-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: Canada Jan Retail Sales Fall After Strong Fourth Quarter

MNI POLITICAL RISK - Senate Passes 'Plan B' Budget Resolution

Contained Signs Of USD Funding Worry Potentially Seen In Asia

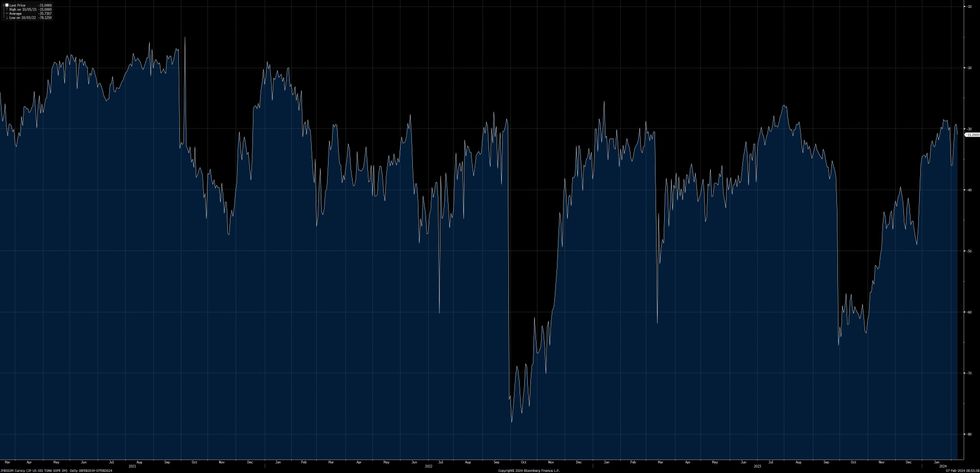

USD funding matters got some attention in Asia. We flagged the spill over into x-ccy basis in the wake of the initial round of NYC Bancorp worry (as footprints of USD demand showed up via those channels). That move evaporated (in 3-month tenors), but a fresh, albeit shallow, downtick in JPY/USD 3-month x-ccy basis has been seen, pointing to some potential worry on that front out of Tokyo.

- A large block buy (+20K) in SFRH4 futures was also seen in Asia-Pac hours, which could point to further USD funding-related worry in the region given that 20K SOFR blocks are a very rare sight in that timezone.

- A reminder that Japanese lender Aozora Bank has fallen afoul of its U.S. CRE exposure, with the company’s Tokyo equity listing losing over 30% in recent sessions. Japanese Finance Minister Suzuki has attempted to placate any worry re: overall Japanese exposure to those issues, stressing that lending to the U.S. real estate market is limited when you look at the totality/size of the Japanese banking sector.

- Pockets of U.S. CRE-related worry have also shown up in European financial names with related exposure in recent sessions.

- Once again, ee highlight that the moves seen in major USD x-ccy measures were limited last week and quickly unwound.

- The moves were also very shallow when compared to swings seen during the initial COVID outbreak and during last year’s U.S. regional banking sector malaise.

- They were also limited when compared to most instances of year end-related (turn) USD demand.

- We have suggested on several occasions that the headwinds faced by NYC Bancorp do not seem to be systemic in isolation, although worry re: U.S. CRE exposure will continue to provide a point of interest owing to the post-COVID evolution of home-office work splits.

- NYC Bancorp saw Moody’s downgrade the name to junk status after hours on Tuesday.

- The U.S. regional banking index KBW has shed a little under 5% vs. late January closing highs, with the index failing to get anywhere totally recouping the ’23 downturn.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.