-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

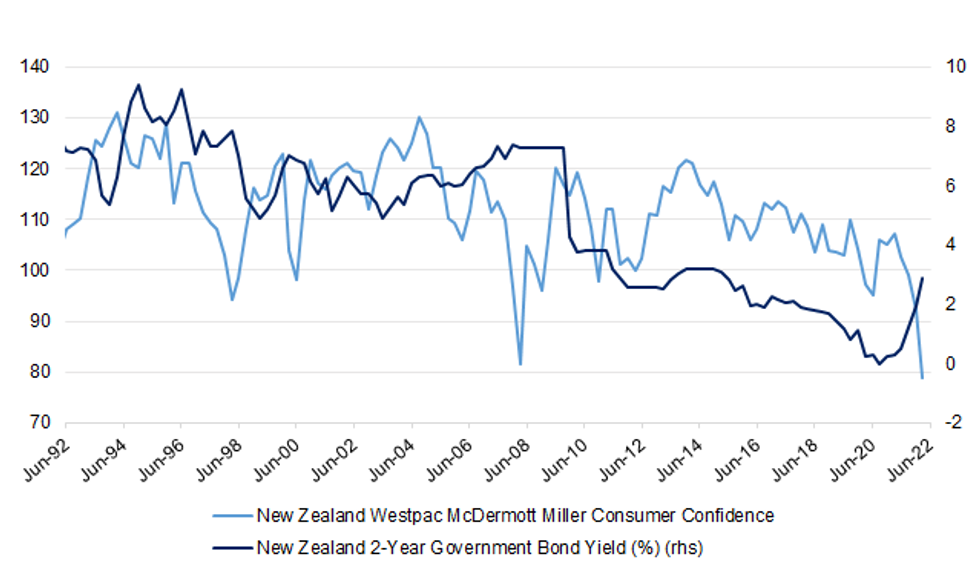

Free AccessConsumer Sentiment Tumbles To Record Low, Kiwi Is Not Bothered

The kiwi dollar has been unfazed by a poor reading of New Zealand's quarterly Westpac Consumer Confidence, which slumped to its worst level in a data series that goes back to 1988. The index fell to 78.7 in the three months through June from 92.1 prior, as "household budgets are being squeezed in a way that they haven't been for decades."

- Westpac notes that "if there is a more abrupt slowdown in spending than the RBNZ anticipates, then it's likely that increases in the cash rate will be more measured," but they "continue to forecast a peak in the cash rate of 3.5%.

- Truth be told, the survey did not reveal much in the way of fresh insights, with the impact of rising living costs and tightening monetary conditions on household budgets reflected in recent data releases.

- This leaves NZD/USD trading flat at $0.6333, holding onto Monday's gains. Improvement in risk sentiment helped push the rate higher at the start to the week, as equity markets firmed during a public holiday in the U.S.

- From a technical standpoint, bulls need NZD/USD to rip through Jun 16 high of $0.6396 before setting their sights on key resistance from Jun 3 high of $0.6576. On the flip side, bears see Jun 14 low of $0.6197 as their initial target.

- Looking further afield, Stats NZ will publish monthly trade data on Wednesday, with the RBNZ set to release credit card spending later that day.

Fig. 1: New Zealand Westpac McDermott Miller Consumer Confidence vs. New Zealand 2-Year Government Bond Yield (%)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.