-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Hawks Continue To Swirl

EXECUTIVE SUMMARY

- POWELL HARDENS HAWKISH PIVOT TOWARD HALF-POINT FED RATE HIKES (BBG)

- LAGARDE SAYS ECB NEEDS TO WAIT ON DATA TO DETERMINE NEXT STEPS (BBG)

- CHINA URGES BIG INVESTORS TO BUY STOCKS AFTER MARKET TUMBLES (BBG)

- CHINA CENTRAL BANK READY TO PROVIDE MORE SUPPORT TO BUSINESS (BBG)

- BORIS JOHNSON TO ORDER FURTHER DELAY TO UK BORDER CHECKS ON EU IMPORTS (FT)

- BOC WON'T RULE OUT BIGGER HIKE AFTER LAST WEEK'S 50BPS (MNI)

- JAPAN, U.S. LIKELY DISCUSSED JOINT FX INTERVENTION IN BILATERAL TALKS (TBS)

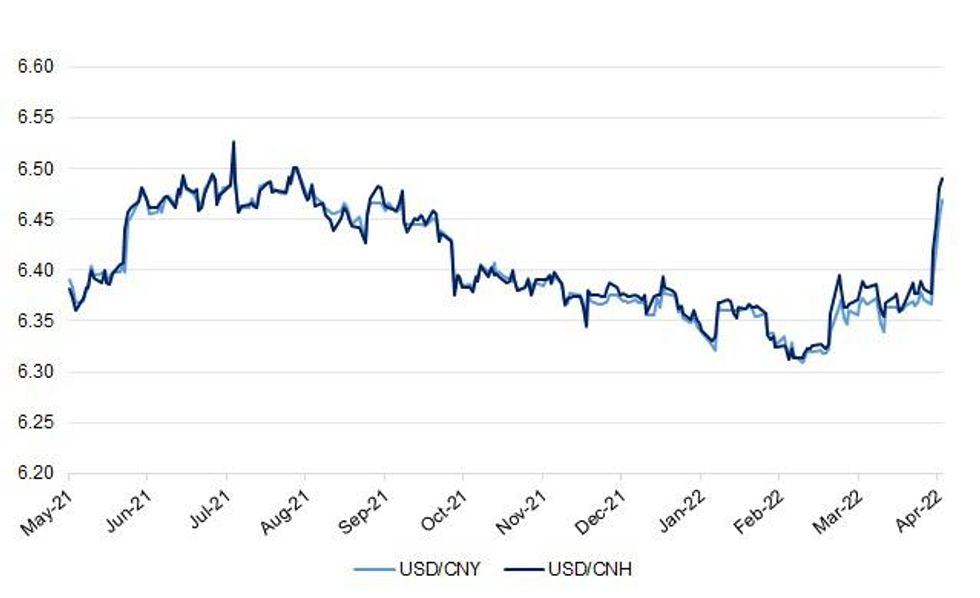

Fig. 1: USD/CNY Vs. USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Governments should be prepared to accept economic hardships as the price for forcing Russia to end its war in Ukraine, according to Bank of England Governor Andrew Bailey. Bailey also said the BOE was facing its “most severe test since independence 25 years ago” as it balances the need to raise interest rates to tackle inflation against driving the economy into recession. “We are walking a very tight line between tackling inflation and the output effects of the real income shock, and the risk that could create a recession,” he said. Inflation is at a 30-year high of 7% and on track to drift into double figures for the first time since the 1980s. (BBG)

POLITICS: Boris Johnson will be investigated by a Commons committee over claims he misled Parliament about parties in Downing Street during lockdown. MPs approved the Privileges Committee launching an inquiry once the police have finished their own investigation into the gatherings. The government had tried to delay the vote, but made a U-turn following opposition from its own MPs. Mr Johnson said he had "absolutely nothing, frankly, to hide". Speaking during an official trip to India, the prime minister added: "If the opposition want to focus on this and talk about it a lot more, that's fine." (BBC)

POLITICS: Boris Johnson is likely to face a vote of no confidence from his own MPs within the next three months, the most senior Tory to call for his resignation has said. Mark Harper, the former government chief whip, said that he expected the number of no-confidence letters in Mr Johnson to breach the level needed to trigger a vote before MPs break for the summer in July. (Telegraph)

POLITICS: Rishi Sunak will not be sacked before the autumn Budget, Boris Johnson has said – but he failed to rule out other Cabinet ministers departing in a summer reshuffle. The Prime Minister's show of confidence comes after Mr Sunak, the Chancellor, considered resigning over reports about his wife's non-domicile tax status. The relationship between Mr Johnson and Mr Sunak has been strained at points this year, not least over tax and spending levels and the Prime Minister's political troubles over "partygate". But asked by reporters on his India trip whether Mr Sunak would still be Chancellor come the autumn Budget, Mr Johnson replied: "The answer to that is yes." (Telegraph)

BREXIT: Boris Johnson is to order another delay to the introduction of post-Brexit border checks on goods entering Britain from the EU, in an admission that piling new costs on imports would exacerbate the cost of living crisis. Full checks on imports from the bloc were supposed to come into effect on July 1, but the prime minister has sided with Tory rightwingers who argue that Brexit is an opportunity to cut red tape at the border. Johnson’s allies said it was “inevitable” that checks would be delayed again — for the fourth time since the end of the Brexit transition period in December 2020. There is a live debate on the length of any new grace period. The prime minister signalled the move on a visit to India. “I’m generally in favour of minimal friction at all junctures between the UK and the EU,” he told reporters. “New technology will make some of the checks we have obsolete.” That was a reference to a promise by the government to create “the world’s most effective border” by 2025. Johnson’s allies confirmed one option being considered by ministers — and promoted by the likes of the Brexit opportunities minister, Jacob Rees-Mogg — was to refrain from new checks until the new border systems were in place. (FT)

RATINGS: Sovereign rating reviews of interest scheduled for after hours on Friday include:

- Moody’s on the United Kingdom (current rating: Aa3; Outlook Stable).

- S&P on the United Kingdom (current rating: AA; Outlook Stable).

