-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessEUROPEAN OPEN: China PMIs Beat, PBoC Uses Surprise MLF, News Flow Mixed

OVERNIGHT NEWS AND PRESS

EXECUTIVE SUMMARY

- UK REGULATOR SET TO APPROVE COVID-19 VACCINE THIS WEEK (FT)

- TRUMP TO ADD CHINA'S SMIC AND CNOOC TO DEFENSE BLACKLIST (RTRS SOURCES)

- EU PITCHES NEW POST-TRUMP ALLIANCE WITH US IN FACE OF CHINA CHALLENGE (FT)

- BREXIT MOOD MUSIC MIXED, FISHING ISSUES VS. OPTIMISM

- CHINA OFFICIAL PMIS BEAT, PBOC SURPRISES WITH MLF

- ANT IS SAID TO FACE SLIM CHANCE OF GETTING IPO DONE IN 2021 (BBG SOURCES)

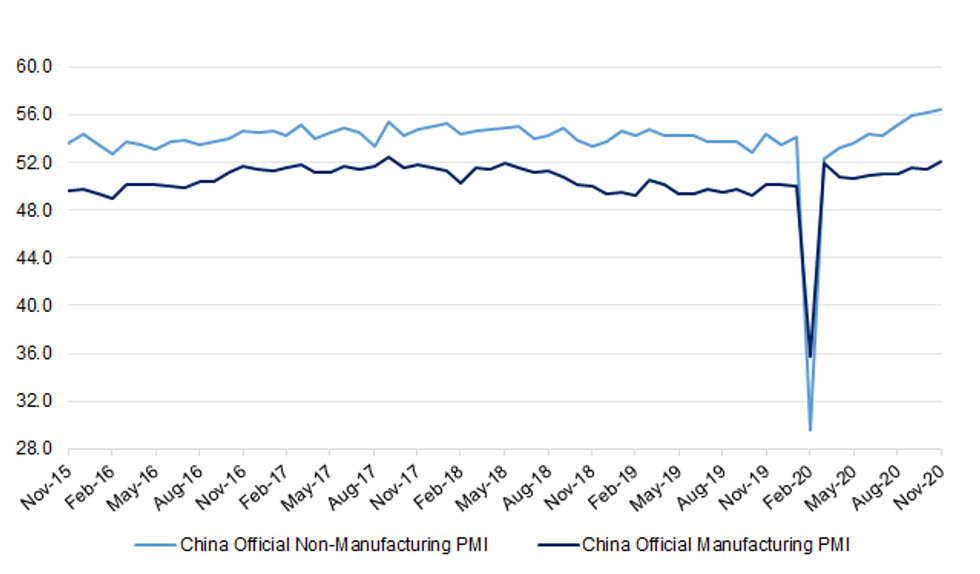

Fig. 1: China Official Non-Manufacturing PMI vs. China Official Manufacturing PMI

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

CORONAVIRUS: The Christmas relaxation of coronavirus rules risks doubling cases and taking the number of infected above a million, scientific advisers to the government have said. (The Times)

CORONAVIRUS: Millions of people heading into the top tier of coronavirus restrictions have been given hope that the curbs will be eased within weeks as an official study showed numbers infected had halved in the north. (The Times)

CORONAVIRUS: Boris Johnson defended his decision to put most of England into the highest levels of pandemic restrictions even as the rate of infection across the U.K. fell to its lowest level since mid-August. (BBG)

CORONAVIRUS: Boris Johnson has said the new coronavirus tiers have "a sunset" clause - or expiry date - of 3 February, as he tries to fight off a backlash from Tory MPs. The prime minister has angered some of his party with a plan to impose stringent restrictions across much of England when the national lockdown ends on Wednesday. In a letter to colleagues ahead of a Commons vote on the restrictions on Tuesday, Mr Johnson insisted the tiered measures for local areas will be reviewed every fortnight. (Sky)

CORONAVIRUS: COVID-19 restrictions are likely to be in force until Easter, Sky News has learned, as Boris Johnson heads for a Commons showdown with rebel Tory MPs over the new tier system. Senior sources have revealed that even if large numbers of COVID-19 vaccinations begin at the end of January it will be Easter - on 4 April next year - before life returns to normal. The stark warning, handed to the prime minister and senior ministers by government scientific advisers, contrasts with more optimistic forecasts by Mr Johnson in recent days. (sky)

