-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessBurberry (Baa2, NR) IPT follow up

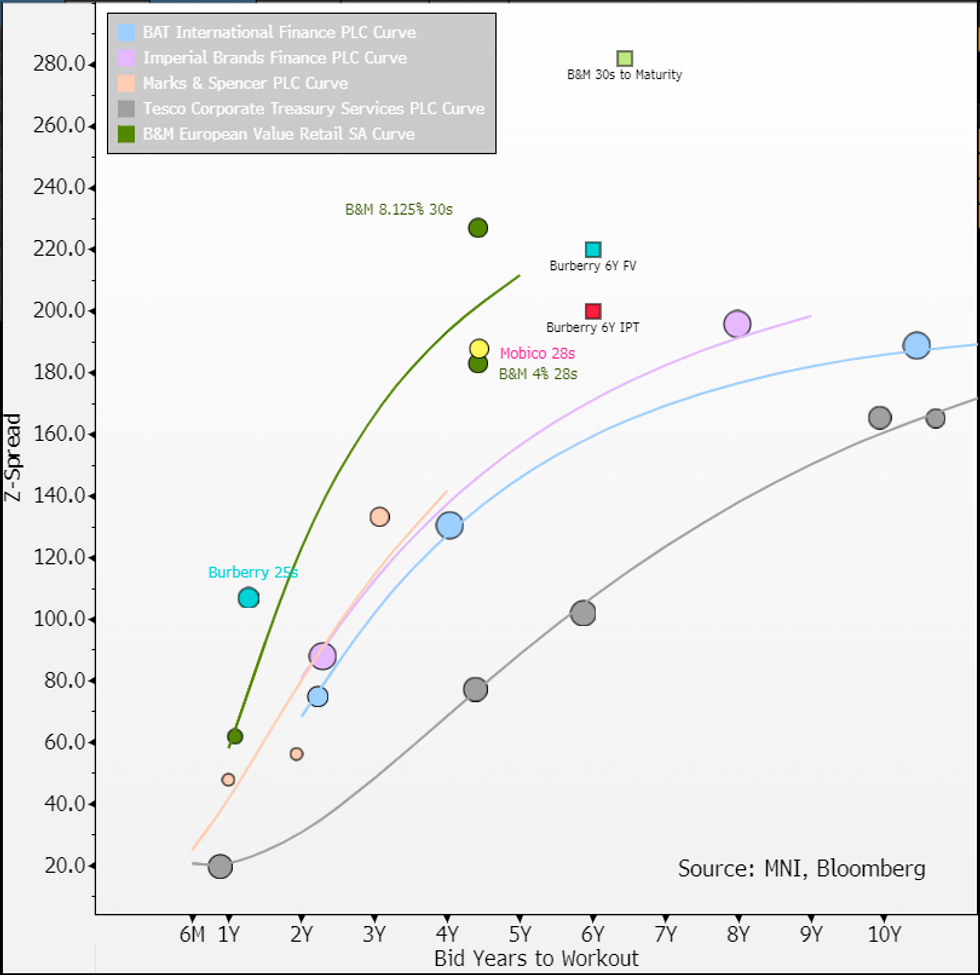

IPT £Benchmark 6Y UKT+200a vs. FV +217 (-17 inside)

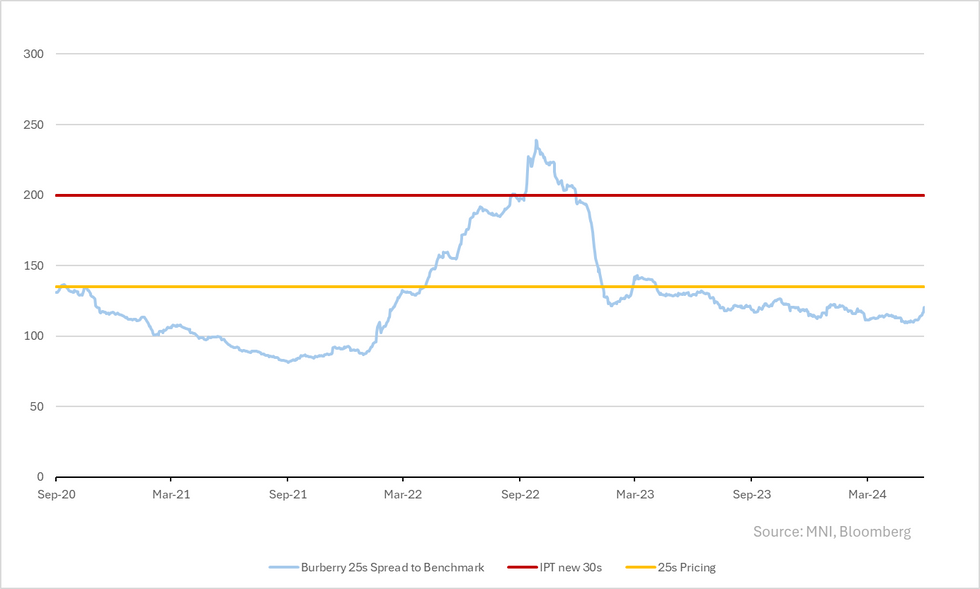

We will record this as negative NIC with FV unch (see image below). Please note swap spreads are close to flat in sterling 6Y (at -3) and not throwing us off; to be clear FV is Z+220 or 6.2% or UKT+216 (against the 0.375% Oct 30s). Couple of final cautionary notes for investors before we leave this to pricing;

- The vol you see in the 25s (below) should be noted; it spiked to T+240 in 1H22 and was a ~3y at the time. The duration on this line is significantly higher.

- Neither the 25s nor this have CoC - this is important for us given market has been brewing if a PE player or fellow European conglomerate (LVMH etc.) will step in and take control.

- Burberry tends to get significant vol for any lux retailer that reports weakness in Asia particularly China given its 44% of sales in Asia - i.e. risk events are not limited to just earnings.

- Our view is management holds back on giving colour including on answering questions like what its online sales as a percentage of revenue is. Key for us (and likely the analyst that asked it) given its spending money on store refreshments yet flagging falling foot traffic.

- Stock price is at a 12y low and a trailing P/E of 14x and still 17 analyst are on hold, 4 on sell with only 2 on buy.

We hope Burberry proves us wrong, shows a turnaround in its brand and allows credit investors to reap some excess returns. But our views are based on information we have and the estimates we can make on that - on which this deal screens well rich. For those disappointed they are missing out on carry, B&M in HY that trades north of it is worth taking a look - we like the 8.125% 30s (cheap view on it) and see early call as likely into cheaper refi.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.