-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Nov Job Gains, Fed Blackout, CPI/PPI Ahead

MNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

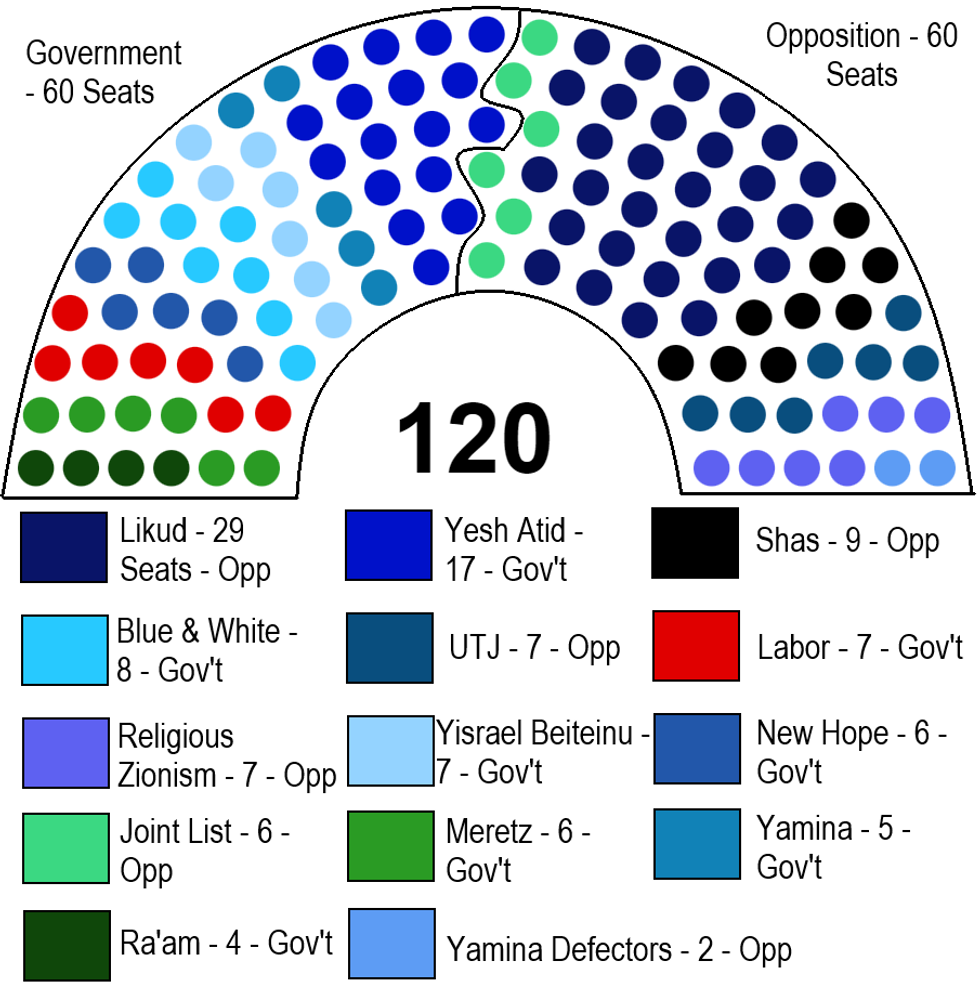

Bennett Gov't On Brink Of Collapse After MK Defection

The broad coalition gov't of Prime Minister Naftali Bennett is on the brink of collapse after it lost its wafer-thin one-seat majority in the Knesset. Idit Silman, a gov't whip from Bennett's own right-wing Yamina Party resigned from the gov't and joined the opposition, meaning the 120-member chamber is now split down the middle, 60-60 between gov't and opposition members.

- The Bennett gov't, formed by parties as varied as the right-wing Yamina, centre-left Labour, green Meretz, liberal Yesh Atid and Islamist Ra'am, came into office in June 2021, ousting then-PM Benjamin Netanyahu after nearly 12 years in office.

- Bennett's party has shown increasing signs of disintegration, with Silman the second MK to leave the group since its leader agreed to work with parties across the political spectrum to oust Netanyahu.

- The collapse of the gov't looks to be more a question of when rather than if. Following this the options will be either the formation of a new coalition gov't, or the dissolution of the Knesset and a snap election. Gov't could theoretically survive until March 2023, when the next budget needs approving, but this would need every single MK to maintain unity at a fractious time.

- At present, Netanyahu's Likud would not be in a position to lead a right-wing coalition, short of the 61 seats required. Polls show that in the event of a snap election, Likud would remain the largest party and be in the box seat to form a new gov't, but this would require one or more parties from current gov't to switch support.

- Comes at an important time in Israeli, regional and global geopolitics. Talks on Iran nuclear deal (opposed by gov't and opposition) has stalled but clear that US and West want a deal in order to allow Iranian oil to flow and replace supplies from Russia. Israel also has the potential to play an important role in the Russia-Ukraine war, with close ties to both the US but also Russia, it could act as a mediator or security guarantor in the future.

Source: Knesset.gov.il, MNI

Source: Knesset.gov.il, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.