-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessDomestic Focus Causes Credit Yield Divergences; Investors Eye Carry & Roll

£IG spreads were the only index to move tighter yesterday, continuing to claw a comeback over the last week, the asset class attractive for yield investors after recent BOE re-pricing.

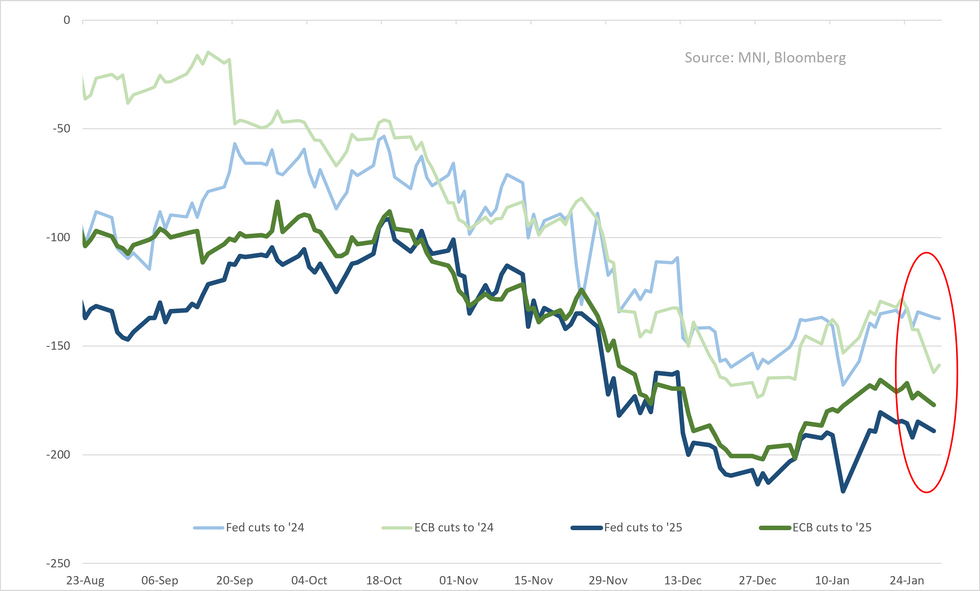

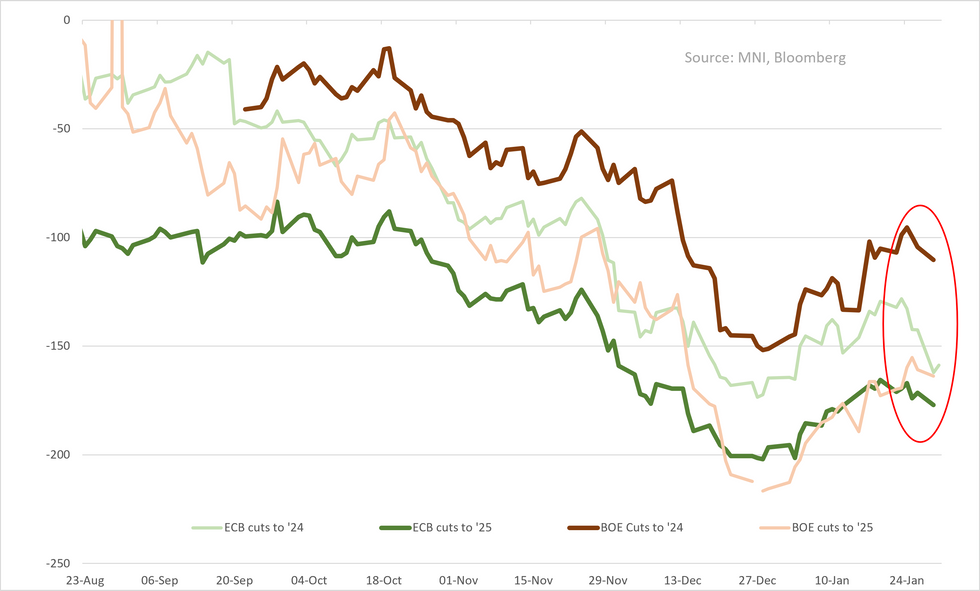

* Across $/€/£, spreads have largely moved in tandem (30-35bps tighter) since the Nov rally began & this (was) matched by front-end rates that moved in tandem. As we mentioned through this year, its likely CB rate paths & pricing diverge as we approach the first cuts (below). We've started to see that emerge with BOE re-pricing (upside to inflation/wages) over the last 2 weeks - the changes were stark enough to result in noticeable credit yield divergences (vs. $IG +20bp vs. parity to start the yr). Two points of note on this;

* The rates divergence still seems inflation (not activity) driven - hence we've seen cuts be pushed further down the line (not away) - we proxy this using the 3-month futures strip - relevant for yield investors who seem to be targeting roll-down along with carry. 