-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

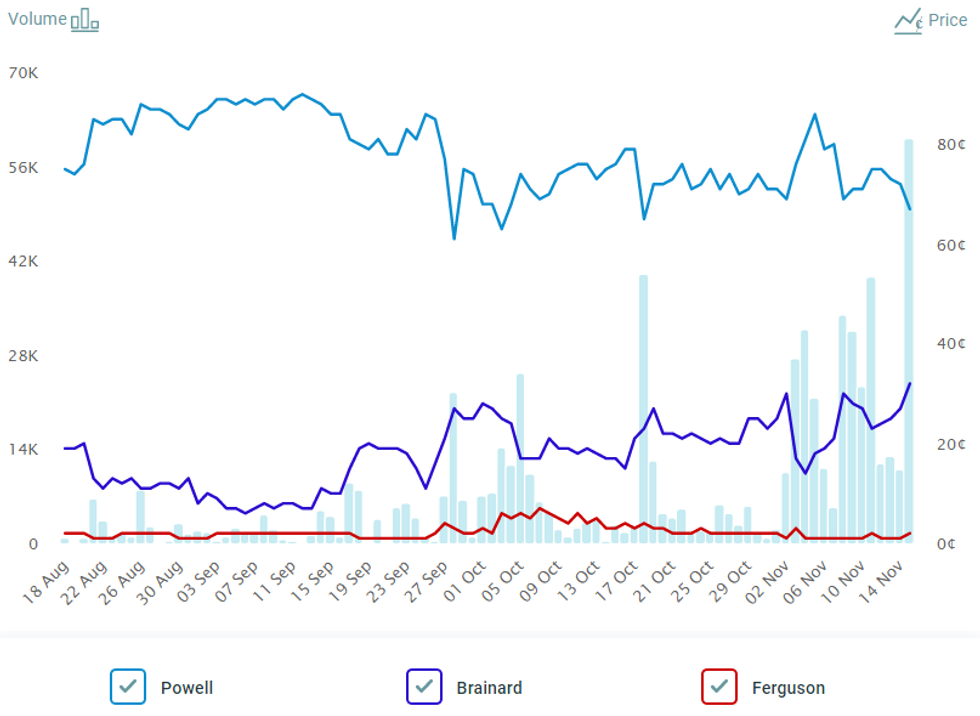

Free AccessA Look At What The Betting Markets Have To Say On The Race For Fed Chair

A reminder that late Monday saw BBG flag comments from Senate Banking Committee Chair Brown, who revealed that he was told by White House officials to expect an "imminent" announcement re: President Biden's pick to Chair the Federal Reserve. Brown said "I'm not going to speculate who I think it might be now. I assume the decision's been made and they haven't announced it, but I don't even know that."

- The incumbent, Jerome Powell, remains the favourite in betting markets, although the odds on that particular outcome have taken a hit in recent days after several press outlets noted that Lael Brainard's interview for the role went better than expected. BBG went as far as deeming her to be a "serious rival" for Powell, per a source report released last week.

- FOX's Charlie Gasparino suggested that Wall St. now sees odds re: a reappointment of Powell at just 50/50 after the decision was seen as a layup in favour of Powell not long ago. Betting market odds aren't quite as finely balanced, but the differential between Powell & Brainard has narrowed in recent days, leaving Powell priced at 67c, with Brainard on 32c.

- One development to note is the recent withdrawal of former Fed Vice Chair, Roger Ferguson, from a role at Apollo Global Management (before he even started work). Ferguson apparently has unspecified commitments he must fulfil with his prior employer (pension firm TIAA), which prevented him from taking up the role at Apollo. Ferguson may enter the running for any of the open positions at the Fed, although his chances of attaining the seat atop the central bank are seemingly slim at best.

Fig. 1: Odds re: Whom Will The Senate Next Confirm As Chair Of The Federal Reserve?

Source: MNI - Market News/PredictIt

Source: MNI - Market News/PredictIt

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.