EUROPE

ECB: Asked about potential interest-rate increases in the euro area, European Central Bank President Christine Lagarde says it doesn’t make sense “to be fixated on a day, a time in the day,” she says at panel discussion hosted by the International Monetary Fund in Washington. Points to the ECB’s June meeting as the moment to decide on next steps based on new data. Reiterates that euro-area economy is moving at a different pace than the U.S., justifying a slower response to the current bout of inflation. Says ECB policy is more about normalizing rather than tightening. Asked about risks that don’t receive enough attention, Lagarde mentions a “green swan,” or a scenario where nature is hurt so much “that it retaliates against us”. (BBG)

FRANCE: Emmanuel Macron would beat far-right National Rally candidate Marine Le Pen 53%-47% in the French presidential runoff on Sunday, according to Odoxa poll of voting intentions released Thursday for L’Obs newspaper and Mascaret. (BBG)

FRANCE: Emmanuel Macron would beat far-right National Rally candidate Marine Le Pen 57.5%-42.5% in the French presidential runoff, according to poll of voting intentions released on Wednesday by Ipsos-Sopra Steria for France Info and Le Parisien. (BBG)

RATINGS: Sovereign rating reviews of interest scheduled for after hours on Friday include:

- Moody’s on Slovenia (current rating: A3; Outlook Stable).

- S&P on Greece (current rating: BB; Outlook Positive), Italy (current rating: BBB; Outlook Positive) & the Netherlands (current rating: AAA; Outlook Stable).

U.S.

FED: Federal Reserve Chair Jerome Powell outlined his most aggressive approach to taming inflation to date, potentially endorsing two or more half percentage-point interest-rate increases while describing the labor market as overheated. “I would say that 50 basis points will be on the table for the May meeting,” Powell said at an IMF-hosted panel on Thursday in Washington that he shared with European Central Bank President Christine Lagarde and other officials. He said demand for workers is “too hot -- you know, it is unsustainably hot.” Powell also reinforced expectations for another half-point increase in June, by citing minutes from last month’s policy meeting that said many officials had noted “one or more” 50 basis-point hikes could be appropriate to curb the hottest inflation in four decades. “There’s something in the idea of front-end loading” moves if appropriate, Powell said -- “so that points in the direction of 50 basis points being on the table.” (BBG)

FED: San Francisco Federal Reserve President Mary Daly on Thursday said she supports raising the U.S. central bank's target for overnight borrowing costs to 2.5% by the end of this year, but whether or how much further it will need to rise will depend on what happens with inflation and labor markets. "Is it 50, is it 25, is it 75? Those are things that I'll deliberate with my colleagues, but my own starting point is we don't want to go so quickly or so abruptly that we surprise Americans" already dealing with 40-year-high inflation, Daly told Yahoo Finance. "I'm watching over this year to see how much our move to neutral restrains the economy, along with the repair of supply chains and the fiscal rolloff," all of which should contribute to easing inflation, she said. (RTRS)

FED: The Chicago Federal Reserve Bank's board of directors has begun a search for a new bank president to succeed Charles Evans, who reaches the mandatory retirement age next January, and on Thursday announced he'd be leaving his post early next year. The bank has hired recruiting firm Diversified Search Group to assist on the nationwide effort, it said in a statement. (RTRS)

OTHER

GLOBAL TRADE: Export controls implemented by the U.S. and its allies have cut Russia's imports of high-tech goods by more than half -- and more export restrictions are being readied, U.S. Commerce Secretary Gina Raimondo said. Ms. Raimondo and European Commission Executive Vice President Valdis Dombrovskis spoke to reporters Thursday evening following their meeting to discuss sanctions against Russia and cooperation under the U.S.-European Union Trade and Technology Council, a bilateral forum launched in September. The two officials also discussed enhancing cooperation under the Trade and Technology Council ahead of their next meeting in mid-May in Paris. The topics include aligning technology standards for areas like cybersecurity and artificial intelligence, and shaping policies on data governance, competition and trans-Atlantic supply chains, Ms. Raimondo said. Mr. Dombrovskis said the establishment of the Trade and Technology Council last year "helped us to coordinate very efficiently and impose export controls in a very short time." (DJ)

GLOBAL TRADE: Ukraine’s farmers have planted 2.5 million ha of spring crops as of Thursday, about 20% of projected planting areas, the nation’s agriculture ministry says Thursday in a statement, citing Deputy Minister Taras Vysotskyi. In northern regions, that have endured Russia’s invasion, farmers are expected to be able to plant only as much as 70% of planned areas due to a problem with landmines. In areas where fighting is ongoing, including the Luhansk, Donetsk, Kherson and Zaporizhzhia regions, sowing can be completed in 30%-40% of areas in a worst-case scenario. In most of Ukraine, planting is going according to plan. (BBG)

INFLATION: Agustin Carstens, general manager of the Bank for International Settlements, said the global inflation environment is changing fundamentally and policy makers will need to change their mindsets. Developed and emerging markets both experiencing higher inflation. Supply has been surprisingly slow to respond to the rebound in demand. Policy rates need to rise to the levels more appropriate for high-inflation environment. Central banks fully aware that short-term costs of stability in employment are the price to pay for avoiding bigger costs down the road. We cannot rely on repeated macroeconomic stimulus, be it monetary or fiscal. Disinflationary trends of recent years may be waning; there’s retreat in globalization and pandemic has disrupted supply chains. Seems clear that policy interest rate levels need to rise; real interest rates may need to rise above neutral level. (BBG)

INFLATION: The world faces a "human catastrophe" from a food crisis arising from Russia's invasion of Ukraine, World Bank president David Malpass has said. He told the BBC that record rises in food prices would push hundreds of millions people into poverty and lower nutrition, if the crisis continues. The World Bank calculates there could be a "huge" 37% jump in food prices. This would hit the poor hardest, who will "eat less and have less money for anything else such as schooling". In an interview with BBC economics editor Faisal Islam, Mr Malpass, who leads the institution charged with global alleviation of poverty, said the impact on the poor made it "an unfair kind of crisis... that was true also of Covid".

