-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Gilt Week Ahead: Triple issuance week?

MNI US MARKETS ANALYSIS - French Politics Undermines EUR

MNI US OPEN - Trump Warns BRICS Over Moving Away From USD

ESTONIA-PM Remains Under Pressure Despite Expansion Of Governing Coalition

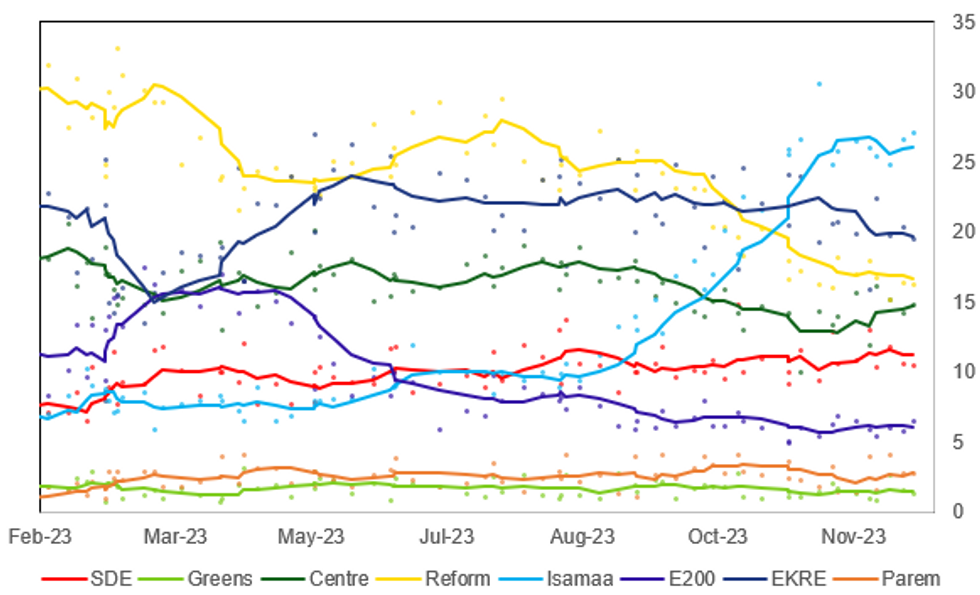

Estonian Prime Minister Kaja Kallas remains under notable political pressure amid declining poll ratings, the continued fallout from a scandal involving her hsuband's alleged business links to Russia, and the call for her ouster from a former prime minister who hails from her own centre-right liberal Reform Party. Her position remains vulnerable despite the governing coalition actually expanding in terms of representation in the Riigikogu in recent days, and her re-election as party head in late-2023. .

- On 5 Jan, five lawmakers from the left-conservative opposition Centre Party defectedto the centre-left Social Democrats (SDE), which sits in gov't alongside Reform and the liberal Estonia 200 party. The gov't now holds 65 seats to the opposition's 36, up from 60 in the March '23 election.

- Former PM and Reform Party head Andrus Ansip, now an MEP, has maintained his calls for Kallas' resignation, stating that "Clearly this change of leader has to be carried out sooner or later. I would prefer to think sooner," Ansip said, adding the party has a roster of several "strong people" who could replace Kallas."

- While Estonia is the third-smallest eurozone economy, ahead of only Malta and Cyprus, it has taken an outsized role in the war in Ukraine. Kallas has been one of the most vocal hawks in the EU calling for Russia's defeat in Ukraine. President Volodymyr Zelenskyy arrives in Tallinn on 11 Jan following the Kallas gov'ts commitment of spending 0.25% of GDP per year for the next four years on Ukraine's defence.

Source: Norstat, Kantar Emor, Turu-uuringute, MNI

Source: Norstat, Kantar Emor, Turu-uuringute, MNI

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.