6-month roll in UK forward swaps (bbg mid's used here) look on par with Euro & US (below). Re. spread curve - we've seen some steepening in Jan but this has been against the short-end (1-3yr). Against 3-5yr bucket spreads are still flat (vs. 2018-21 avg. +20-30bps) - similar thematic to $/€ spread curves here.

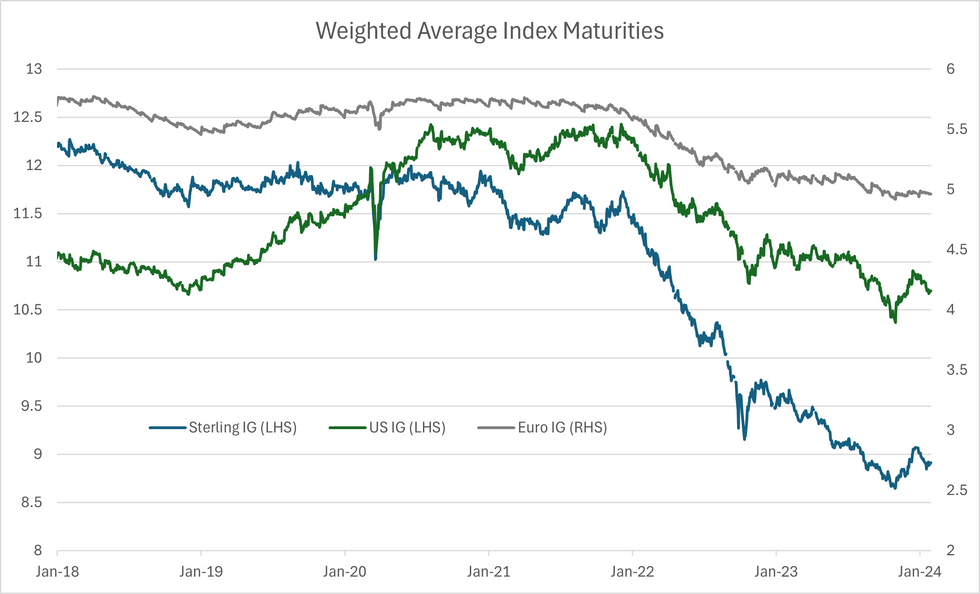

* £ has underperformed YTD (closing the gap in the last week) but as we noted it still screens tight vs. € spreads (historically) - though we are weary of comparing vs. historical ranges given duration changes (our ref. £IG index has seen significant fall in weighted average maturity - below) & focus from investors on pull-to-par opportunities at index level. On fundamentals, as we mentioned previously, we don't see any note of concern (yet) in £IG or significant divergence from €/$IG indices.

| 6m Roll | Fwd/Tenor | 1y | 2y | 5y | 10y | 30y |

| 6m | -68 | -46 | -20 | -8 | -4 | |

| 1y | -49 | -28 | -12 | -4 | -3 | |

| 18m | -23 | -14 | -4 | 0 | -1 | |

| 2y | -7 | -5 | 0 | 2 | 0 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.