U.S./CHINA: A White House adviser on Thursday suggested the United States could lower tariffs imposed on a host of non-strategic Chinese goods such as bicycles or apparel to help combat inflation. Deputy National Security Adviser Daleep Singh said tariffs imposed by the former Trump government may have given the administration some negotiating leverage, but these tariffs served no strategic purpose, and China had similar non-strategic retaliatory tariffs in place. "So that's the opportunity," he told an event hosted by the Bretton Woods Committee. "It could be that in this moment of elevated inflation and China having its own very serious supply chain concerns ... maybe there's something we can do there." (RTRS)

GEOPOLITICS: Canada would support including Sweden and Finland in the NATO military alliance, Prime Minister Justin Trudeau said on Thursday, after Russia's invasion of Ukraine has prompted both countries to consider joining. "Conversations are being had around Sweden and Finland looking to join NATO, and Canada, of course, is very supportive of that," Trudeau told reporters when asked if he backed the two countries joining the North Atlantic Treaty Organization. (RTRS)

BOJ: Current and former Bank of Japan deputy governors are the clear favorites among economists to replace Governor Haruhiko Kuroda next year, according to a Bloomberg survey. Some 29 of 30 economists said Masayoshi Amamiya, the current deputy, is a strong candidate for the job, according to the poll. Hiroshi Nakaso, who also served under Kuroda as a deputy, gained 28 votes in a survey asking for three strong candidates to helm the central bank when the governor steps down. (BBG)

JAPAN: Japan’s Finance Minister Shunichi Suzuki said he discussed recent abrupt moves in the yen with U.S. Treasury Secretary Janet Yellen, and the two agreed to uphold existing foreign exchange rate agreements. “We discussed existing Group of Seven thinking on foreign exchange,” said Suzuki, speaking to reporters late Thursday in Washington D.C. “We’ll respond based on that agreement.” Suzuki said he showed Yellen how recent moves in the yen have been very sudden, though he added that talks focused more on the state of their economies than on concerns over currencies. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki and U.S. Treasury Secretary Janet Yellen likely discussed the idea of coordinated currency intervention to stem further yen falls during their meeting held in Washington, D.C., TBS reported on Friday. The U.S. side sounded as if it will consider the idea positively, the Japanese television broadcaster quoted a Japanese government source as saying. (RTRS)

JAPAN: The Japanese government is making preparations to lift the ceiling for gasoline subsidies provided to oil distributors to 35 yen ($0.2727) a litre from 25 yen, public broadcaster NHK reported on Friday. The temporary subsidy programme was adopted in January to mitigate high fuel prices after tight global supplies boosted crude prices, with further pressure added by the Ukraine conflict that began on Feb. 24. The subsidies are due to end this month and the government has been discussing the possibility of extending them as well as raising the ceiling as high energy prices hit homes and companies. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un has exchanged letters with outgoing South Korean President Moon Jae-in and thanked him for trying to improve relations, state media KCNA reported on Friday, amid tension over Pyongyang's weapons tests. Moon's office confirmed that he had exchanged "letters of friendship" with Kim. Moon sent a letter on Wednesday and promised to continue to try to lay a foundation for unification based on joint declarations reached at summits in 2018, despite the "difficult situation," the official KCNA news agency said. Kim said in his reply on Thursday that their "historic" summits gave the people "hope for the future", and the two agreed that ties would develop if both sides "make tireless efforts with hope." "Kim Jong Un appreciated the pains and effort taken by Moon Jae-in for the great cause of the nation until the last days of his term of office," KCNA said, adding the exchange of letters was an "expression of their deep trust." (RTRS)

HONG KONG: Hong Kong is set to relax the threshold for suspending incoming flights carrying passengers infected with Covid-19, from the existing three to five, the Post has learned. A source familiar with the matter said the government would make an announcement "very soon" in a bid to further ease flight restrictions. "Raising the threshold for suspending inbound flights that bring in passengers found to be infected with coronavirus would reduce the likelihood of suspension," the insider said. "The government considers the risks brought by the relaxation of restrictions on incoming travellers since the beginning of the month as still manageable." (BBG)

BOC: MNI: BOC Won't Rule Out Bigger Hike After Last Week's 50BPS

- Bank of Canada Governor Tiff Macklem told reporters Thursday he won't rule anything out when asked about following up last week's half-point rate hike with something even bigger. "I've used the wording that we need to normalize monetary policy reasonably quickly, and we're prepared to be as forceful as needed, and I'm really going to let those words speak for themselves,” he said. Last week's 50bp rate increase was already "an unusual step" that hadn't been taken in two decades and "Canadians should expect further increases in interest rates," he said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

MEXICO: The U.S. will likely tighten monetary policy faster than previously expected, triggering knock-on effects in Mexico, central bank Governor Victoria Rodriguez Ceja said Thursday. Fed hikes “will probably be greater and faster than anticipated, which implies an additional challenge for monetary policy in our country,” Rodriguez said in a senate hearing on Thursday. Rodriguez said the board will move decisively to bring inflation to its 3% target, down from a 21-year high of 7.45% as of March. The bank sees inflation hitting its target in early 2024, she said, its projection unchanged since its last rate decision in March. (BBG)

MEXICO: Mexico central bank Governor Victoria Rodriguez said Thursday President Andres Manuel Lopez Obrador revealing an interest rate increase early was an “isolated event.” Finance Minister’s participation in monetary policy meetings will remain the same as required by law, Rodriguez said in remarks to senators. (BBG)

MEXICO: Petroleos Mexicanos bonds tumbled to fresh lows as the state-owned oil giant prepares to resume paying its own debt maturities, halting a government policy of covering its amortizations. Pemex has the cash flow to make its debt payments, Mexico Finance Minister Rogelio Ramirez de la O said at an event in Washington on Thursday, confirming earlier reports. “To the extent that they do have this cash flow and they can make the payments, they will be making their payments,” Ramirez said, adding that the government would be fully behind Pemex should the Covid-19 pandemic worsen again and the company needed its support. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro said on Thursday that he would pardon an allied federal congressman who was sentenced to nearly nine years in prison by the Supreme Court, a move likely to heighten tensions between the nation's executive and judiciary during an election year. Bolsonaro's move is the latest escalation in his feud with the court, and could add to the likelihood of a constitutional crisis ahead of October's presidential vote, in which Bolsonaro is seeking re-election. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Thursday said Russia had rejected a proposal for a truce over the Orthodox Christian Easter period this weekend but added he still harbored hopes for peace. Zelenskiy made the remarks in a video address. The Orthodox Easter service starts late on Saturday into Sunday morning. (RTRS)

