-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - Trump Warns BRICS Over Moving Away From USD

MNI BRIEF: Japan Q3 GDP To Be Slightly Revised Down

MNI EUROPEAN OPEN: Familiar Risks Persist

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

* REMDESIVIR HAS LITTLE EFFECT ON COVID-19 MORTALITY, WHO STUDY SAYS (FT)

* CHINA SET TO PASS ITS OWN LAW PROTECTING VITAL TECH FROM U.S. (BBG)

* U.S. OFFERS TARIFF TRUCE IF AIRBUS REPAYS BILLIONS IN AID (RTRS SOURCES)

* EU LEADERS CALL FOR UK TRADE TALKS TO CONTINUE (BBC)

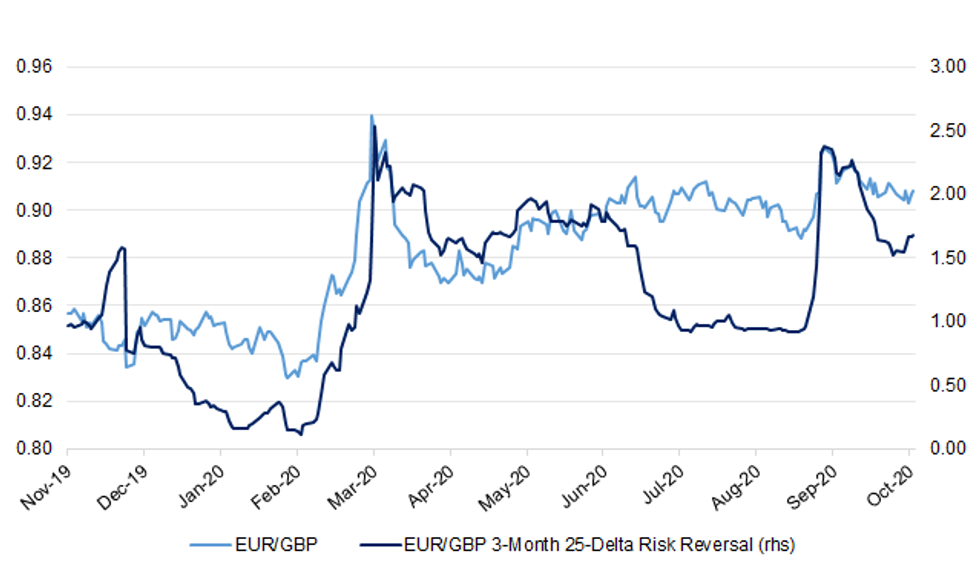

Fig. 1: EUR/GBP vs. EUR/GBP 3-Month 25-Delta Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

OVERNIGHT DATA

NEW ZEALAND SEP BUSINESSNZ M'FING PMI 54.0; AUG 51.0

BusinessNZ's executive director for manufacturing Catherine Beard said that given what happened post the nationwide COVID lockdown, a boost in activity post the Auckland lockdown was not a surprise. "September saw Auckland at level 2.5 or lower, which meant back to business for most manufacturers. This saw the unadjusted regional activity level for the Northern region recovering from 41.2 in August to 50.6 in September". "All but one of the key sub-indices improved in September, including Employment (51.6), which showed expansion for the first time since February". BNZ Senior Economist, Doug Steel said that "although the September PMI pushed above its long term average of 53.0, it should not be confused with above average activity levels. Rather, it indicates growth off the low base set earlier in the year. Growth has not yet been enough to recoup previous loses, but some progress is being made". (Business NZ)

NEW ZEALAND SEP NON-RESIDENT BOND HOLDINGS 49.4%; AUG 49.5%

SOUTH KOREA SEP UNEMPLOYMENT 3.9%; MEDIAN 3.7%; AUG 3.2%

SOUTH KOREA SEP EXPORT PRICE INDEX -6.2% Y/Y; AUG -6.7%

SOUTH KOREA SEP EXPORT PRICE INDEX -0.3% M/M; AUG -0.1%

SOUTH KOREA SEP IMPORT PRICE INDEX -11.5% Y/Y; AUG -10.5%

SOUTH KOREA SEP IMPORT PRICE INDEX -1.3% M/M; AUG -1.1%

CHINA MARKETS

PBOC NET DRAINS CNY150BN VIA OMOS

The People's Bank of China (PBOC) injected CNY50 billion via 7-day reverse repos with the rate unchanged on Friday. This resulted in a net drain of CNY150 billion given the maturity of CNY200 billion of medium-term lending facilities, according to Wind Information.

