-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Early Geopol Risk Roils, Focus Turns To Fed

MNI ASIA MARKETS ANALYSIS: South Korea Rescinds Martial Law

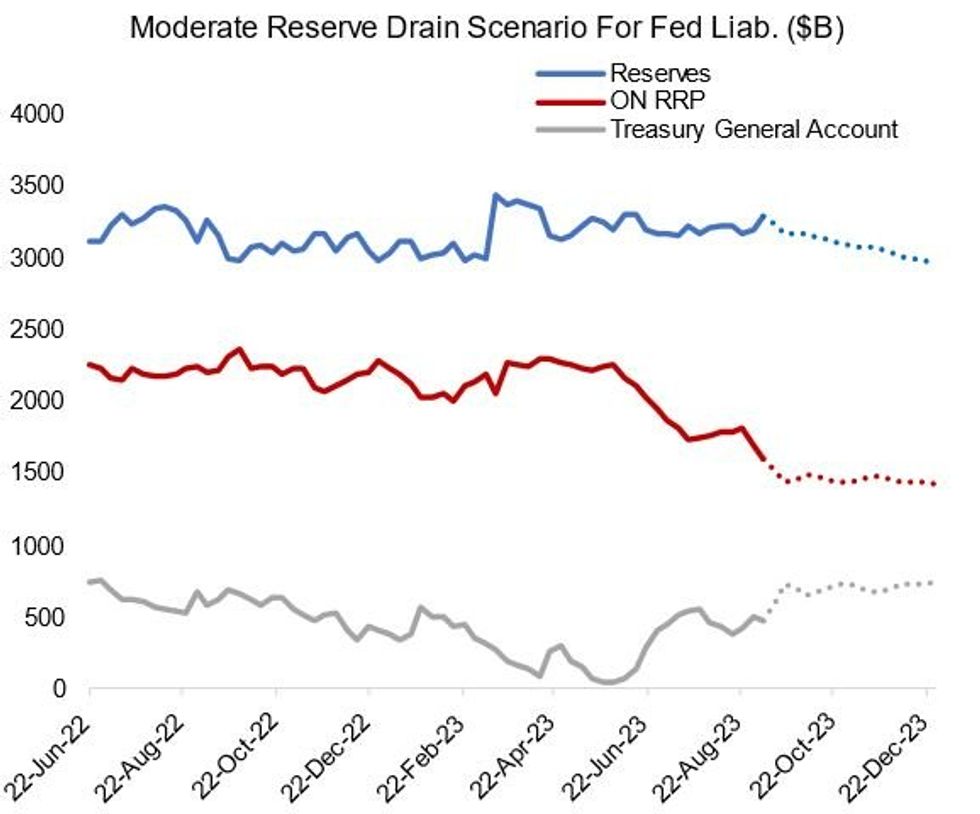

Benign Reserve Drain Scenario Playing Out, Months Ahead Key (2/2)

Perhaps the most remarkable turn in the Fed's balance sheet in the past month has been in overnight reverse repo levels which dropped $91B in the past week and $191B in the month to Sep 6th, to a post-March 2022 low $1.61T. At the same time bank reserves are up $94B on the week/$62B on the month despite a $49B rise in the Treasury General Account over the past month.

- The TGA’s post-debt limit cash rebuild in other words has gone as smoothly as could be expected so far, and broadly speaking in line with the “moderate” reserve drain scenario for Fed liabilities that we laid out a couple of months ago.

- The drop in ON RRP usage since June has come alongside some further gains in money market fund assets under management and steady commercial bank deposits. Certainly we’re not seeing any meaningful sign of reserve scarcity (eg bank deposit rates on offer, repo rates, Fed funding facility usage (including BTFP), and borrowing from FHLBs).

- Though as we have been saying, the real test for reserve scarcity would be going into late September and Q4, with QT continuing unabated and Treasury issuance picking up again with the TGA’s end-Sep cash balance target of $650B representing a $170B jump from current levels.

- By the end of next week TGA levels should be back over $600B and could exceed $700B temporarily later in the month. Levels could recede through early October as net bill supply pulls back but rise again by end-year Treasury is targeting an end-December $700B cash balance.

Source: MNI Estimates (Dotted Lines), Fed

Source: MNI Estimates (Dotted Lines), Fed

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.