RUSSIA: Ukraine’s deputy chief of staff, Ihor Zhovkva, said that even though Russia controls major parts of the port city of Mariupol that’s been under siege since March 1, the Ukrainian army is still there. “Most of them as well as many civilians are blocked at the Azov steel plant,” Zhovkva said in an interview with Bloomberg. Ukraine offered to exchange Russian wounded soldiers for those Mariupol civilians and soldiers who are wounded, he said, adding that “we have not received any answer.” (BBG)

RUSSIA: Ukraine needs $7 billion a month to function amid the devastating "economic losses" inflicted by Russia, said President Zelensky. The figure is an increase from Kyiv's previous estimate of $5 billion in monthly needs. In a virtual address to a World Bank forum, Zelensky said the global community needed to exclude Russia immediately from international financial institutions, and urged all countries immediately to break relations with Moscow. Zelensky told the leaders of the IMF and World Bank that Russian forces in his country "are aimed at destroying all objects in Ukraine that can serve as an economic base for life. That includes railroad stations, food warehouses, oil refineries."He also noted the Russian blockade of Black Sea ports has blocked Ukrainian exports, impacting world food safety. (France 24)

RUSSIA: Physical damage to Ukraine's buildings and infrastructure from Russia's invasion has reached roughly $60 billion and will rise further as the war continues, World Bank President David Malpass said on Thursday. Malpass told a World Bank conference on Ukraine's financial assistance needs that the early estimate of "narrow" damage costs does not include the growing economic costs of the war to Ukraine. "Of course the war is still ongoing, so those costs are rising," Malpass said. (RTRS)

RUSSIA: Yellen anticipates steps to get Russia to help pay for rebuilding war-ravaged Ukraine, while saying that any move to deploy confiscated Russian assets for that effort would need to be considered carefully. “The rebuilding costs, ultimately, in Ukraine are going to be enormous,” Yellen said at a press conference in Washington Thursday. “And certainly looking to Russia -- one way or another -- to help provide some of what’s necessary for Ukraine to build is something I think we ought to be pursuing.” (BBG)

U.S./CHINA/RUSSIA: The U.S. State Department said on Thursday that China continues to "parrot" some of Russia's security ideas amid the war in Ukraine, including the Kremlin's concept of "indivisible security." State Department spokesman Ned Price made the comment at a regular briefing when asked about a speech by Chinese leader Xi Jinping in which he referenced the concept along with his proposed "global security initiative." (RTRS)

RUSSIA: U.S. Defense Secretary Lloyd Austin will host Ukraine-focused defense talks with allies at Ramstein Air Base in Germany on April 26, the Pentagon said on Thursday. "The goal is to bring together stakeholders from all around the world for a series of meetings on the latest (Ukrainian) defense needs and ... ensuring that Ukraine's enduring security and sovereignty over the long-term is respected and developed," Pentagon spokesman John Kirby said. Kirby did not say how many allies would participate. (RTRS)

RUSSIA: The United States has been in contact with Ukraine's prosecutor and is assisting with the preservation and collection of evidence of war crimes committed by Russia, U.S. Attorney General Merrick Garland said on Thursday. (RTRS)

RUSSIA: President Joe Biden announced on Thursday the United States will ban Russian-affiliated ships from American ports, joining Canada and European nationsin the latest step to pressure Russia over its invasion of Ukraine. (RTRS)

RUSSIA: Actions by the U.S. and its allies to restrict Russia’s access to high-tech imports and parts has seen those shipments fall by more than 50%, frustrating the nation’s manufacturing and servicing efforts, Commerce Secretary Gina Raimondo said. “The Russian military is struggling to find spare parts for their tanks, for their satellites, for their rocket-mounting systems,” Raimondo told reporters in Washington Thursday. “We have denied them almost all semiconductors, night-vision goggles, avionics. We’re hearing reports of an auto manufacturing facility shutting down,” for planes being unable to fly because they don’t have spare parts. (BBG)

RUSSIA: Societe Generale may sell its Rosbank unit to Vladimir Potanin’s Interros Capital for 40b rubles to 60b rubles, Kommersant reports, citing unidentified people close to the deal. The sale will be for cash and the buyer plans to use funds from accounts outside of Russia.The transaction is expected to happen soon. Interros declined to comment on the deal details; Rosbank also declined to comment on the details saying that deal will be commercial and won’t include an asset swap. (BBG)

RUSSIA: British Finance Minister Rishi Sunak and his Canadian counterpart Chrystia Freeland walked out of an International Monetary Fund (IMF) meeting in Washington to protest the invasion of Ukraine when Russia's delegate spoke on Thursday, a British finance ministry spokesperson said. Before walking out, Sunak "described (Russian President Vladimir) Putin's assault on Ukraine as an assault on the rules and norms that are the foundation of our economic way of life," the spokesperson said. (RTRS)

RUSSIA: The Russian central bank said on Thursday it had decided to extend measures to ease forex currency control measures for all Russian export-focused companies. The mandatory sales of foreign currency earned by these companies remain in place, however the currency they receive after April 19 can now be sold within 60 days instead of the previous three days, the central bank said. On Tuesday, the regulator decided to ease forex currency control measures for Russian export-focused companies outside the commodities and energy sectors. (RTRS)

RUSSIA: Russia will not face sustained slowdown in inflation until 2023, the Russian Central Bank reported on Thursday citing a survey of its analysts. The analysts expected that annual inflation rate will remain elevated in the near future before beginning to slow, the regulator said. According to Russian Economy Ministry, annual inflation in Russia accelerated to 17.62% as of April 15, its highest since early 2002. (RTRS)