- The operation aims to keep the liquidity in the banking system ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) increased to 2.2015% at 09:35 am local time from the close of 2.1823% on Thursday: Wind Information.

- The CFETS-NEX money-market sentiment index closed at 36 on Wednesday, flat from the close of Tuesday. A lower index indicates decreased market expectations for tighter liquidity.

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7332 on Friday, compared with 6.7473 set on Thursday.

MARKETS

SNAPSHOT: Familiar Risks Persist

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 55.49 points at 23451.41

- ASX 200 down 26.8 points at 6183.5

- Shanghai Comp. down 9.329 points at 3322.854

- JGB 10-Yr future up 4 ticks at 152.12, yield up 0.2bp at 0.025%

- Aussie 10-Yr future up 1.5 ticks at 99.250, yield down 2.2bp at 0.744%

- U.S. 10-Yr future +0-00+ at 139-04+, yield down 0.49bp at 0.727%

- WTI crude down $0.37 at $40.59, Gold down $3.31 at $1905.4

- USD/JPY down 18 pips at Y105.27

- REMDESIVIR HAS LITTLE EFFECT ON COVID-19 MORTALITY, WHO STUDY SAYS (FT)

- CHINA SET TO PASS ITS OWN LAW PROTECTING VITAL TECH FROM U.S. (BBG)

- U.S. OFFERS TARIFF TRUCE IF AIRBUS REPAYS BILLIONS IN AID (RTRS SOURCES)

- EU LEADERS CALL FOR UK TRADE TALKS TO CONTINUE (BBC)

BOND SUMMARY: A Mixed Bag

A light downtick in e-minis resulted in some modest support for core FI markets as we moved through the final Asia-Pac session of the week, although there was little in the way of notable headline flow, with the moves only marginal, at best.

- T-Notes clung to a tight range, last +0-01 at 139-05, with yields sitting 0.3-0.8bp richer across the cash Tsy curve. Flows were eyed, with some focus on the downside, with some light screen interest in 1x2 TYZ0 137.00/135.00. Eurodollar futures sit unchanged to 0.5 tick higher through the reds. Here, a combination of block and screen sales in EDM1 and on screen steepener flow in EDU2/U4 received attention, especially given the lack of headline flow that was evident overnight.

- JGB futures sagged during the morning, after the pullback from overnight highs continued, before the defensive feel in the Nikkei 225 and e-minis crept in, allowing JGB futures to bottom, at least for now. Contract last +4, with the super-long end outperforming in cash, while 10s represent the weak point on the curve.

- Spill over from yesterday's RBA commentary, in addition to a stellar ACGB auction and Westpac expressing greater conviction re: imminent RBA easing, supported the Aussie bond space. YM +0.5, XM +1.5.

JGBS AUCTION: Japanese MOF sells Y6.1563tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y6.1563tn 3-Month Bills:

- Average Yield -0.0834% (prev. -0.0945%)

- Average Price 100.0224 (prev. 100.0254)

- High Yield: -0.0781% (prev. -0.0875%)

- Low Price: 100.0210 (prev. 100.0235)

- % Allotted At High Yield: 26.7333% (prev. 79.9574%)

- Bid/Cover: 3.229x (prev. 2.631x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.25% 21 Nov '24 Bond, issue #TB159:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.25% 21 November 2024 Bond, issue #TB159:- Average Yield: 0.1895% (prev. 0.3070%)

- High Yield: 0.1900% (prev. 0.3075%)

- Bid/Cover: 7.0100x (prev. 6.5405x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 93.8% (prev. 99.0%)

- bidders 42 (prev. 60), successful 9 (prev. 10), allocated in full 3 (prev. 5)

AUSSIE BONDS: Vanilla AOFM Issuance Schedule For Next Week

The AOFM has released its weekly issuance schedule:

- On Wednesday 21 October it plans to sell A$2.0bn of the 1.00% 21 December 2030 Bond.

- On Thursday 22 October it plans to sell A$1.5bn of the 26 February 2021 Note & A$1.0bn of the 21 May 2021 Note.

