-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY25.7 Bln via OMO Thursday

MNI: PBOC Net Drains CNY195.3 Bln via OMO Wednesday

MNI ASIA OPEN: Late Rate & Stock Rally, 5Y Sale Well Received

Business Survey Sees Dovish Labor Developments But No Further Progress In Prices

Significant moderation on labor-related aspects:

- Wage growth expectations decline “significantly”, with labour costs seen increasing 3.4% over the next twelve months vs 4.1% in both Q1 and Q4. It’s the lowest since 1Q21 and close to the historical average of 3.2%.

- The share of firms reporting labour shortages as limiting ability to meet demand fell from 22% to 15%, its lowest since 2Q20 and below the 29% average since 2017.

Price expectations see broad stalling in what had been good progress:

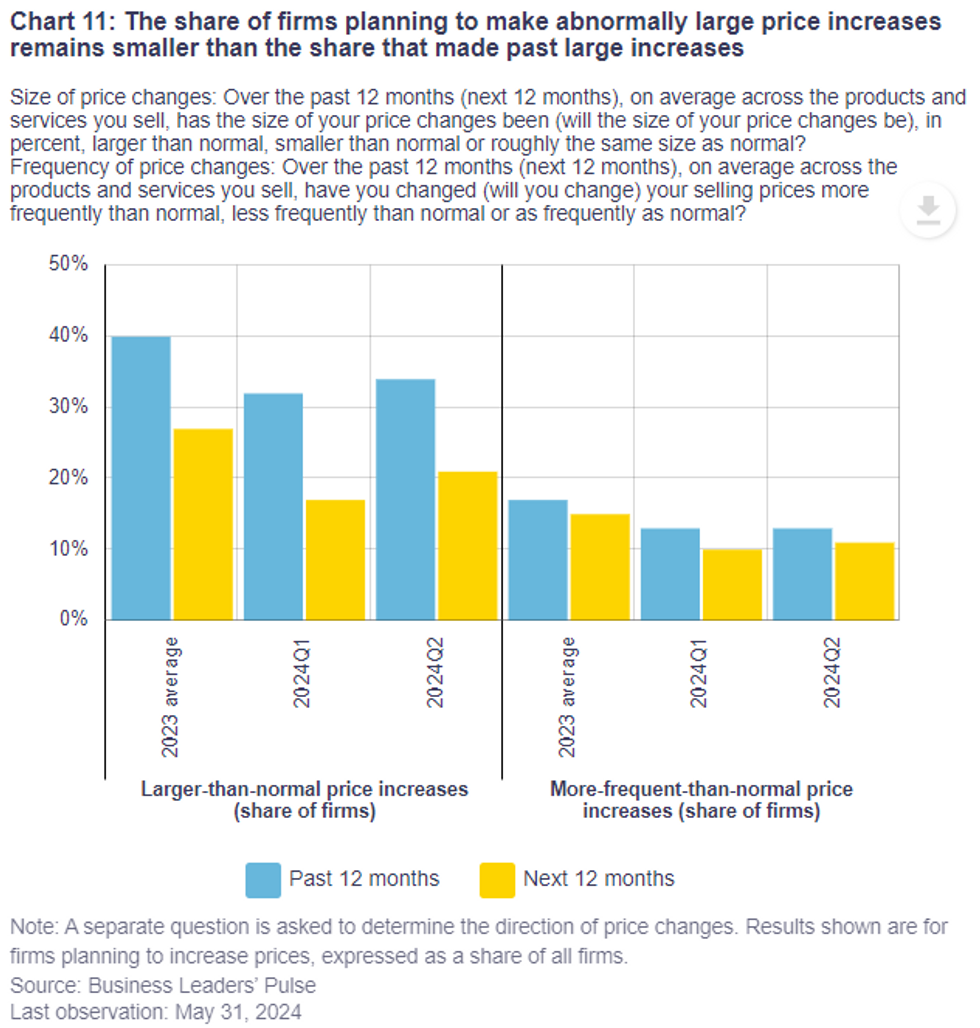

- The share expecting larger-than-normal price increases over the next twelve months increased from 17% to 21% in Q2 (vs the 27% average response to the same question in 2023).

- BoC commentary paints this in a positive light; it’s “well below” last year’s average and “considerably lower” than the 34% realized over the past year. However, the BoC make it very hard to know how this compares historically. Last quarter’s survey had a different question which showed 13% expecting output prices to increase significantly vs a pre-pandemic average of 11%.

- The increase in the share expecting larger than usual increases was at least partly offset by “more firms expect[ing] to keep prices flat”, whilst the share expecting more-frequent-than-normal price increases only marginally increased from 10% to 11% (averaged 15% in 2023).

- Inflation expectations generally flat over the quarter, with the 2Y unchanged at 3.0%. Monthly readings from the Business Leaders’ Pulse paint a similar picture.

- Fewer firms expect inflation of 2-3% over the next two years (from 54% to 48%). That more than offsets the 1pp increase for the share expecting inflation of >3% (from 40% to 41%) but a large increase in the no response share muddies the takeaway here.

Weak investment outlook:

- Investment intentions saw a tepid lift with a net 11% in Q2 expecting to increase investment spending on machinery & equipment over the next year after the 0% in Q1 was the lowest since 2Q20. It’s still below the 16% averaged since 2017.

Source: Bank of Canada

Source: Bank of Canada

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.