-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessConsumer Confidence Edges Higher But Improvement Stalling Overall

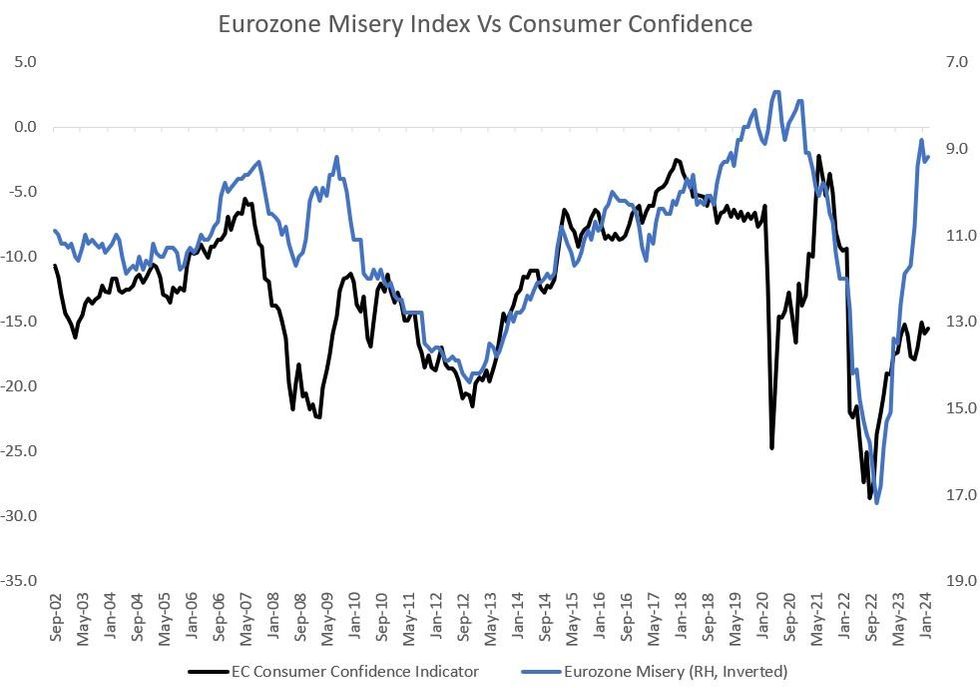

Eurozone consumer confidence picked up slightly in February in the European Commission's flash estimate, by 0.6pp to -15.5 points. That reading was exactly in line with market consensus, but as noted in the release, remains well below the long-term average.

- The release provides very limited commentary on the dynamics underlying the reading, but improvement from the Russia-Ukraine War depths of 2022 has appeared to stall over the past three months.

- Whereas the "misery index" (inflation plus unemployment rate) would normally point to above-average consumer confidence as inflation has fallen sharply from the peak and unemployment has steadied, that relationship has broken down since the Covid pandemic began in 2020. See chart below.

- The modest improvement in the consumer confidence indicator in the months to January were driven by upticks in the assessment in future financial/ economic/ employment situations - though confidence on the inflation outlook began deteriorating in summer 2023 albeit from very optimistic levels. We will get more details in the final February data on Feb 28.

- The bigger picture is that Eurozone consumption is likely to remain subdued for the next couple quarters, though a bit of an acceleration would probably be welcomed by the ECB and not a major obstacle to rate cuts. Pres Lagarde noted at the January press conference that "one of the reasons why we see growth coming up and the recovery beginning in the course of 2024; because of rising wages while inflation comes down, which will free up some purchasing power, which hopefully will stimulate consumption."

- As of the December 2023 ECB projections, real private consumption was seen ticking higher from 0.2% Q/Q in Q3 and Q4 2024, to 0.4% in Q1 2024 and levelling off at 0.5% in the next two quarters and slowing again thereafter.

Source: EC, Eurostat, MNI Calculations

Source: EC, Eurostat, MNI Calculations

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.