- On Friday 23 October it plans to sell A$1.5bn of the 0.50% 21 September 2026 Bond.

EQUITIES: No Firm Direction

E-minis edged higher in Asia-Pac trade, building on Thursday's late bounce, while the major Asia-Pac indices struggled for any uniform direction.

- The Hang Seng was the outperformer within the region, after underperforming yesterday, while the remainder of the major regional indices traded either side of unchanged.

- As we have noted, familiar sources of risk have dominated headline flow of the last 24 hours, most notably, the fiscal impasse in DC, COVID-19 worry (largely focused on Europe) and the ongoing Brexit saga.

- Nikkei 225 +0.1%, Hang Seng +0.9%, CSI 300 +0.2%, ASX 200 -0.3%.

- S&P 500 futures +6, DJIA futures +37, NASDAQ 100 futures +15.

OIL: Oil Nudges Lower, Aided By Downtick In E-Minis

WTI & Brent sit $0.45-0.50 lower vs. settlement at typing, with e-minis pulling back in recent trade, although there has been little in the way of meaningful headline flow to drive the move.

- Thursday saw OPEC Secretary General Barkindo look to reinforce faith in the OPEC+ production pact, even with RTRS source reports noting that "OPEC+ made little progress in September in compensating for overproduction in previous months. The volume of compensatory cuts stood at 2.33 million barrels per day in September, the sources said. The figure was 2.38 million bpd in August, sources previously said." Platts sources went as far as noting that "with the oil market's recovery from the coronavirus pandemic slower than hoped, some OPEC+ members are acknowledging that the alliance's production cuts may need to be extended."

- Elsewhere, Libyan production continues to come back online, with U.S. Gulf facilities also re-opening.

GOLD: Familiar Themes, Familiar Levels

Little to drive a meaningful move for bullion over the last 24 hours, with spot edging higher over that time, last sitting unchanged on the day around $1,907/oz. Familiar fundamental drivers and technical parameters remain in play.

FOREX: Defensive Feel Supports JPY, Sino-Aussie Trade Tensions Weigh On AUD

A sense of caution continued to linger in Asia, as the timezone digested a mix of familiar risks. The rapid resurgence of coronavirus across Europe, Brexit uncertainty and U.S. fiscal stalemate buoyed JPY, the best G10 performer, with a round of purchases seen into the Tokyo fix.

- AUD faltered amid reports noting that Chinese mills have been instructed to stop buying Australian cotton, as Beijing may slap 40% tariffs on the commodity, making shipments unviable.

- A downtick in oil prices applied pressure to NOK & CAD, while preventing any recovery attempts in AUD.

- GBP edged lower as participants awaited UK PM Johnson's decision, whether the UK will abandon Brexit talks with the EU. The announcement is expected today, after the European Council called upon the UK to make concessions, drawing the ire of London's chief negotiator.

- USD/KRW crept higher as South Korean unemployment rose more than expected, which offset potential impact of an optimistic signal sent by local health data. Daily coronavirus case count dipped below 50 for the first time in nearly three weeks.

- Focus turns to EZ trade balance & final CPI, U.S. retail sales, industrial output & flash U. of Mich. Survey as well as comments from Fed's Bullard & Williams and from Riksbank's Ingves.

FOREX OPTIONS: Expiries for Oct16 NY cut 1000ET (Source DTCC):

- EUR/USD: $1.1525(E651mln), $1.1650(E888mln), $1.1700(E680mln), $1.1715-25(E687mln), $1.1745-50(E643mln), $1.1800(E2.51bln-E2.32bln of EUR calls), $1.1845-50(E1.1bln), $1.1900(E832mln-EUR calls)

- USD/JPY: Y104.50($1.6bln), Y105.00-04($3.0bln-$2.9bln of USD puts), Y105.35-40($1.2bln), Y105.50-60($626mln)

- GBP/USD: $1.2945-50(Gbp483mln)

- EUR/NOK: Nok10.30(E840mln), Nok10.55(E800mln), Nok10.65(E571mln)

- AUD/USD: $0.6700(A$753mln), $0.7050-60(A$566mln), $0.7175(A$794mln)

- AUD/JPY: Y74.30(A$555mln)

- USD/CAD: C$1.3000($745mln), C$1.3220($670mln)

- USD/CNY: Cny6.72($570mln)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.