CORONAVIRUS: Towns and villages near Covid hotspots would be lifted out of the toughest restrictions under plans being drawn up by ministers to quell a growing Tory backlash. MPs have been told that rural areas with low infection rates could be "decoupled" from cities that have "unfairly" dragged them into Tiers 2 and 3 under the Government's regional approach. (Telegraph)

CORONAVIRUS: Boris Johnson has told MPs they must back his tougher tier system to avoid another lockdown. The prime minister has written to MPs to insist that an indoor socialising ban that covers 99 per cent of England is necessary to avoid "the overwhelming of the NHS". (Sunday Times)

CORONAVIRUS: Every hospital in England faces being overwhelmed with Covid-19 cases if MPs fail to back the government's tough new restrictions, Michael Gove has warned. Amid a growing Conservative backbench rebellion over the tiering system, the Cabinet Office minister is calling on MPs to "take responsibility for difficult decisions" to prevent further spread of the disease. (The Times)

CORONAVIRUS: Concerns have been raised about the risk of disruption to supplies of the Pfizer coronavirus vaccine and added costs after the drugs company shut a cold storage facility in the south of England ahead of the end of the Brexit transition period next month. (The Times)

BREXIT: EU negotiator Michel Barnier arrived for talks in London on Saturday morning. He had said on Friday night that he was "very happy" to be back in the city and would keep working with "patience and determination". (RTRS)

BREXIT: The European Commission has begun to "lean on" its own Brexit negotiator to get a trade deal with Britain, raising hopes in Downing Street that a new agreement can be struck by Friday this week. Senior government sources say Ursula von der Leyen, the commission president, is now being "quite helpful" and is "keen to unblock things". She has sent one of her most senior officials, Stephanie Riso, to assist Michel Barnier, the EU's frontman. Riso was part of Barnier's team during the Brussels negotiations with Theresa May's government and is seen as someone who can help to find a solution. (The Times)

BREXIT: A Brexit breakthrough on fishing could be close, with the EU set to formally recognise British sovereignty over UK waters, The Telegraph can reveal. (Telegraph)

BREXIT: The UK is in the "last leg of negotiations" with the EU over a post-Brexit trade deal, the foreign secretary has said. Dominic Raab told the BBC it was likely the talks were entering the "last real major week", and an agreement remained possible if the EU showed "pragmatism". He added that the talks now depended on resolving a "fairly narrow" set of issues, including fishing rights. (BBC)

BREXIT: Years of wrangling over Britain's future trade relationship with the EU are set to enter what could be their final week, with Boris Johnson's government saying there remains a significant gap on the issue of how much fish European trawlers should be allowed to catch in British waters. Michel Barnier, the EU's lead negotiator, has proposed that the EU's share of the catch be cut by 15% to 18%, an offer that Downing Street dismissed in a statement as "risible." "The EU side know full well that we would never accept this," according to a government official. "No agreement is arguably underpriced." (BBG)

BREXIT: EU and UK officials are expressing confidence that an overarching agreement on the outstanding issues of the Northern Ireland Protocol can be agreed in the coming weeks. Sources say that officials are making progress on all the key obstacles that have held up the full implementation of the Protocol in recent months. (RTE)

BREXIT: Barnier told MEPs in a private meeting on Friday that he would work through the weekend and then "maybe one or two more days" in a last-ditch attempt to bridge the large gaps between the sides. EU sources said there was a growing feeling that the lack of progress and the need to prepare businesses for the repercussions of a no-deal British departure from the EU made it unwise for negotiations to continue beyond then. (Guardian)

BREXIT: The prime minister and the taoiseach (Irish PM) have "reaffirmed the need to prioritise the Good Friday Agreement" in Brexit talks, Downing St has said. Boris Johnson spoke to Micheál Martin by phone on Friday evening and the two leaders discussed the UK-EU trade deal talks as well the coronavirus pandemic. Downing St said Mr Johnson "underlined his commitment to reaching a deal that respects the sovereignty of the UK". It also said the pair reaffirmed their commitment to avoiding a hard border. (BBC)

