-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - ECB Set to Deliver Third Consecutive Cut

MNI China Daily Summary: Thursday, December 12

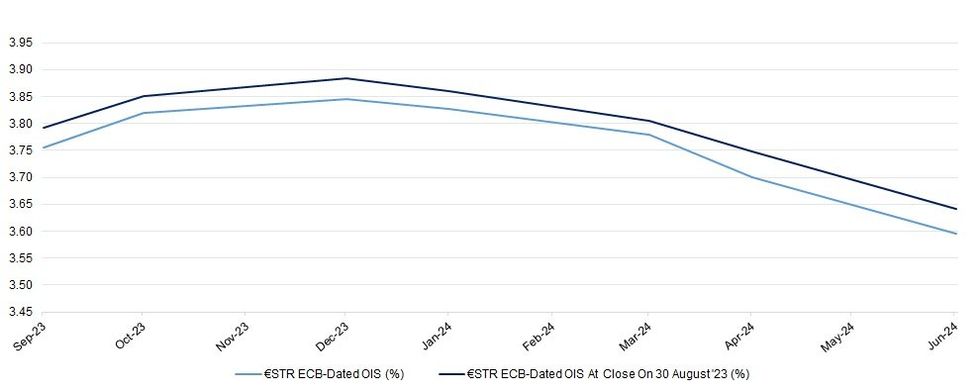

ECB Pricing Eases In Wake Of Schnabel's Comments

The previously alluded to comments from ECB’s Schnabel have weighed on the ECB-dated OIS strip, with the contracts 3.5-5.0bp softer on the session, as the strip flattens.

- She notes that “under this data-dependent approach, we cannot predict where the peak rate is going to be, or for how long rates will have to be held at restrictive levels. We can also not commit to future actions, meaning we cannot trade off a need for a further tightening of monetary policy today against a promise to hold rates at a certain level for longer.”

- While the comments are not overtly dovish, her historic hawkish bias and lack of commitment to further tightening allows the market to unwind some of the tigthening that was priced into the strip.

- Elsewhere, she flagged a visible moderation in economic activity, alongside stubbornly high price pressures.

- On the hawkish side, she noted that "real risk-free rates have declined back to the level observed at the February Governing Council meeting. This decline could counteract our efforts to bring inflation back to target in a timely manner."

- That leaves ~10.5bp of tightening showing for next month, while terminal deposit rate pricing eases back to 3.94%.

- The ECB debate re: terminal rate level seems to remain within the 3.75-4.00% band, which is reflected in market pricing.

- ECB-dated OIS was already biased a touch lower pre-Schnabel, given activity in the front end of the Euribor strip, with any hawkish flows surrounding firmer than expected French CPI quickly reversed.

| ECB Meeting | €STR ECB-Dated OIS (%) | €STR ECB-Dated OIS At Close On 30 August '23 (%) |

| Sep-23 | 3.756 | 3.7916 |

| Oct-23 | 3.819 | 3.852 |

| Dec-23 | 3.846 | 3.8836 |

| Jan-24 | 3.828 | 3.8605 |

| Mar-24 | 3.779 | 3.8052 |

| Apr-24 | 3.700 | 3.7482 |

| Jun-24 | 3.596 | 3.6416 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.