-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

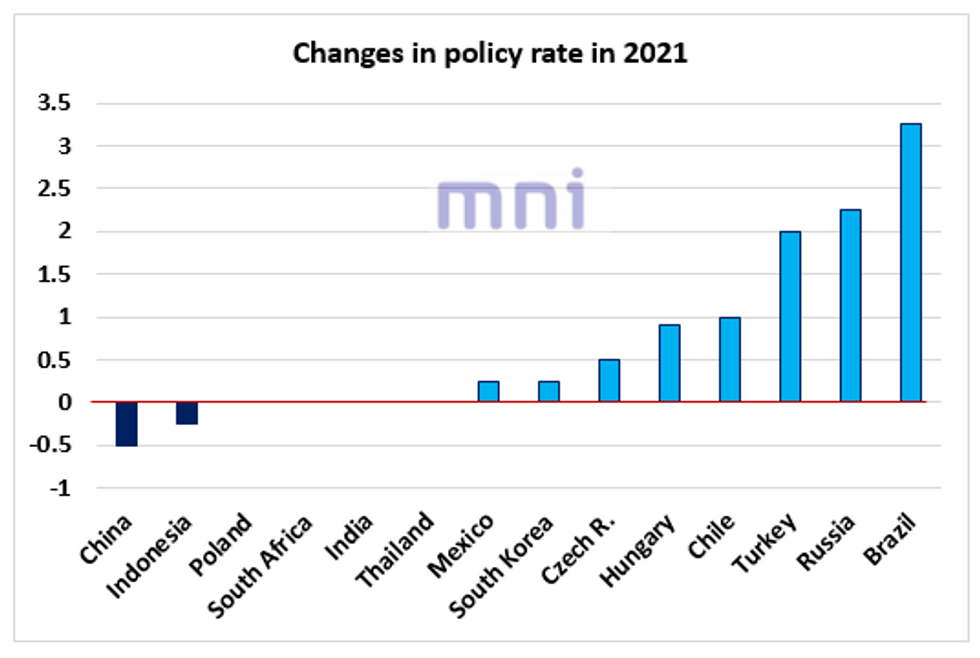

Central Banks Turning Hawking Despite 'Delta' Uncertainty

- As inflationary pressures remain firm in the EM world (especially Latam and CEEMEA), a rising number of central banks have embarked into a tightening cycle.

- Yesterday, Central Bank of Chile 'surprised' the market by taking a hawkish route, hiking by 75bps to 1.50% (vs. 50bps exp.) following a 25bps increase in July. The constant CLP weakness this summer amid elevated political uncertainty could also increase inflation risks in the coming months, therefore pushing the central bank to raise more 'aggressively'.

- Banxico also rose its policy rate by 25bps (a 'dovish' hike) in order to curb inflationary pressures, with CPI inflation coming in at 5.8% in July (vs. 4% CB upper tolerance band). Projections for headline inflation is expected to gradually decrease and converge towards the 3% target in Q1 2023.

- Brazil central bank raised the Selic rate by 100bps to 5.25% (unanimous decision) following three consecutive rate increases of 75bps, with the Copom expecting to deliver another 100bps hike at next meeting on Sep 21/22.

- In the CEE region, the NBH maintained a hawkish tone and raised the policy rate by 30bps (again) to 1.5% for the third consecutive time. HUF was the best performer among EM currencies in August, up 2.2% against the USD, strongly supporting Hungary equities (with BUX index trading close to its all-time high).

- Surprisingly, the NBP remains quiet despite headline inflation standing significantly above the 3.5% upper tolerance band (August CPI came in at 5.4% YoY). The majority of the NBP members is still aiming to keep interest rates low as the economic uncertainty remains elevated.

- Bank of Korea raised its policy rate by 25bps to 0.75% for the first time in nearly three years as financial economy has started to show some signs of overheating. The decision was not unanimous as the uncertainty over the economic recovery remains elevated.

- Interestingly, Asian and SE Asian currencies have performed strongly despite central banks keeping rate on hold due to the Delta variant; THB and INR were the second and third best-performing currencies in August, up 2% and 1.9% against the greenback, respectively.

- The rapid deceleration in inflation in Malaysia and Thailand in recent months combined with the broad ADXY strength in the past two weeks could be two explanations behind Asian and SE Asian currencies strength last month.

Source: Bloomberg/MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.