-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

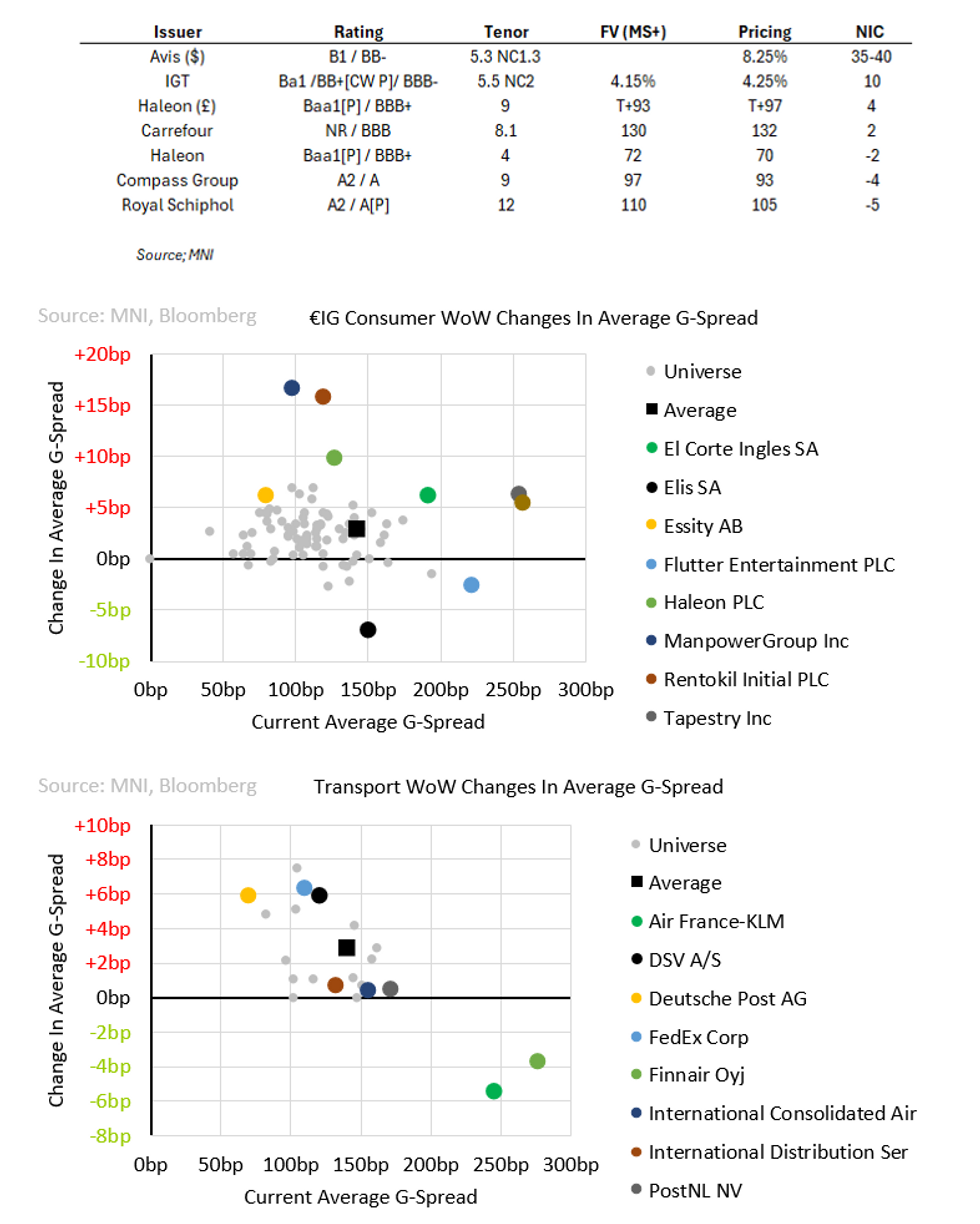

Free AccessConsumer & Transport: Week in Review

We have had a good mix of volatility from both continued M&A (DSV, Elis) and fundamentals (Rentokil, Mobico). Primary reflects a clear skew from investors towards non-cyclicals – we sympathise but continue to see pockets of opportunities both outside staples (Pluxee, Flutter) and in timely M&A situations.

Fundamentals linked news

- Rentokil profit warning led to outsized moves in equities as they took the foam out of prior PE and Activist stake rumour rallies. Credit is holding onto some of the latter. Step-ups give some protection to the downside.

- Elis gives a roadshow to sooth equity investor concerns on a potential Vestis acquisition.

- Broker cuts continue for higher-beta luxury names a; Burberry & Kering

- Pluxee faces a broker cutand headlines a French competitor who is turning profitable. We are sympathetic to bonds that have underperformed.

- Deutsche Bahn to receive desperately needed cash but 1H results don’t show a recovery in profitability.

Event Driven Movers

- Tapestry goes well bid as injection court proceedings with the FTC begin. It seems light on a clear driver, but TPR longs will take comfort nonetheless; Day 1, 2, 3 and 4 summaries.

- Lufthansa may take a stake in AirBaltic IPO. 2-notch uplift on AirBal 29s may be dependent on how much Latvian government holds onto and/or who takes the controlling stake from it.

- DSV finally wins €14.3b bid for Deutsche Bahn’s logistics unit; financing is better than expected (40% equity) and though we expect sizeable supply we don’t expect rating pressure.

- Couche-Tard/7-11 back and forth continues. FTC gets started on its investigation pre-emptively, seven and i successfully gets it’s government classification upgraded (seen as defensive measure) while its shareholders continue coming out in protest.

- Flutter makes $350m acquisition in Brazil; diversifying outside US and UK is nice to see and earnings growth should bring leverage into target by year end.

Primary (fundamentals linked, see table below for pricing)

Rating Actions

- Mobico (Ba2/NR/BBB-); Moody’s double notch downgrade catches us off-guard. We missed firming up a view on the 1.25% step-up protected £28s – one we flagged as potential value in the last two weekly’s.

- Elis (Ba1 Pos/BBB-); Moody’s stays on positive outlook without assuming Vestis acquisition. Comments are positive and echoes company targets. We still see up to €900m in supply.

- IGT (secured; Ba1/BB+ CW Pos/BBB-) S&P stays put on IGT till spin-off closes - as expected.

- Fnac (NR/BB+ Neg/BB+); affirmed by Fitch

- Avis (B1/BB-) affirmed by Moody’s but we have concerns on rating headroom.

- General Mills (Baa2/BBB) affirmed by S&P after NA yoghurt business sale. We are more cautious and keen to see earnings next week.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.