RUSSIA: Russia’s customs service has decided to temporarily suspend publication of import and export data in order to exclude errors and “speculation”, the head of the service said on Thursday. The move will make it much harder to gauge the impact on trade of sweeping western sanctions imposed against Russia since it sent its troops into Ukraine on Feb. 24 in what it calls a special military operation. “The Federal Customs Service is not publishing statistics on imports and exports. I support this decision, I think it is justified in order to avoid incorrect estimates, speculation and discrepancies regarding imports. This is a temporary measure,” Interfax news agency quoted the head of the service, Vladimir Bulavin, as saying. (RTRS)

RUSSIA: Russia will oblige the largest coal companies to sell at least 10% of their thermal coal output on exchange, Kommersant reports, citing draft of joint executive order of Energy Ministry and Anti-monopoly Service. According to regulators, this will allow to set domestic price indicators and decouple the domestic market from export parities. (BBG)

RUSSIA: Russia barred entry to Meta Platform Inc’s Mark Zuckerberg and 28 other Americans, a symbolic retaliation for U.S. sanctions against its top officials and business figures. The latest Russian “stop list” includes U.S. Vice-President Kamala Harris alongside White House, Pentagon and State Department officials and ABC’s George Stephanopoulos, the Foreign Ministry said in a statement on Thursday. The “top officials, executives, experts and journalists who shape the Russophobic agenda, as well as the spouses of a number of high-ranking officials” are being barred from Russia in response to U.S. sanctions, the ministry said. (BBG)

IRAN: Iran will not abandon plans to avenge the 2020 U.S. killing of Quds Force Commander Qassem Soleimani, despite "regular offers" from Washington to lift sanctions and provide other concessions in return, a top Iranian official said on Thursday. (RTRS)

WORLD BANK/IMF: U.S. Treasury Secretary Janet Yellen and a top White House adviser called for major reforms at the World Bank on Thursday, saying the seven-decade-old multilateral development bank was not built to address multiple and overlapping global crises. Yellen told reporters that both the World Bank and the International Monetary Fund were not designed to handle the multiple global crises they now face, including fallout from Russia's war in Ukraine and the COVID-19 pandemic, and they lack the resources to tackle climate change. "We face challenges that will now require investment on a scale that an international institution can't manage on its own, like climate change," Yellen said. "The investments for climate change will add up to just trillions and trillions of dollars." (RTRS)

OIL: OPEC told the International Monetary Fund's steering committee on Thursday that the surge in oil prices was largely due to the Ukraine crisis, in the latest signal that the producer group would not take further action to add supply. (RTRS)

OIL: The U.S. Department of Energy said on Thursday it has awarded contracts for 30 million barrels of crude oil in the initial round of the largest sale ever from the Strategic Petroleum Reserve (SPR) in response to price hikes caused by Russia's invasion of Ukraine. "This is an important step to addressing the supply shortage and the (Russian President Vladimir) Putin price hike Americans are facing," Jen Psaki, the White House spokesperson, said in a statement about the initial contracts. (RTRS)

OIL: Su Wei, deputy secretary-general of China’s economic planning agency, had a video meeting with Saudi Aramco Senior Vice President Mohammed Yahya Al Qahtani, NDRC says in a statement. Two sides discuss cooperation in energy and chemical engineering, the statement says, without giving details. (BBG)

CHINA

ECONOMY: Communist Party’s flagship newspaper says in opinion piece Friday that China’s economic fundamentals are unchanged and point to long-term growth. The economy’s persistent ability to recover has not changed and its traits of having great potential, strong tenacity and “broad space” has not changed, the People’s Daily says. Since start of year, a complicated and grim international market and persistent virus outbreaks in China have had big impact on economy. However economic numbers reflected in 1Q presented an overview of a stable industrial supply chain, new capacity for innovation and a domestic market with big potential. (BBG)

PBOC: China’s financial markets are not immune to external shocks and the COVID situation also put more pressure on China's economy, governor of the People's Bank of China (PBOC) Yi Gang said on Friday in a video speech to the annual Boao Forum for Asia. Yi said China will provide policy support for the real economy, and the country's money policy will focus on supporting small firms and sectors hit by the COVID-19 outbreaks. (RTRS)

PBOC: China’s central bank Governor Yi Gang said monetary policy is in a “comfortable range” and is helping support the economy as growth pressures mount. “Accommodative monetary policy is stepping up support for the real economy,” the governor of the People’s Bank of China said on a panel at the Boao Forum for Asia on Friday. He cited recent measures by the PBOC to transfer profits to the central government and support for small and mid-sized businesses. “We also stand ready to support small and medium enterprises with more instruments if needed,” he said. “We have accommodative monetary policy supporting our real economy throughout this year.” The PBOC has taken a measured easing approach this year in the face of rising economic risks from the country’s worst Covid outbreak since early 2020. It refrained from cutting policy interest rates last week and gave banks only a modest cash boost, disappointing investors. Economists from UBS Group AG to Nomura Holdings Ltd. have downgraded their growth forecasts for this year to well below the government’s target of about 5.5%. (BBG)

CAPITAL FLOWS: The net inflow of foreign capital into China will still be considerable in 2022, as China’s economy is resilient to withstand shocks and the country is resolute to keep expanding high-level opening up, Xinhua News Agency reported citing Fang Xinghai, vice chairman of the China Securities Regulatory Commission. Fang said it takes time for foreign investors to get familiar with the Chinese capital market, and they will return after new policies created uncertainties, Xinhua reported. From 2019 to 2021, a net of CNY887.4 billion of foreign capital has flowed into the A-share market, with foreign capital currently accounting for about 4.5%, Xinhua said. (MNI)

YUAN: Many overseas investment institutions believe the yuan is unlikely to fall sharply as far as China keeps stable growth and balanced cross-border capital flow, and the recent weakening of yuan is more likely a correction of the previous high valuation, the 21st Century Business Herald reported citing an unnamed trader in Hong Kong. The correction of yuan can moderately release the accumulated depreciation pressure and a more flexible currency will help to stabilize growth and maintain a high level of safety and yield prospects for yuan assets, the newspaper said. Onshore yuan traded around 6.4472 against the U.S. dollar on Thursday, hitting an intra-day high of 6.4518, the weakest since November 2021. (MNI)

