-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

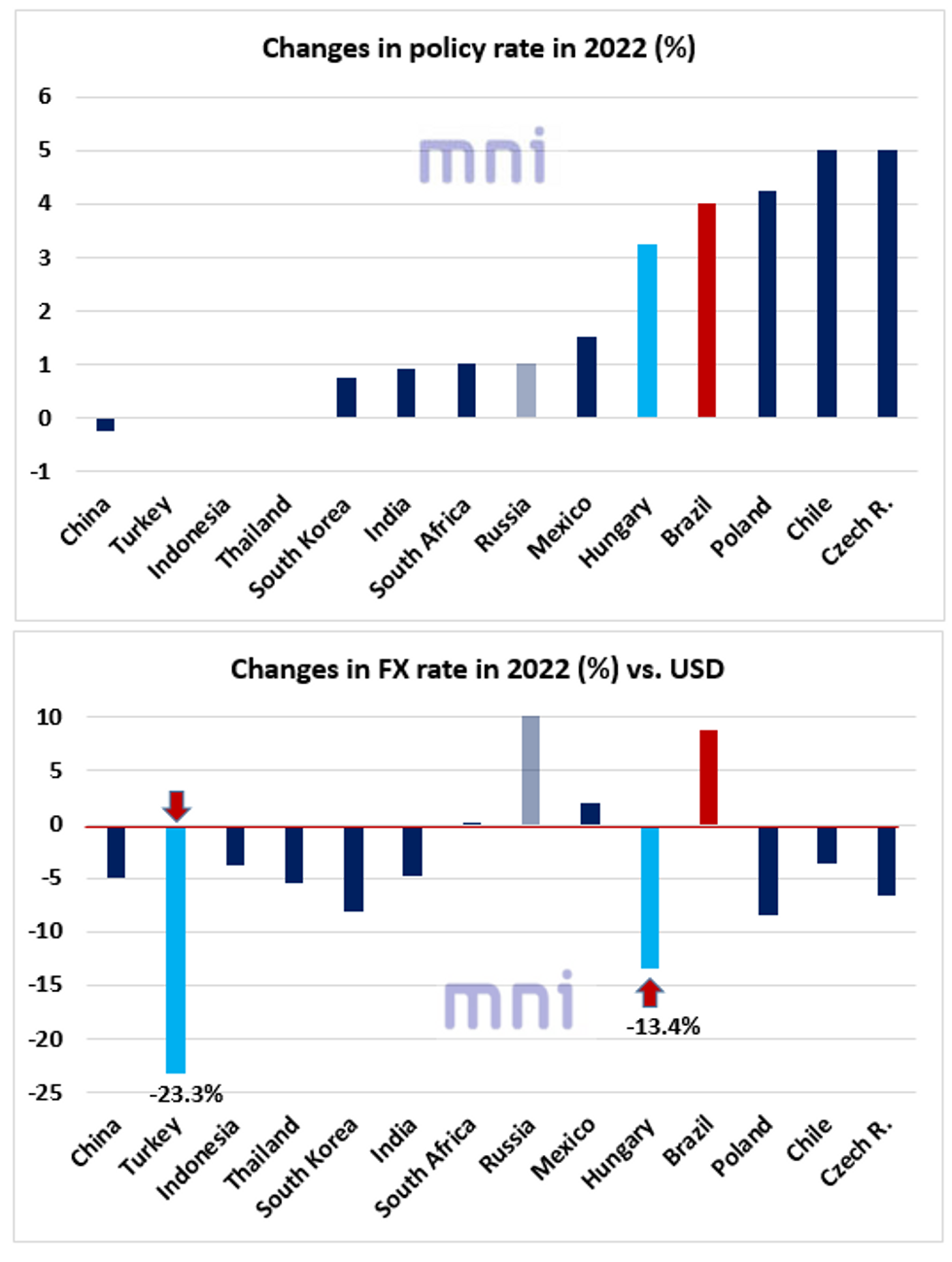

EM FX Suffer Despite Aggressive Tightening

- In the beginning of the year, we questioned if the aggressive tightening cycle run by EM central banks in 2021 (Latam/CEE) was eventually going to support EM currencies, which would help policymakers ease inflationary pressures (via the FX channel).

- However, geopolitical and macro events (Ukraine war, supply chain disruptions, China slowdown) have led to stronger pressure in EM, particularly in the CEE region (including Turkey).

- USD strength and accelerating inflation have ‘forced’ EM central banks to maintain their hawkish stance in 2022 and prolong their tightening cycle, therefore increasing the risk of accelerating the economic downturn.

- The chart below shows that Latam and CEE have continued their aggressive tightening cycle in hopes to tame inflation, with Czech Republic and Chile being the ‘most hawkish’ ones.

- However, momentum on CZK and CLP has remained bearish since the start of the year, with the two currencies down 6.7% and 3.6%, respectively.

- USDCLP broke above the 876.15 key resistance this week and is currently trading at an all-time high.

- TRY remains the worst performing currency in 2022 as dovish CBRT and deep negative real yields continue to weigh dramatically on the lira.

- Despite EM policymakers’ effort, stagflation fears and market uncertainty keep weighing on EM FX; to the exception of BRL, MXN and ZAR, the rest of EM currencies are down in 2022 (If we look only at QE, all EM FX are down this quarter).

- We left RUB aside as we do not think that the current spot rate reflects the ‘true market’ rate of the ruble.

- See our analysis on RUB here: https://marketnews.com/rub-spot-the-illusion-recovery

- With the Fed accelerating its tightening (75bps hike last week) and geopolitical uncertainty favoring demand for USD, EM policymakers are in a difficult position as further tightening will significantly impact the economic activity.

Source: Bloomberg/MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.