-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

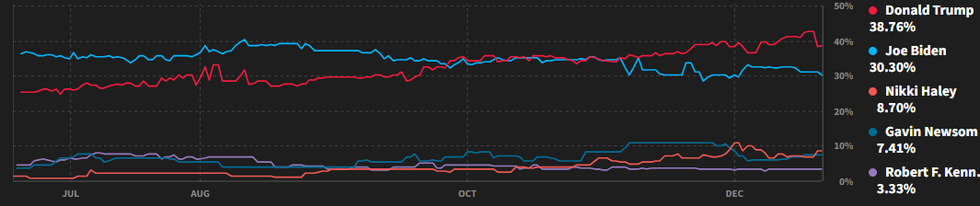

Colorado Supreme Court Ruling Sees Trump Odds Drop In Betting Market

The Colorado Supreme Court'sruling that disqualifies former President Donald Trump from appearing on the ballot in the state's presidential primary has seen a small decline in the Republican frontrunner's implied probability of winning the 2024 presidential election. The court ruled that Trump's alleged role in the 6 Jan 2021 riots at the Capitol amounted to an 'insurrection', and that under an 1868 provision to the US Constitution insurrectionists can be barred from running for office.

- Data from Smarkets shows Trump's implied probability of winning the presidency falling from 42.7% before the ruling to 38.8% presently. The primary beneficiary has not been incumbent President Joe Biden, but Trump's GOP primary opponent, former South Carolina Governor Nikki Haley. Her implied probability of winning the presidency has risen from 6.9% prior to the ruling to 8.7% currently.

- Courts in a number of other states are considering similar cases, and as is often the case in political rulings it could come down to the conservative/liberal split on various courts. All seven of Colorado's Supreme Court justices were appointed by Democratic governors, and even then the decision came to a 4-3 split in favour of barring Trump.

- Trump's legal team has stated that it will challenge the ruling, likely setting up a US Supreme Court showdown. Given that SCOTUS would prove the final arbiter of what constitutes an insurrection, the 6-3 split there in favour of conservatives could bolster Trump's chances of avoiding banishment from the ballot.

Source: Smarkets

Source: Smarkets

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.