CORONAVIRUS: Shanghai will carry out nine major measures from Friday aiming to achieve zero community transmission of Covid-19 sooner, according to a statement on the municipal government’s WeChat account. Residents in locked-down areas are banned to leave their home, while those in controlled areas are not allowed to leave their residential complex, and gathering is strictly prohibited in the rest of the city. Intensive COVID-19 and antigen tests will be carried out in different areas, the statement said. (MNI)

CORONAVIRUS: About 70% of 666 major industrial companies in Shanghai have resumed production in the past week, Vice Mayer Zhang Wei says at a regular briefing. Shanghai’s industrial output fell 7.5% in March as Covid outbreak caused significant impact on the city’s industrial sector, says Wu Jincheng, a local economic official. (BBG)

EQUITIES: China urged some of the country’s biggest investors to buy more stocks, stepping up efforts to stem the market’s slide toward a two-year low. The nation’s securities regulator issued the guidance at a Thursday meeting with investors including the country’s giant social security fund, just as the benchmark CSI 300 Index was sliding toward the lowest level since June 2020. The gauge was little changed on Friday after erasing a drop of as much as 1.1%. The Thursday meeting convened by the China Securities Regulatory Commission was followed by a series of articles in state media projecting confidence in the economy and markets. The concerted efforts underscore growing pressure on authorities to boost confidence before a closely watched leadership confab that’s expected to confirm a precedent-breaking third term for Chinese President Xi Jinping. (BBG)

EQUITIES: China’s equity market will turn around after 2Q economy improves, China Securities Journal reports, citing analysts. 2Q will be a turning point for economic growth with external factors affecting market fading gradually, the report says, citing Liang Yuejun at Rosefinch Fund. Currently market is at a large bottom after a sharp drop and that means big opportunity, Liang is cited as saying. Government doubled down on policy to stabilize growth and virus prevention are seeing positive progress, which are good news for A-share market, the report says, citing Xun Yugen at Haitong Securities. A-share market is currently at the bottom and value for mid- to long-term investment has emerged, AXA SPDB Investment Managers says. (BBG)

OVERNIGHT DATA

JAPAN MAR CPI +1.2%; MEDIAN +1.2%; FEB +0.9%

JAPAN MAR CORE CPI +0.8%; MEDIAN +0.8%; FEB +0.8%

JAPAN MAR CORE-CORE CPI -0.8%; MEDIAN -0.7%; FEB -1.0%

JAPAN APR, P JIBUN BANK SERVICES PMI 50.5; MAR 49.4

JAPAN APR, P JIBUN BANK M’FING PMI 53.4; MAR 54.1

JAPAN APR, P JIBUN BANK COMPOSITE PMI 50.9; MAR 50.3

The latest Flash PMI data showed that Japanese private sector activity improved at a sharper rate at the start of the second quarter of 2022. Services companies recorded an expansion in activity for the first time since last December, while manufacturers saw output levels rise for the second successive month. April data signalled the sharpest expansion in four months, though the pace of growth was only marginal. Moreover, growth in incoming business in the private sector stagnated amid increased headwinds. Cost pressures were sustained and remained more acute at manufacturers, though the rate of input cost inflation at service providers accelerated to the highest since August 2008 on the month and pushed composite input cost inflation up for the third month running. Concurrently, firms passed these price rises to clients through the steepest rise in output charges for eight years. Business confidence eased to an eight-month low amid increased headwinds as concerns over the impact the war in Ukraine and strict China lockdown measures would have on supply chains, costs and demand – especially at manufacturing firms where positive sentiment was the weakest since June 2020. (IHS Markit)

AUSTRALIA APR, P S&P GLOBAL SERVICES PMI 56.6; MAR 55.6

AUSTRALIA APR, P S&P GLOBAL M’FING PMI 57.9; MAR 57.7

AUSTRALIA APR, P S&P GLOBAL COMPOSITE PMI 56.2; MAR 55.1

The expansion of the Australian economy continued in April, according to the S&P Global Flash Australia Composite PMI, buoyed by the easing of COVID-19 disruptions. Foreign demand played a part as well with new export business rising for the first time since December 2021. Price pressures persisted, however, for private sector firms that faced higher costs across raw material to wages. Input costs rose at the fastest pace since data collection began in May 2016, reflecting the impact from both the Ukraine war and lockdowns in China. Higher employment levels in April remained a bright spot to highlight, though the lack of suitable candidates have contributed to a slowdown of hiring activity. Meanwhile, despite better output growth, business confidence eased in April which is a worrying trend. (IHS Markit)

UK APR GFK CONSUMER CONFIDENCE -38; MEDIAN -33; MAR -31

The cost crunch is really hitting the pockets of UK consumers and the headline confidence score has dropped to a near historic low. The scores looking at the next 12 months for our personal finances at -26 and the general economy at -55 are worse than the 2008 financial crash. The personal finance score for the next year is also worse than the initial Covid shock in 2020. When rising inflation and interest rates meet low growth and declining incomes, consumers will understandably be extremely cautious about any spending. There’s clear evidence that Brits are thinking twice about shopping, as seen in the tumbling Major Purchase Index – now is not considered to be a good time to buy. This is dire news for consumer confidence and with little prospect of any economic relief on the horizon we can only forecast further falls in the Index for the year ahead. (GfK)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9798% at 09:25 am local time from the close of 1.7018% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 45 on Thursday vs 46 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.4596 FRI VS 6.4098

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.4596 on Friday, compared with 6.4098 set on Thursday, marking the biggest daily drop since March 9, 2021.

