March 13, 2025 09:18 GMT

POWER: Czech Cez Continues to Up Hedging for 2025-28, Contracted Emissions Rise

POWER

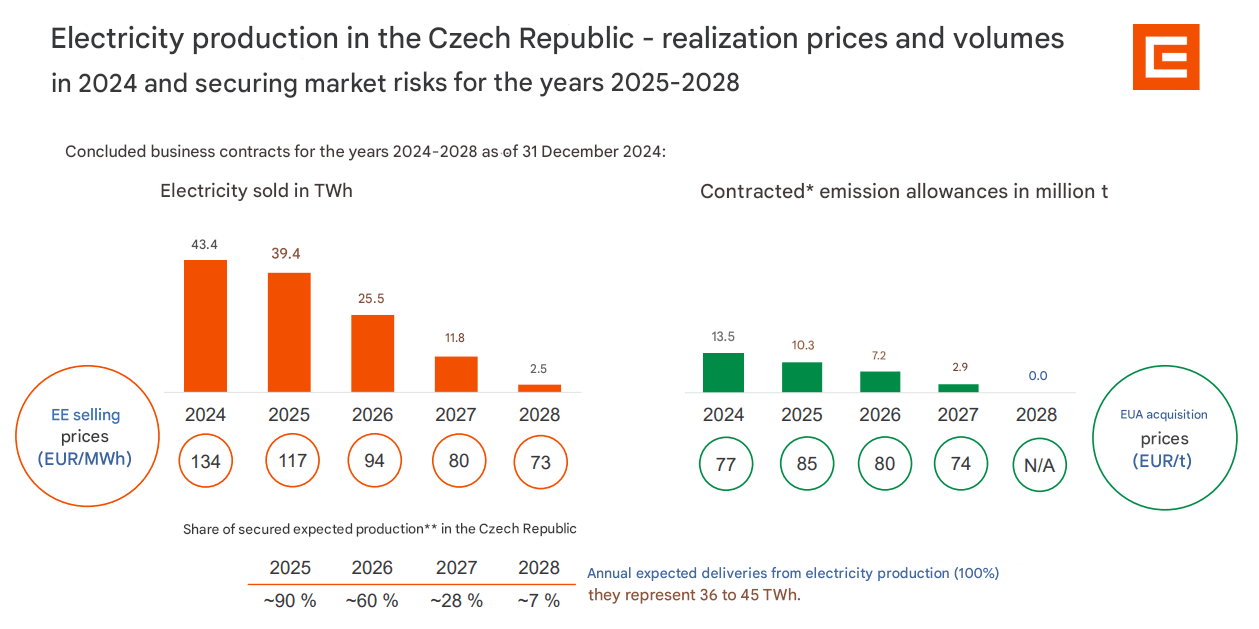

Czech Cez continued to raise its hedging for power delivered in 2025-28 at the end of 2024 from 3Q24, with average prices increasing for 2027-28 delivery. Its contracted emissions rose for all years – except 2028, which still hasn’t been hedged.

- Cez hedged 60% and 28% of its power output for delivery in 2026-27 at an average price of €94/MWh and €80/MWh, respectively at the end of December 2024.

- This is up from the end of September when the firm hedged 49% and 22% of its 2026-27 power at €95/MWh and €79/MWh.

- The firm sold forward 7% of its 2028 power at an average of €73/MWh. This is slightly up from the 5% hedged at the end of 3Q, which was sold at an average of €72/MWh.

- And its hedging for 2025 was at 90% at €117/MWh – climbing from 80% at the end of September 2024 – which was sold at €118/MWh at the time.

- The Czech 2026 baseload power contract settled at €89.29/MWh on 12 March, while the 2027-28 baseload power contracts cleared at €77.92/MWh and €72.42/MWh, respectively on 12 March, according to EEX.

- Additionally, it hedged around 10.3 mn/t of emission allowances for 2025 at an average price of €85/t CO2e at the end of 4Q24, with 7.2 mn/t and 2.9 mn/t of emissions hedged for 2026-27 at an average price of €80/t CO2e and €74/t CO2e, respectively.

- This is up from 9.6 mn/t of emission hedged for 2025 at the end of September 2024, as well as 5.2 mn/t and 1.9 mn/t contracted for 2026-27, respectively. Price falls were evident on the quarter for all years.

The December 25 and December 26 EU ETS contracts are at €69.56/t CO2e and €71.60/t CO2e, respectively, at the time of writing.

284 words