-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

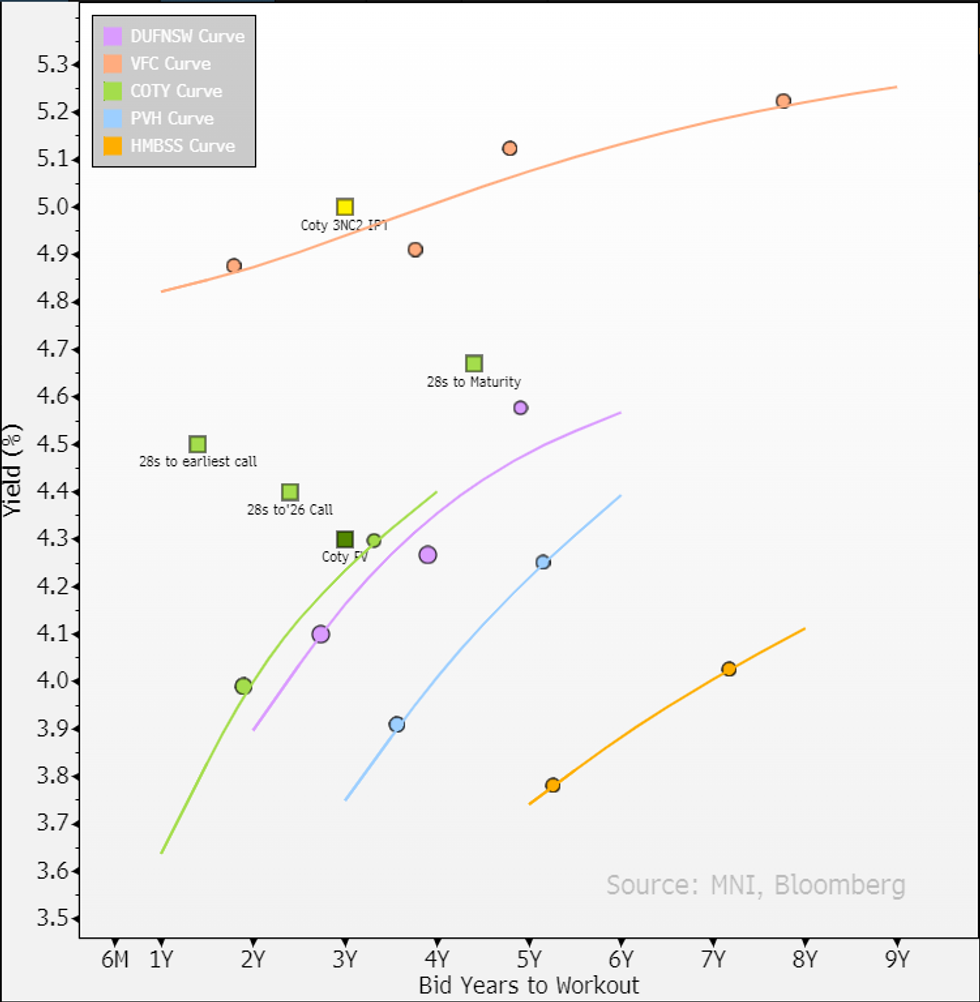

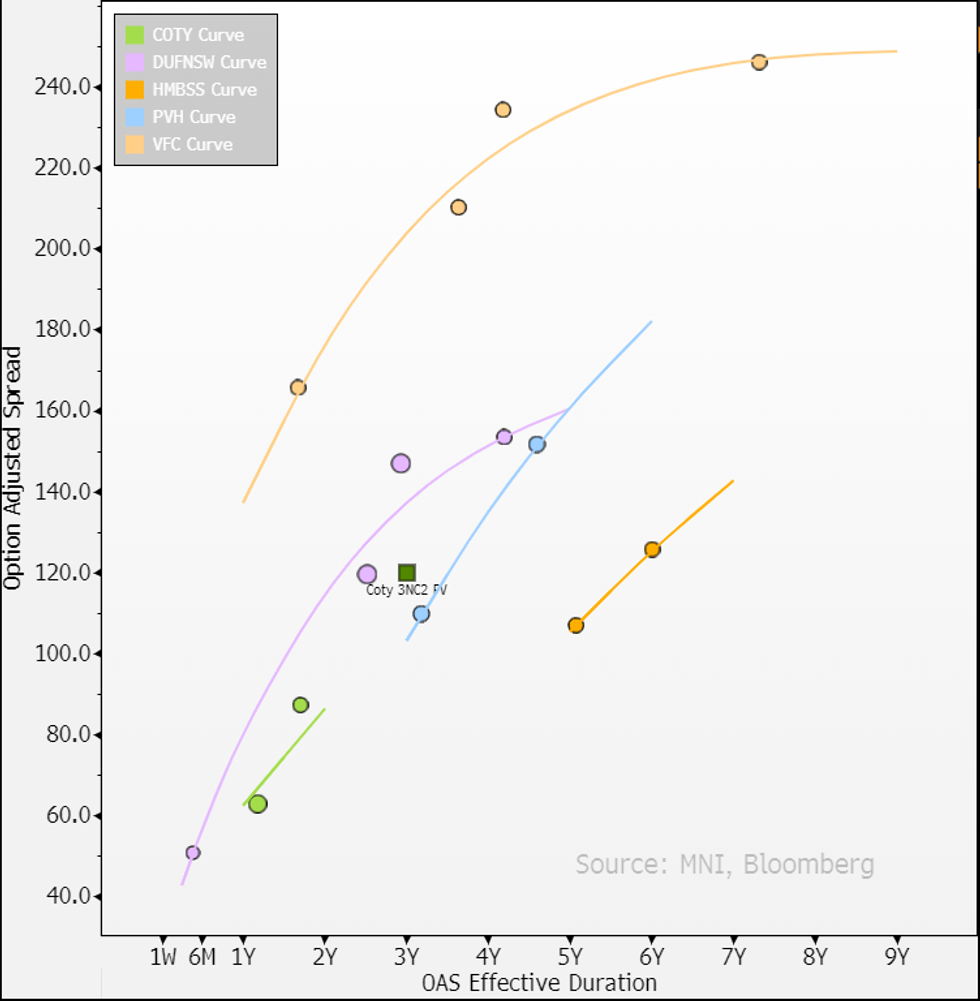

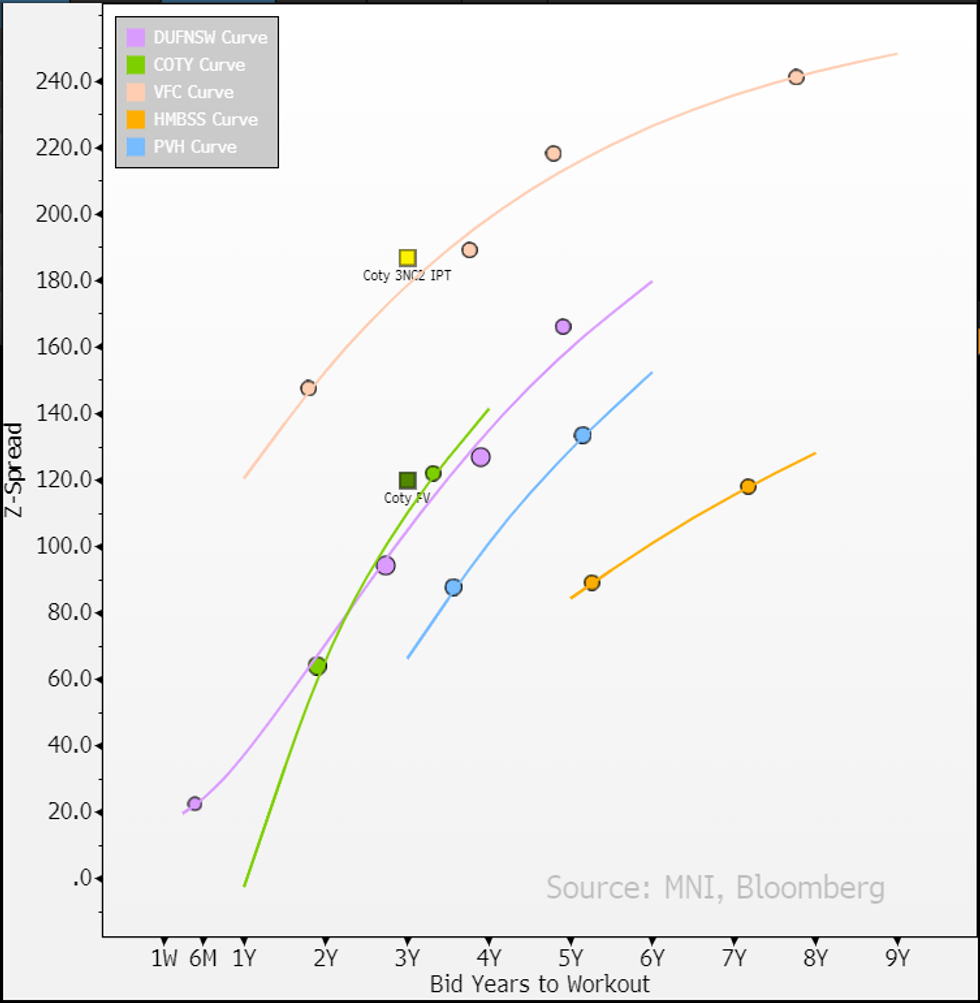

Free AccessCoty (Secured; Ba2 Pos, BB+ Pos, BBB- Stable) FV

€500m 3NC2 IPT 5% (to low5%s) (eqv. Z+187) vs. FV 4.3% (Z+120) **We have FV 70bps inside IPT & have a screen cheap on this deal. Reminder we already had a screen cheap on the Coty28s in secondary. We don't see much need to price the call structure on this new issue re. gross paydowns; plenty (including 28s) that it will take down into target 2x/IG levered.

- We've priced it tad outside of Dufry curve not on fundamentals but the 28s (YTW of 4.37%) shifting our FV higher/acting as a floor.

- 28s are pricing to ~3.5yr call right now at 4.37%/Z+125 but has the potential for a call as early as Sept 2025 at €102.875 (at 4.5%/Z+91 for 1.3yr duration).

