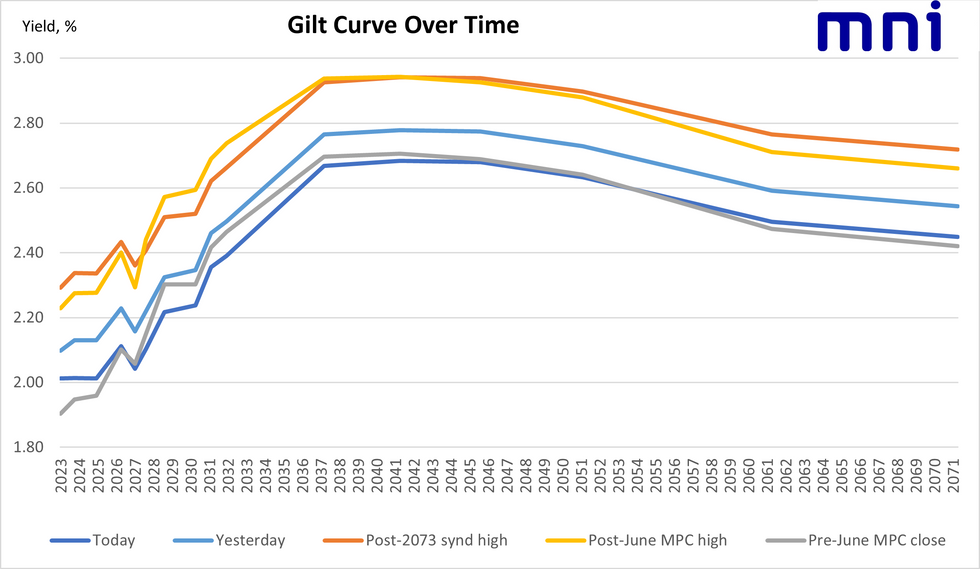

5-30-year yields now below post-June MPC levels

- As noted earlier, gilts have moved higher today. Initially driven by misses in European PMIs, but then finding a little stability as the UK PMI didn't come in quite as weak as the European data had suggested. The UK PMI also pointed to a strong labour market and continued inflationary pressures, meaning the reasons for hikes remain in place (albeit as we have long argued, not at the pace markets had priced - we still see around a 60% probability of a 50bp hike in August with the alternative a 25bp hike - markets still after today's data price 53bp for August).

- Yields at the very front-end of the gilt curve remain higher than the post-June MPC reaction, as do 30+ year yields, but between 5-30 years, yields are now lower than the initial reaction.

- As well as PMI data, this morning saw the release of public sector finance data which weren't market moving but saw borrowing at higher levels than expected.

- Overnight tonight we will receive consumer confidence data for June ahead of tomorrow morning's retail sales print for May. These will give a further update on the state of the consumer following the increase in NICs and the energy price cap - both of which came into effect in April.

- Tomorrow afternoon will see another speech from BOE Chief Economist Huw Pill on ‘Inflation and Debt – Challenges for Monetary Policy after Covid-19’ - an interesting topic but he has already made several appearances since last week's MPC meeting so it is unclear whether he will give much new immediate policy-relevant guidance. MPC member Jonathan Haskel also appears on a panel on the global economy tomorrow.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.