-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

EU Could Face New Populist Challenge As Fico Set To Return As PM

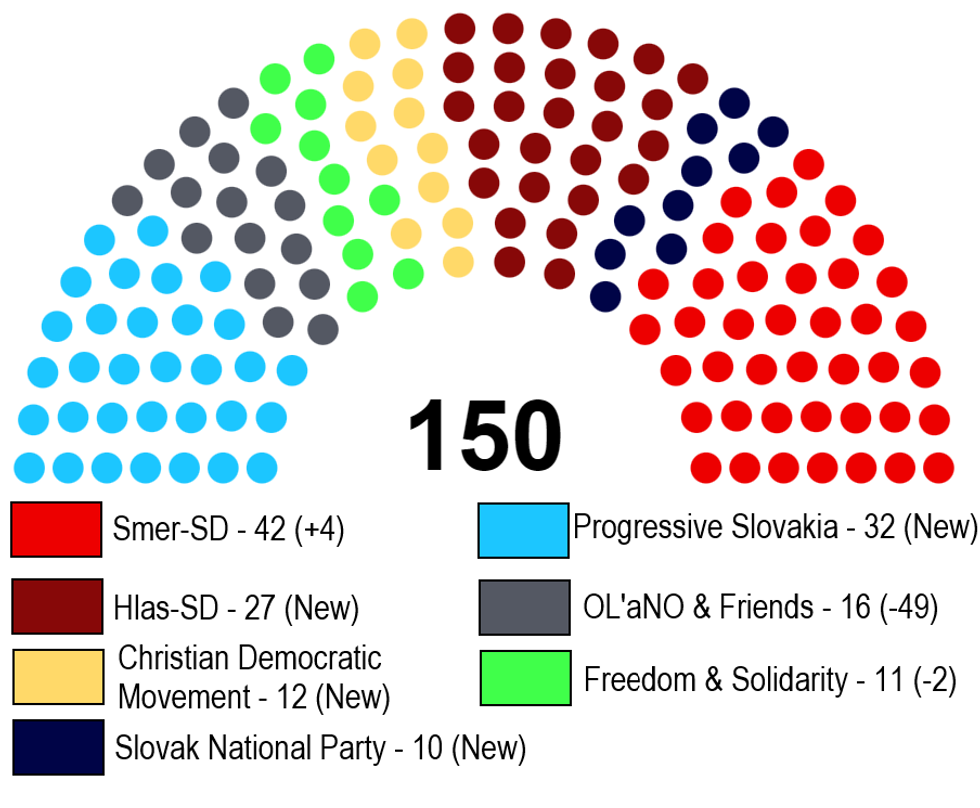

The Slovakian general election on 30 September delivered a strong result for former PM Robert Fico and his left-wing populist Smer-SD. Smer-SD won 42 seats in the 150-member National Council, ahead of the pro-EU liberal Progressive Slovakia (PS) in second place with 32 seats. While Fico will still have to hold negotiations with other parties to form a majority gov't, the make-up of the National Council makes a Smer-SD-led coalition more likely than a PS-led one.

- The third-largest party in parliament, the centre-left Hlas-SD with 27 seats, appears more willing to work with Smer-SD than PS. Hlas-SD is led by former Smer-SD PM Peter Pellegrini. In the aftermath of the vote hestated that his partywas “closer” both “politically and ideologically,” with Smer-SD than PS. The right-wing nationalist Slovak National Party (SNS) has worked with Smer-SD in the past, and its 10 seats would put a Smer-SD/Hlas-SD/SNS gov't over the majority threshold.

- Given Fico's swing towards anti-EU populism and his statements regarding 'not a single round' of ammunition being provided to Ukraine under his gov't there will be major concerns in Brussels about a Fico-led Slovakia.

- However, Pellegrini has hinted that in exchange for his party's support, Fico will have to moderate his tone and policies, stating that “Hlas will only join such a coalition [with Smer] if all of the fears [PS leader] Mr. Šimečka mentioned are off the table,...Smer will have to make compromises and correct [some of] its statements.“

Source: volbysr.sk, MNI. 99.98% of results counted.

Source: volbysr.sk, MNI. 99.98% of results counted.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.