-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Markets Gear for Further EUR Gains

MNI BRIEF: EU: "More Will Come" To Boost Defence

China Related Assets Consolidate - A Bump In The Road Or Something More Threatening?

The market reaction to the Caixin China PMI beat has been limited in China related assets. USD/CNH continues to drift higher, last around 6.7475, while local equities struggle.

- This is similar to the reaction to the official PMIs from earlier in the week, which showed services much better than expected, but with little positive follow through to China related assets.

- It may the case we are entering a consolidation phase post the strong rally we saw from Nov through to end January. The CSI 300 is off over 3% from its recent peak, but this comes after a 22% rally in the previous 3 months. The China Dragon index has also stabilized somewhat, while the HSI is off ~5% post a 55% rally through Nov-Jan.

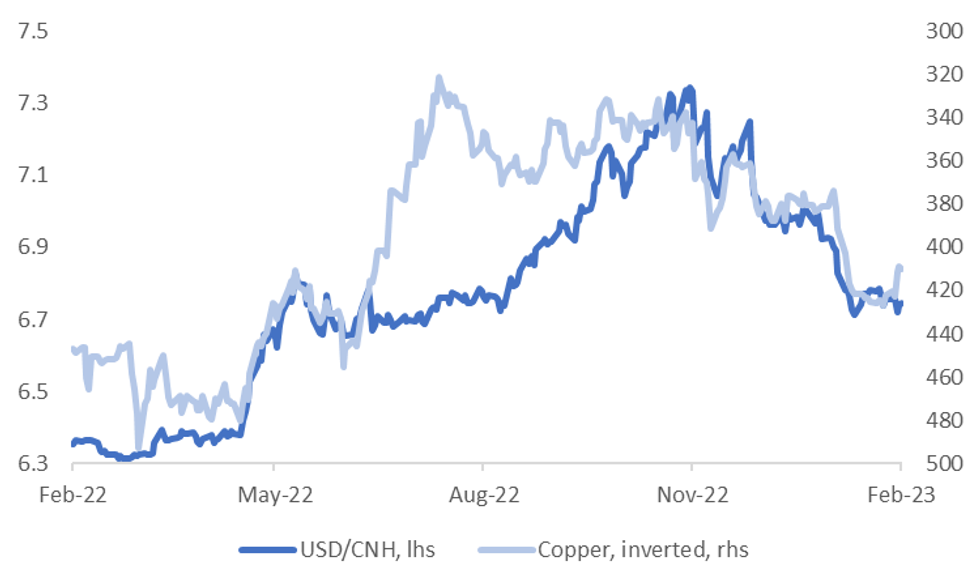

- Consolidation is also evident elsewhere, the first chart below plots USD/CNH and copper prices. Note copper is inverted on the chart. The two series have moved closely in recent months, which is not surprising given they serve as proxies (to some degree) for the re-opening theme. The broader Bloomberg metals index is off recent highs, while iron ore has also slipped, albeit after a very impressive rally.

Fig 1: USD/CNH & Copper Prices

Source: MNI - Market News/Bloomberg

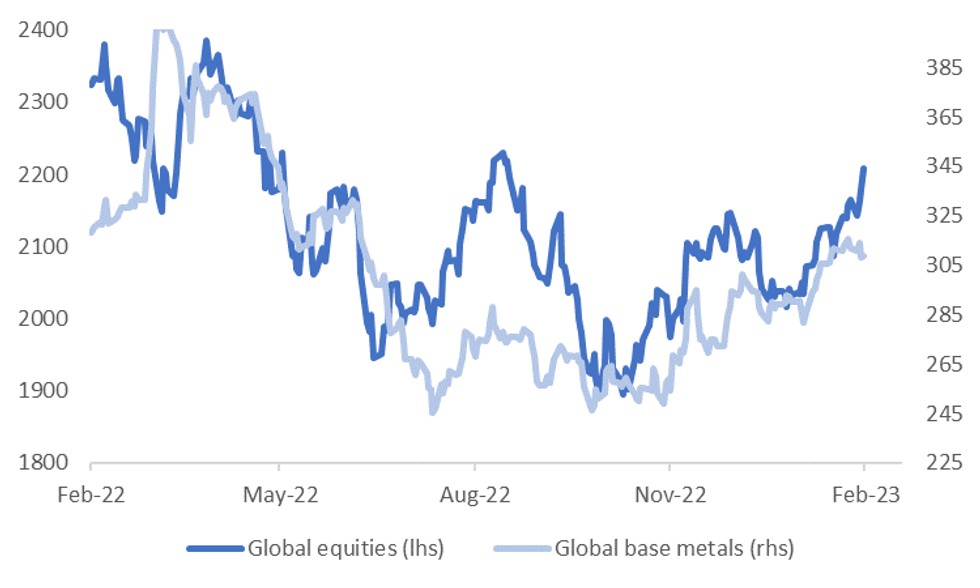

- It's also noteworthy commodity prices haven't seen much upside post this week's Fed outcome, compared to other risk assets. The second chart below overlays global equities versus base metal prices.

- The nature of the China rebound may also be a factor, with services indicators performing better relative to manufacturing. Also earlier in the week, housing data for China showed new home sales down 32.5% y/y for Jan, with few signs of a near term turnaround.

- Our policy team noted yesterday the challenges the China faces as well, see this link for more details.

- These moves may just represent a consolidation/speed hump as part of the broader recovery, but the trends outlined will be worth monitoring. The softer commodity price backdrop is taking the shine off the A$, while USD/Asia pairs are recovering in sympathy with USD/CNH.

Fig 2: Global Equities Versus Base Metals

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.