-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBaht Edges Higher As Equity Inflows Resume, Gov't Vows Not To Meddle With BoT

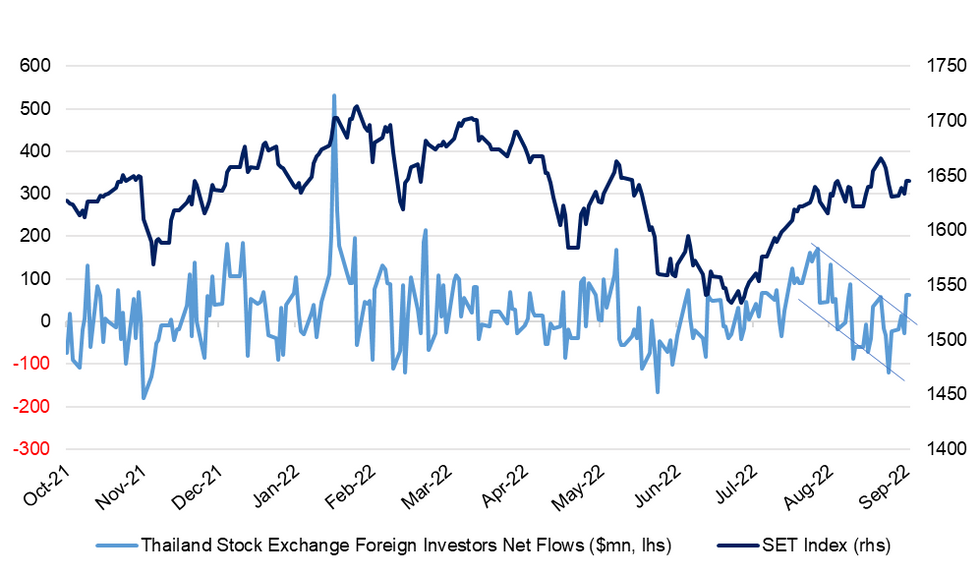

Positive spillover from Thai stock market has helped USD/THB ease off this morning, with the pair last sitting -0.065 at THB37.305. A retreat under the 50-DMA (THB36.334) is needed to inspire hopes for a deeper sell-off. Bulls see yesterday's high of THB37.448 for initial resistance, followed by Sep 19, 2006 high of THB37.951.

- Thursday saw the largest net daily equity inflow this month, as foreign investors snapped up a net $61.71mn in local stocks, challenging the recent downtrend. The SET index added ~0.7% as its 50-DMA crossed above the 100-DMA.

- Acting PM Prawit sought to reassure markets that the government will not meddle with the central bank days after he expressed concern about the baht's recent slump and said that the MoF will speak with the BoT soon. Prawit now clarified that he had instructed FinMin Arkhom to "only talk" with the BoT about currency matters, while Arkhom noted that he didn't issue any directives to BoT officials during Thursday's talks.

- Thailand loosened its COVID-19 rules again in a move intended to support the recovery of domestic tourism industry. From October 1, foreign visitors will no longer be required to show vaccination/test certificates on arrival. The main COVID-19 panel meets today and may end the emergency decree to control the pandemic.

Fig. 1: Thailand Stock Exchange Foreign Investors Net Flows ($mn) vs. SET Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.