MARKETS

SNAPSHOT: Hawks Continue To Swirl

Below gives key levels of markets in the second half of the Asia-Pac session:

- ASX 200 down 114.188 points at 7478.6

- Shanghai Comp. down 2.008 points at 3077.8

- JGB 10-Yr future down 4 ticks at 149.11, yield down 0.6bp at 0.245%

- Aussie 10-Yr future down 5 ticks at 96.82, yield up 4.9bp at 3.13%

- US 10-Yr future down 12.5 ticks at 118.625, yield up 2.02bp at 2.9297%

- WTI crude down $1.11 at $102.68, Gold up $1.1 at $1952.74

- USD/JPY down 36 pips at Y128.02

- POWELL HARDENS HAWKISH PIVOT TOWARD HALF-POINT FED RATE HIKES (BBG)

- LAGARDE SAYS ECB NEEDS TO WAIT ON DATA TO DETERMINE NEXT STEPS (BBG)

- CHINA URGES BIG INVESTORS TO BUY STOCKS AFTER MARKET TUMBLES (BBG)

- CHINA CENTRAL BANK READY TO PROVIDE MORE SUPPORT TO BUSINESS (BBG)

- BORIS JOHNSON TO ORDER FURTHER DELAY TO UK BORDER CHECKS ON EU IMPORTS (FT)

- BOC WON'T RULE OUT BIGGER HIKE AFTER LAST WEEK'S 50BPS (MNI)

- JAPAN, U.S. LIKELY DISCUSSED JOINT FX INTERVENTION IN BILATERAL TALKS (TBS)

US TSYS: Off Worst Levels Into Europe, Bear Flattening Again

A combination of spill over from Thursday’s cheapening, hawkish sell-side calls (Nomura now look for back-to-back 75bp rate hikes from the Fed in June & July after a “likely” 50bp move in May), hawkish BoC speak and weakness in Aussie bonds applied pressure to Tsys in the Asia-Pac session, although the space has corrected from worst levels of the day ahead of London dealing.

- TYM2 trades -0-05 at 118-19, 0-11 off fresh cycle lows, on volume of ~155K. Note that TU-UXY contracts showed through their Thursday lows after the Nomura Fed call hit the wider wires, with a flow-drive element likely exacerbating weakness at that time.

- Cash Tsys sit 1.5-3.5bp cheaper across the curve, bear flattening.

- FOMC meeting dated OIS now prices a cumulative ~151bp of tightening across the next 3 Fed meetings i.e. 3 consecutive 50bp hikes are fully priced.

- The Eurodollar strip moved with the wider bond market gyrations, trading 2.0-3.0 ticks lower through the reds at typing, also off of worst levels.

- Flash PMI data from across the globe headlines the broader docket on Friday.

JGBS: Resilience Evident

JGB futures have exhibited resilience when it comes to withstanding the wider pressures observed in core global FI markets. Participants never looked to force a challenge of overnight session lows, even with the likes of U.S. Tsys coming under pressure. That left the contract to operate around late overnight levels during the morning session, before a light uptick was seen in the afternoon, with the contract trading closer to unchanged levels ahead of the bell.

- The BoJ’s presence in the 10-Year zone of the curve is limiting the pressure in paper out to 10s/in futures, although the overnight downtick in futures applied some pressure to 7s, which underperform surrounding tenors (cheapening by ~1bp vs. 0.5bp in other tenors out to 10s). Meanwhile, the longer end of the JGB curve has provided some more notable weakening given the gyrations in wider core global FI markets since Thursday’s Tokyo close, with super-long JGBs cheapening by ~2.5bp on the day. The steepening of the curve is also facilitated by the relative lack of BoJ control further out the curve.

- Japanese officials (from both the government & BoJ) have added little fresh when it comes to discussions re: FX, with Finance Minister Suzuki confirming that Japan and the U.S. have agreed to uphold existing agreements re: FX, while he provided no comment on the prospect of FX intervention, noting that Japan will respond to FX moves with a sense of urgency. Source reports in the local media have indicated that discussions between Suzuki & U.S. counterpart Yellen were received positively by the U.S., providing some modest JPY strength, although the Japanese MoF once again provided no comment as to whether such discussions took place post-reports.

JGBS AUCTION: Japanese MOF sells Y4.7822tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.7822tn 3-Month Bills:

- Average Yield -0.1191% (prev. -0.1128%)

- Average Price 100.0320 (prev. 100.0303)

- High Yield: -0.1172% (prev. -0.1005%)

- Low Price 100.0315 (prev. 100.0270)

- % Allotted At High Yield: 32.6938% (prev. 58.2692%)

- Bid/Cover: 3.893x (prev. 2.437x)

AUSSIE BONDS: Bear Flattening, Westpac Look For 40bp June RBA Liftoff

Cross-market spill over allowed the space to extend on its overnight weakness during the early rounds of Sydney dealing, with breaks below previous cycle lows in YM & XM generating fresh rounds of selling later in the day. YM -10.0 & XM -5.0 at typing.

- Note that Westpac chief economist Bill Evans has adjusted his RBA call, now looking for a 40bp cash rate lift off in June, which triggered further weakness in the space.

- Bear flattening was already in play before that view was provided, with the curve off session flats at typing.

- Bills run 15-20 ticks lower through the reds as a result. Note that today’s 3-month BBSW fixing set ~5.2bp higher. There is a near 60bp spread between the current 3-month BBSW fixing and the implied rate observed in IRM2.

- The latest round of S&P flash PMI data revealed slightly faster than expected rates of expansion across the 3 headline metrics, will the details revealing familiar stories when it comes to the Australian labour market and inflation.

- A quick reminder that ACGB markets will be closed on Monday as Australia observes the ANZAC day holiday. The AOFM’s weekly issuance schedule is light as a result, with A$1.0bn of ACGB Sep-26 providing the only round of coupon bearing supply next week.

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Thursday 28 April it plans to sell A$500mn of the 22 July 2022 Note & A$500mn of the 12 August 2022 Note.

- On Friday 29 April it plans to sell A$1.0bn of the 0.50% 21 September 2026 Bond.

EQUITIES: Mostly Lower In Asia; Chinese Equities To End Week Lower As Easing Disappointment Lingers

Most major Asia-Pac equity indices are softer at typing following a negative lead on Wall St., after well-covered comments from Fed Chair Powell on a possible 50bp rate hike for the May FOMC saw U.S. equity benchmarks dive below neutral levels in Thursday’s session. Japanese and Australian equity benchmarks lead losses, with EM indices faring a little better across the board.

