-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI:Largest Canada New Home Price Dip Since `09 Led By Toronto

MNI: Canadian Oct Retail Sales Rise For Fourth Straight Month

MNI POLITICAL RISK - Trump Cabinet Hits First Roadblock

Central Bank Smoothing Negates Strong Data

Taiwan dollar has weakened through the session after strengthening at the open, USD/TWD last at 27.859. USD/TWD has still not managed to close below 28.00 with the central bank actively "smoothing" the market on the close. Markets look ahead to foreign reserves data on Friday for indications of how much the central bank has intervened.

- There are upside risks to TWD, writes ANZ: "The shortage in semiconductors, which has hit many sectors, including the automobile industry, could last through H1 2021. This will likely keep Taiwan's trade surplus close to record highs in the coming months, which bodes well for TWD. We think TWD is well-positioned to benefit from the strong demand for high-end chips."

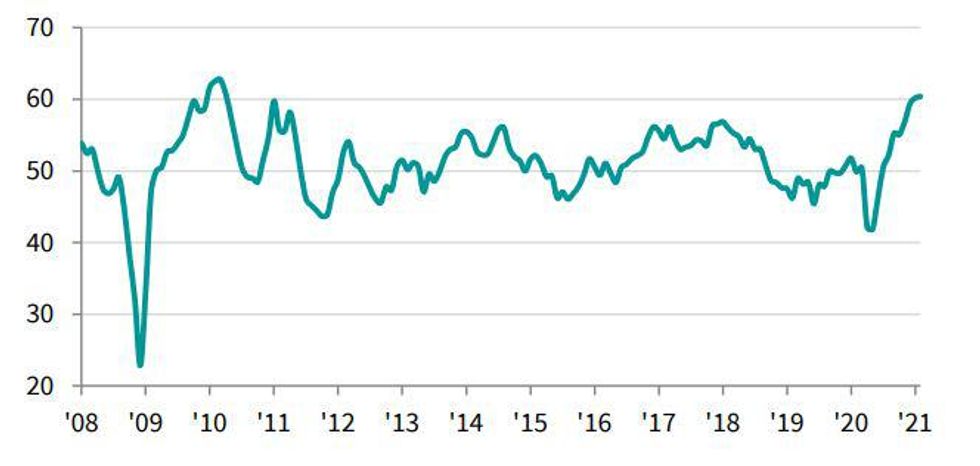

- Data earlier saw Markit manufacturing PMI rise to 60.4 in February, from 60.2. The strong reading indicated further robust expansion in the manufacturing sector, with a substantial rise in new orders supported expansions of both output and employment.

- "Taiwan's manufacturing sector continued to enjoy its best period of growth for a decade in February, as businesses benefited from robust sales at home and abroad. The steep increases in new work and purchasing activity suggest that activity across the sector will continue to expand strongly in the months ahead" said Annabel Fiddes, Associate Director at IHS Markit.

- There were some areas of concern in the report, supply chain delays were the worst seen on record amid stock shortages and shipping-related delays. This in turn drove a further sharp increase in input costs, which was partly passed on to customers in the form of higher factory gate charges.

- Fig 1 Taiwan Manufacturing PMI

Source: IHS Markit

Source: IHS Markit

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.