-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

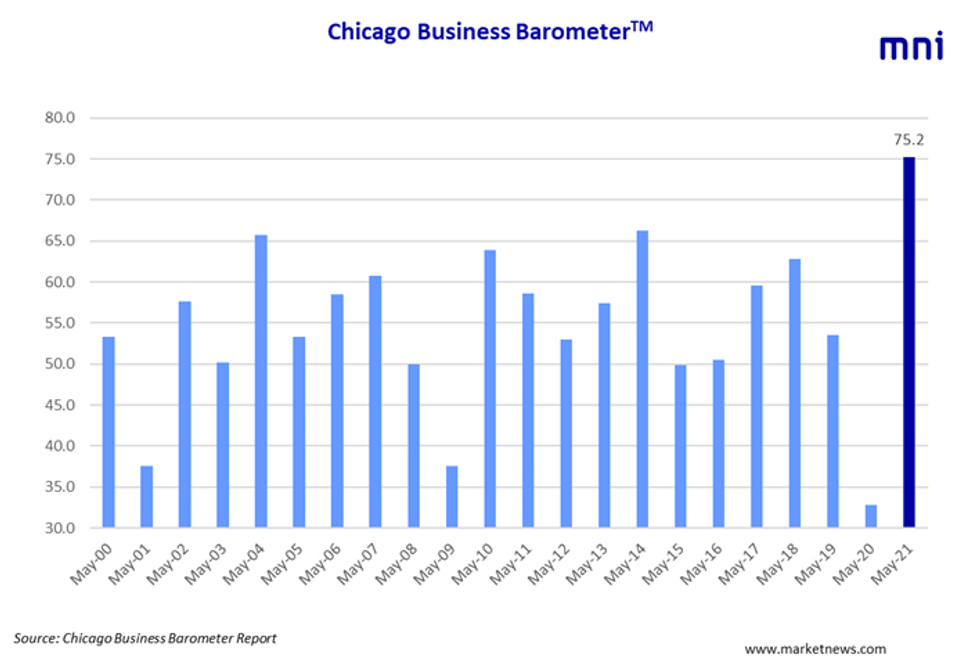

Chicago Business Barometer™ – Pushed On To 75.2 May

Key Points – May 2021 Report

The Chicago Business Barometer™, produced with MNI, jumped to 75.2 in May, the highest level since November 1973. Demand provided a boost to business activity, but supply chain constraints remain.

Among the main five indicators, New Orders and Order Backlogs saw the largest gains, while Employment recorded the only decline.

Order Backlogs jumped 7.5 points to 80.7, hitting a 70-year high. Firms noted logistical issues and personnel shortages which are driving backlogs.

Inventories fell 8.7 points in April, dipping below the 50- mark for the first time since December 2020.

Inventories dropped to a 9-month low of 41.8, the second successive reading below the 50-mark.

Employment slipped back into contraction territory in May, following two months of readings above 50. The indicator declined from 56.4 to 49.8 and firms indicated difficulties finding new staff.

Supplier Deliveries rose to a 47-year high of 82.3 in May with supply chain constraints remaining a serious problem. Firms continuously noted delivery delays due to transportation issues and material shortages.

Prices paid at the factory gate fell to 88.4 in May, down from April's 41-year high of 91.5. However, several respondents said prices for commodities, such as steel, plastics, copper, or electronic components rose further.

The time to source Production Material and MRO Supplies rose to record highs of 85.9 days and 26.2 days, respectively, while sourcing time for Capital Equipment eased to 170.8 days.

The survey ran from May 3 to 18.

SPECIAL QUESTION

Considering the global shortage of computer chips, do you have contingency plans in place? While 46.2% do not use the product, 28.2% have no contingency plans in place and only 5.1% of respondents are about to create a plan. Anecdotal evidence suggests that some firms are using alternative chips, while others hold more inventory to manage volatility.

As tension in global logistics and component shortages increase, are you: (Select one or more) The majority is looking for ways to mitigate the risks and 51.3% are passing on higher costs to customers. One fifth looks to absorb the higher costs, while 30.8% are looking for alternative carriers.

Click below for the full press release:

MNI_Chicago_Report_-_2021-05.pdf

For full database history and full report on the Chicago Business Barometer™, please contact:sales@marketnews.com

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.