- The '25 call option has (some) value for 28s mainly on refi to cheaper debt (our FV is 1.45% below 28s coupon). See our full notes below but Coty is guiding to gross paydowns (mainly though $1.1b asset sale next year) to target 2x leverage by end of CY25. That implies (on current earnings consensus) net debt will fall from $3.7b to ~$2.4b (-$1.3b reduction). Reminder this deal is leverage neutral.

- We see it taking down the single remaining €180m unsecured line first {AR860154 Corp} (at par) and then tackling the $1.4b maturity wall in Senior '26 debt (a dollar and € line). Both will be par callable after April next year and trade 0.5-1.5pts below that right now – i.e. nothing interesting.

- That gives plenty of room into 2x leverage target, but we don't rule out partial pay down on 28s or a refi into cheaper debt - latter seems likely here.

- We don't see the call structure (starting in year 2) in new 3Y having value on above; it will issue well below the 28s that have a 5.75% coupon and has the ‘26-maturity wall to tackle.

- Charts below (OAS, Yield & Z-spread). We have removed Tapestry/TPR lines that are skewed on M&A/call option risk - please see previous notes for RV on the curve. We have also removed single Levi 27s (Ba2/BB+; S) that trades well inside (investors may be eyeing early call on that line) and the Pandora 28s (tight/trades on H&M curve, mandate out for 6Y). Neither impact our FV.

- Notes on co, including financials; https://marketnews.com/coty-secured-ba2-pos-bb-pos...

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.