September 24, 2024 08:42 GMT

CREDIT SUPPLY: Naturgy (NTGYSM Baa2/BBB/BBB): New Issue FV

CREDIT SUPPLY

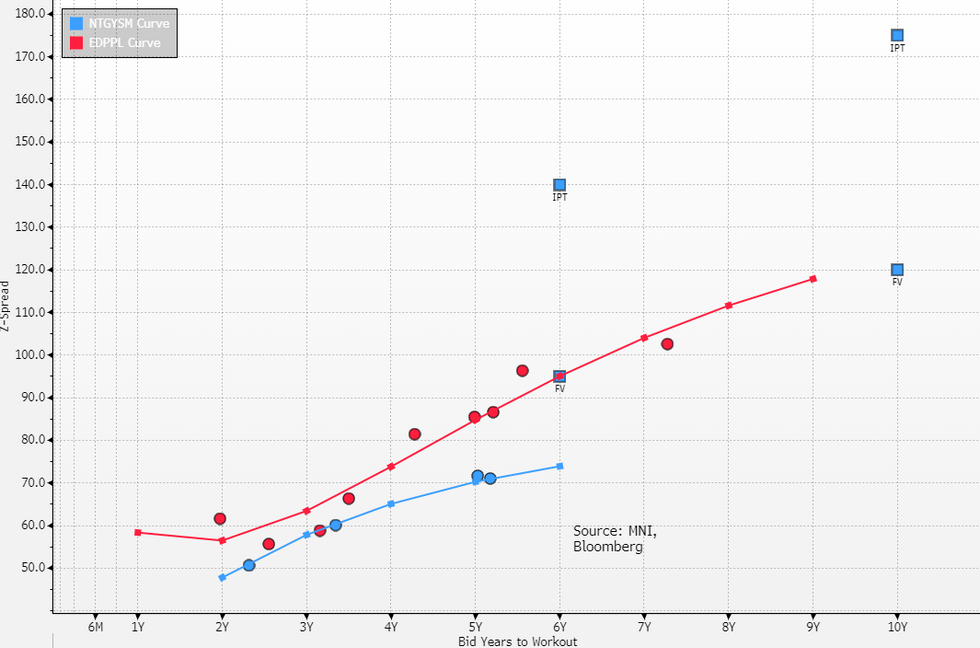

- IPT: EU500m WNG 6Y MS+140 Area, EU500m WNG 10Y MS+175a.

- We see FV at MS+95a, MS+120a with a wider confidence interval than usual.

- This is a somewhat unusual credit story, with ownership overhang for some time. A recent attempt to sell to Taqa fell through. Management is now due to present a new strategic plan, which has been lacking for some time.

- Naturgy last issued € in 2021 and the curve is generally low coupon and illiquid. We apply a 10-15 adjustment for current coupons. Same rated EDPPL (Baa2/BBB/BBB) is a reasonable comparison. The tender for the outstanding € bonds further muddies the picture although spreads haven’t reacted much given the €1bn maximum acceptance.

121 words