BREXIT: Four out of five companies are not ready for the end of the Brexit transition period, according to the "alarming" results of the latest polling. With little more than a month until the UK leaves the single market and customs union, of more than 1,700 businesses surveyed by EY, 80pc did not "know the full extent of Brexit risks" or "have sufficient preparations in place". One in five firms said that they expected the UK's final departure from the EU to present "a bump in the road" with normal service resuming shortly afterwards. But whether or not a UK-EU trade deal is reached, change will be "inevitable and protracted", the consultancy firm cautioned. (Telegraph)

BREXIT: Keir Starmer, the Labour party leader, faces the threat of resignations from his frontbench team should he order MPs to vote in favour of a Brexit deal agreed by the government. Labour sources said that there were shadow ministers willing to step down if ordered to vote for the deal that could be agreed this week, with one describing it as a "dangerous moment" for the Starmer's authority. (Observer)

FISCAL: Treasury ministers are hoping that a quick economic recovery in the middle of next year will mean that any consideration of significant tax rises can be delayed until 2022. There has been speculation for months that personal taxes will start to increase in this spring's Budget to start bringing down the deficit, which has surged during the pandemic. However, The Telegraph understands that senior Treasury ministers are keen to ensure the UK has gone past the worst of the pandemic before even considering tax rises. (Telegraph)

FISCAL: Pubs and restaurants hit by new coronavirus restrictions will be given extra cash to help get them through Christmas, Prime Minister Boris Johnson is set to announce as he tries to see off a growing Tory rebellion. (Telegraph)

BANKS: British banks are finalizing plans for outsourcing the recovery of billions of pounds in taxpayer-backed business loans issued during the Covid-19 pandemic. A consortium of lenders is expected to set up an entity that will oversee debt collectors tasked with chasing bad loans, people with knowledge of the matter said. A final decision is expected in early December, said the people, who asked not to be named discussing private information. (BBG)

BOE: Bank of England Chief Economist Andy Haldane said progress on developing COVID-19 vaccines, combined with huge amounts of stimulus pumped into economies this year, meant inflation could rise by more than expected in the medium term. (RTRS)

BOE: The extraordinary expansion in central banks' balance sheets over the past decade poses a challenge to the independence of monetary policy, Bank of England Chief Economist Andy Haldane said. (BBG)

POLITICS: Boris Johnson is lining up a group of younger and northern Conservative MPs to join his Cabinet next year in a reshuffle that will complete the reset of his government and keep potentially rebellious backbenchers on

SCOTLAND: The Scottish National party is to discuss "alternative routes" to a second referendum on independence, as tensions rise among members about what to do if Boris Johnson's government refuses to approve such a vote. Delegates to the SNP virtual annual conference on Sunday overwhelming backed a motion welcoming plans for a "national assembly" in January, a move leaders hope will ease divisions within the party over strategy and other issues. side. (FT)

EUROPE

ECB: The European Central Bank sees an even weaker outlook for inflation than presented in its most recent September forecasts, with price growth likely to average around 1% next year, according to Vice President Luis de Guindos. In remarks published less than two weeks before policy makers meet to reset their monetary stimulus, Guindos told Finnish newspaper Helsingin Sanomat that inflation will be negative until the end of this year, and revealed lower estimates for 2021. (BBG)

EU/FISCAL: European Union budget rules need to be more consistent with expected higher levels of sovereign debt, the bloc's economics commissioner said, but dismissed calls to cancel debt amassed during the coronavirus crisis. The idea of debt cancellation has been raised by Italy's co-ruling 5-Star Movement, backing a proposal by EU Parliament President David Sassoli. "In Europe debts cannot be cancelled", Paolo Gentiloni said. The European Commission, which is in charge of enforcing EU fiscal rules, this year suspended requirements to keep government deficits below 3% of GDP and to cut public debt below 60% of GDP as the economy entered a record recession. (RTRS)

