-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI BRIEF: Aussie Labour Market Tightens, Unemployment At 3.9%

MNI FOMC Hawk-Dove Spectrum

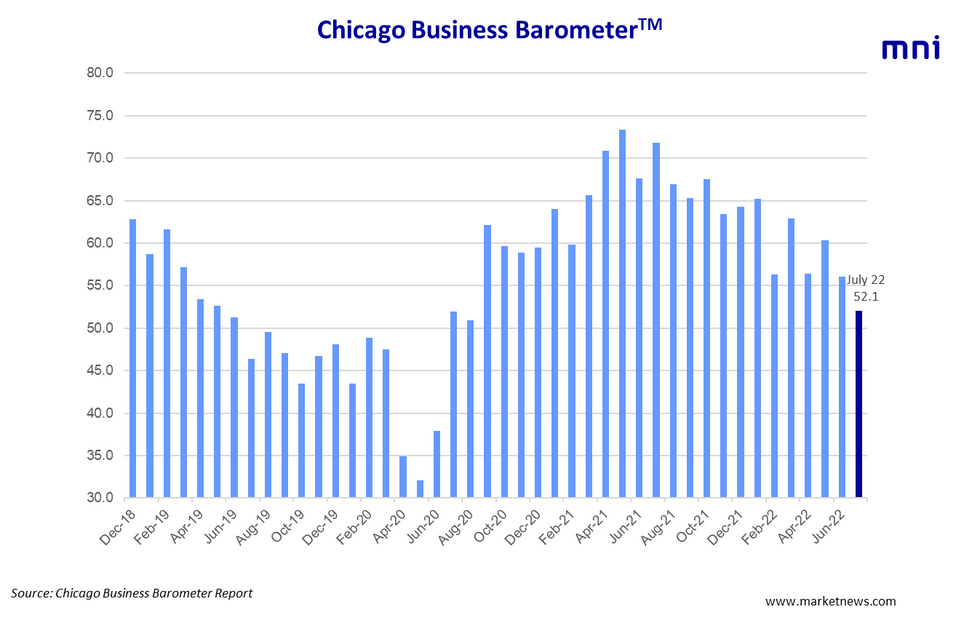

Chicago Business Barometer™ – Fell Further in July

Key Points – July 2022 Report

The Chicago Business Barometer™, produced with MNI, slid further in July, extending June’s decline. The indicator fell 3.9-points to 52.1, the lowest level since August 2020.

- All main indicators decreased except for prices paid and employment, the latter of which hit the highest level since October 2021. Production, New Orders, Order Backlogs and Supplier Deliveries are all back around 2020 levels.

- Production fell 7.0 points to 48.2 in July, a two-year low. Close to a fifth of firms saw lower production.

- New Orders slid a further 5.4 points to 44.5, the lowest in 25 months. Overall demand waned in July.

- Order Backlogs slumped 6.8 points in July to 48.4. As new order levels softened, a quarter of businesses saw backlogs decline as they worked through postponed production.

- Employment grew 5.4 points to a current year high of 56.1 as the labor market continued to tighten.

- Supplier Deliveries ticked down 2.0 points to 67.1. This was the lowest since October 2020 as deliveries remained slow and lead times lengthened. Both the war in Ukraine and knock-on effects of Chinese lockdowns continued to hamper supply chains.

- Inventories saw the largest decrease this month, plunging 16.2 points. This is a stark difference to May’s near 50-year high.

- Prices Paid rose 2.3 points to 81.9 as price pressures intensified. Transparency issues regarding grounds for supplier price increases were flagged.

SPECIAL QUESTION

This month we asked firms “How are you looking to manage rising fuel prices affecting your running costs?”. Increasing charged prices was the mode tactic (56.7%), followed by 30% of firms reducing costs in other areas. Less businesses were reconsidering distribution plans (13.3%) and cutting back production (6.7%). 43.3% of firms were not intending to make changes or saw fuel prices not affecting running costs

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.