-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US Macro Weekly: Politics To The Fore

MNI Credit Weekly: Le Vendredi Noir

Attention Turns To Run-Off Contests After RN Wins 1st Round Plurality

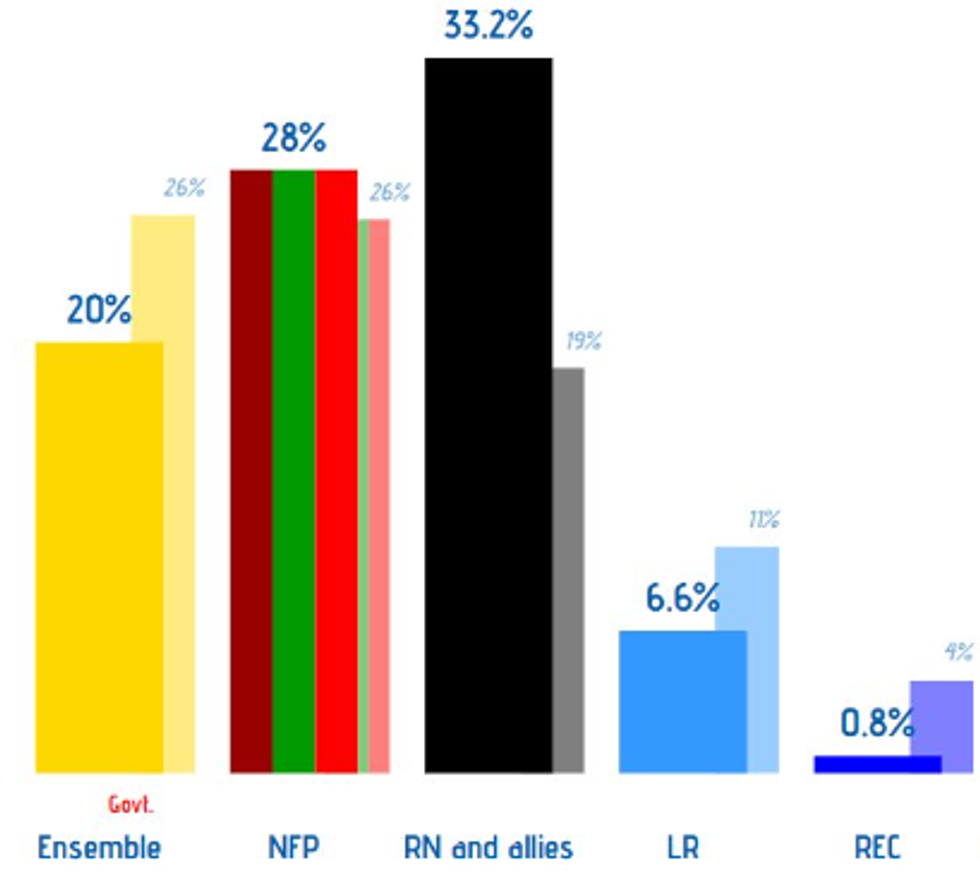

The first round of the French parliamentary election on 30 June delivered a result largely in line with opinion polling as the right-wing nationalist Rassemblement National (National Rally, RN) secured a plurality of the vote. Attention now turns to the second round on 7 July, where President Emmanuel Macron - after a poor third-placed finish for his centrist Ensemble alliance - is calling for a 'republican front' of the centre and left to join together to stop RN securing a majority.

- Projections from pollster Ifop expect the RN to win between 240 and 270 seats based on these vote shares, short of the 289 required for a majority. The leftist New Popular Front (NFP), in second place on 28%, could win 180-200 seats, while Ensemble could fall to 60-90 according to Ifop projections.

- The election has seen three notable highs:

- The highest turnout since the 1986 legislative election at 66.7%, compared to 47.5% just two years ago.

- A total of 75 of 577 seats were won in a first round, a far greater total than usual. Thirty eight went to the RN, 32 to the NFP, three to the centre-right Les Republicains and its allies, and two to Ensemble.

- A very high number of seats could see three-way contests in the second round, with 285-315 of seats seeing more than two candidates reach the threshold of securing support from 12.5% of eligible voters in that constituency.

- If Ensemble candidates do not stand down in favour of NFP or vice versa it would smooth the path to an RN majority, with the centre/left vote split.

Chart 1. Parliamentary Election Vote Share, % (2022 Result in lighter shaded column)

Source: Interior Ministry, @EuropeElects

Source: Interior Ministry, @EuropeElects

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.