- The Chinese CSI300 outperformed (relatively) regional peers, sitting a little above neutral levels at typing after paring earlier losses from as low as 1.1%, putting it possibly on track to break a five-session streak of daily lower closes. The move to reverse losses came after reports of China’s securities regulator issuing guidance for institutional investors on to buy more stocks crossed the wires, adding to a speech from PBoC Gov Yi Gang pledging to keep policy accomodative in view of softer economic conditions. The Financials sub-index outperformed, neutralising broad weakness in high-beta equities, with consumer staples (particularly Chinese liquor stocks) and healthcare names leading losses in that sphere. Tech-related names struggled as well, with the ChiNext and STAR50 indices trading 1.0% and 1.6% lower at typing.

- The Hang Seng is 0.6% worse off at typing, on track to close lower on every single day this week. Steep losses were again seen in China-based tech names, with debate re: the de-listing of Chinese equities from U.S. exchanges again doing the rounds in Asia.

- U.S. e-mini equity index futures are 0.2% to 0.3% weaker at typing, rising off their respective worst levels heading into European hours.

OIL: On Track For Lower Weekly Close As Supply Worry Takes Back Seat

WTI and Brent are ~$1.20 worse off, operating around session lows, and a touch above their respective worst levels on Thursday at typing.

- Both benchmarks are on track for a lower weekly close particularly after Tuesday’s ~$6 decline, with the move lower coming as well-documented worry re: demand destruction due to China’s ongoing COVID outbreak, and continued debate over the possibility of stagflation has taken focus over the past week.

- Looking to China, fresh COVID case counts nationwide and in the city of Shanghai appear to have plateaued for now, with reported daily case counts in the latter coming in below 20K for a second consecutive day (a note that new cases “outside quarantined areas” in the city continue to number in the low hundreds). The pace of relaxation in citywide lockdowns remains abundantly cautious, with focus turning to the re-opening of factories through “closed-loops” after around three weeks of closures. City authorities have so far declared that around 70% of the city’s industrial companies have resumed operations to date, although previously flagged source reports have pointed to possible issues some companies have faced in restarting operations.

- Recent Dollar strength has also helped limit gains in crude, with the DXY operating a touch below 2-year highs made earlier this week.

- Elsewhere, RTRS source reports have highlighted the European Commission’s efforts to “cut the cost” of banning Russian oil such as through exploring national-level deals with oil-producing countries, likely targeting well-documented resistance from EU members such as Germany and Austria. Looking at timelines, POLITICO reports are pointing to details of an EU-wide ban on Russian oil imports possibly emerging early next week, although evidence so far points to the likelihood of any embargo being proposed in phases (as with coal), as opposed to an outright ban.

GOLD: Slightly Lower As Powell Blesses Possibility Of 50bp Hike For May

Gold is ~$3/oz weaker to print $1,948/oz, operating a touch above the session’s worst levels at typing, and remaining clear of Thursday’s two-week lows. The precious metal has declined after struggling for direction earlier in the session as nominal U.S. Tsy yields have pushed higher in Asia-Pac dealing, with 2-Year Tsy yields resuming a climb above recent cycle highs.

- To recap, the precious metal hit session lows (@ $1,936.8/oz) on Thursday amidst a rise in nominal U.S. Tsy yields, with the move in the latter facilitated by the latest in hawkish remarks from central bank speakers on both sides of the pond. Looking to the Fed, Chairman Powell on Thursday signalled support for a 50bp hike for the May FOMC, while hinting at further 50bp hikes for following meetings as a form of “front-end loading” of hikes.

- May FOMC dated OIS are now fully pricing in a 50bp hike for that meeting in the wake of Powell’s comments, with pricing for the next two meetings (in mid-June and end-July) pointing to consecutive 50bp hikes as well. Pricing to end ‘22 has firmed to ~250bp at writing, easily surpassing highs seen earlier this month.

- From a technical perspective, gold’s failure to hold on to recent highs signals the potential for further bearishness in the near-term. Initial support is seen at around ~$1,926.5/oz (50-Day EMA), while resistance is located at $1,998.4/oz (Apr 18 high and bull trigger).

FOREX: Antipodeans Stay Heavy, Yen Gets Reprieve From Intervention Chatter

Antipodean currencies came under pressure ahead of the weekend elongated by the ANZAC day. The prospect of more aggressive global monetary policy tightening continued to spook markets, dissuading participants from taking more risk, after Fed Chair Powell noted that a 50bp move in May is on the table.

- NZD/USD pierced Apr 18 low of $0.6715 and probed the water under the round figure of $0.6700 on its way to levels not seen in some two months.

- AUD/USD was old on the breach of its 50-DMA, which provided support earlier this week. The rate faltered to its worst levels since mid-March.

- Offshore yuan continued to weaken in defiance of a firmer than expected PBOC fix, which saw the mid-point of permitted USD/CNY trading band set ~50 pips below the sell-side estimate. Spot USD/CNH had a brief look above the CNH6.5000 figure and is heading for its best week in a few years.

- The yen firmed a tad as TBS reported that the U.S. positively responded to the idea of a joint currency intervention floated by Japanese FinMin Suzuki during his talks with Tsy Sec Yellen. The report did not outline any specific parameters (e.g. price trigger for intervention), but at least confirmed that such discussion took place, after FinMin Suzuki chose to remain tight-lipped on the matter.

- Global PMI data will hit the wires today alongside UK & Canadian retail sales. Comments are due from ECB & BoE chiefs.

FOREX OPTIONS: Expiries for Apr22 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E814mln), $1.0850(E640mln), $1.0900(E1.4bln), $1.0925-30(E554mln)

- GBP/USD: $1.2900(Gbp1.1bln), $1.3000(Gbp1.2bln)

- USD/CAD: C$1.2500($514mln), C$1.2540-60($1.2bln)

- USD/CNY: Cny6.4000($529mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/04/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 22/04/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 22/04/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 22/04/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 22/04/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 22/04/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 22/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 22/04/2022 | 1300/1500 |  | EU | ECB Lagarde Speech at Peterson Institute | |

| 22/04/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/04/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 22/04/2022 | 1430/1530 |  | UK | BOE Bailey Panels IMF Event |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.