-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

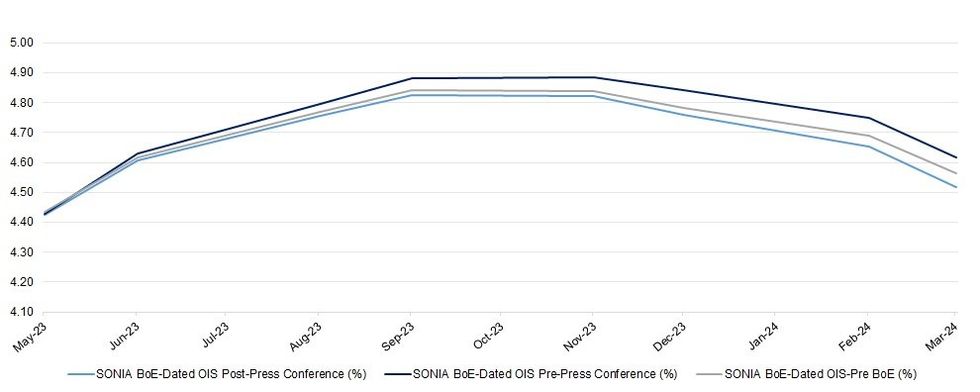

BoE Pricing Twist Flattens On The Day As Wider Impetus Takes Hold

The BoE-dated OIS curve has twist flattened after the initial steepening move that was seen as pricing nudged higher on the reaffirmation of the Bank’s pre-existing guidance verse and adjustments to the economic forecasts that were delivered alongside the widely expected 25bp rate hike, with spill over from broader market price action (centred on the latest round of U.S. regional Bank worry) evident, pushing the contracts back from session highs.

- In the post-meeting press conference Bailey stressed that the Bank “will be guided by the evidence, not giving directional steer on rates today. Difference in inflation to forecasts is mainly food and clothing. It appears to be taking longer for food price pressures to work through the system. These are unusual times and models need to be treated with caution.”

- When questioned on overtightening Bailey pointed to the evolution of the mortgage market towards fixed rate products, while noting that there is “still a lot of pass through to come. It is a very lively subject of debate in the MPC - there has to be quite a lot of judgment involved.”

| BoE Meeting | SONIA BoE-Dated OIS Post-Press Conference (%) | SONIA BoE-Dated OIS Pre-Press Conference (%) | SONIA BoE-Dated OIS-Pre BoE (%) |

| May-23 | 4.426 | 4.428 | 4.434 |

| Jun-23 | 4.612 | 4.628 | 4.617 |

| Aug-23 | 4.762 | 4.797 | 4.769 |

| Sep-23 | 4.833 | 4.881 | 4.842 |

| Nov-23 | 4.829 | 4.885 | 4.837 |

| Dec-23 | 4.766 | 4.841 | 4.783 |

| Feb-24 | 4.662 | 4.749 | 4.689 |

| Mar-24 | 4.527 | 4.617 | 4.565 |

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.