EU/FISCAL: The dogged opposition of Poland and Hungary to the European Union's budget and recovery package has turned into a dangerous stand-off with nations in deep recession in dire need of help to cope with the pandemic. Unless these two holdouts drop their veto on the deal within days, France warned of severe and potentially existential disruption to the 27-nation bloc still coping with Brexit. The alarm came at a meeting of EU envoys in Brussels on Friday, when Polish and Hungarian ambassadors dug in. They object to the disbursement of 1.8 trillion-euros ($2.2 trillion) being tied to democratic standards they are accused of falling short of. (BBG)

CORONAVIRUS: Officials from the World Health Organization are looking into reports that cases of Covid-19 emerged in Europe in the fall of 2019, well before the pandemic erupted in China last December, though their focus remains on the first human cases in Wuhan, said WHO official Michael Ryan. (BBG)

GERMANY: Chancellor Merkel sought to rally citizens after Germany reported its worst run of coronavirus fatalities since the pandemic broke out. "We have come a long way," she said in her weekly podcast published on the government's website, imploring people to wear masks and stick to social-distancing measures as cases mount. "Each and everyone one of us still has a role to play." (BBG)

GERMANY: Germany's partial shutdown could be extended until early spring 2021, Economy Minister Peter Altmaier said in an interview with the German newspaper Die Welt. "There are three to four long winter months ahead of us," Altmaier said. "It is possible that the restrictions will remain in place for the first months of 2021." (BBG)

GERMANY: The premier of Germany's most populous state said cases in the country were falling too slowly, and Christmas celebrations could trigger a new flare up. "So long as we don't have the vaccine distributed, we need to be careful," Armin Laschet, leader of the North Rhine-Westphalia region said in an interview with radio station Deutschlandfunk. Laschet also called on Germans not to go skiing this year, even if neighboring Austria decides to keep its resorts open. (BBG)

FRANCE: France added 9,784 cases, with the seven-day average falling to 11,1182, the lowest since Oct. 2. The rate of positive tests fell to 11.1%, just over half of where it was in early November. The number of patients in intensive care continued to decline from a peak almost two weeks ago. Deaths linked to the virus increased by 198 to 52,325, the smallest daily increase in a month. (BBG)

FRANCE: A new French survey found that 59% of respondents said they wouldn't get a Covid-19 vaccine once it becomes available, Le Journal Du Dimanche reported on Sunday, citing the findings of the Ifop survey carried out on Nov. 26-27. (BBG)

ITALY: Italy's government will ease restrictions for financial capital Milan and for industrial hub Turin starting on November 29, following a steady reduction in the number of coronavirus cases. Health minister Roberto Speranza signed a new order Friday which will allow more movement and economic activities in five Italian regions, according to a statement. (BBG)

GREECE: The Greek banking sector has expended tremendous efforts to resolve its key issue, that of non-performing loans (NPLs) inherited from the previous crisis, Andrea Enria, chair of the European Central Bank's (ECB) Supervisory Board, told national broadcaster ERT in an interview. The interview was taped on November 24 and broadcast on November 28. Enria said that NPLs dropped by nearly 25 billion euros from December 2018 to the third quarter of 2020, but a lot still needs to be done, as Greece has an NPL ratio of 36.7 pct to total loans, compared to other countries in the Eurozone which have limited them to 3 pct. (ANA)

BELGIUM: Belgian Prime Minister Alexander De Croo warned against immediately easing the virus restrictions which took effect almost 4 weeks ago. He said the latest epidemiological models suggest Belgium may not start relaxing curbs before mid-January. (BBG)

IRELAND: Ireland moved to roll back its nationwide lockdown after six weeks, in a bid to allow a relatively normal Christmas period. Stores, gyms and churches will reopen from December 1, while restaurants and pubs serving food will reopen shortly after. Pubs not serving food will remain closed. (BBG)

SWITZERLAND: Swiss voters rejected two proposals that had the potential to alter the corporate landscape of a country known for low taxes and light-touch regulation. An initiative that would've banned the Swiss National Bank from investing in defense companies was opposed by almost 60% in a ballot on Sunday. A second measure, the Responsible Business Initiative, was also unsuccessful. It would've held multinational corporations responsible for human rights and environmental lapses abroad but failed to get the requisite majority among the country's cantons, or states. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Moody's affirmed Switzerland at Aaa, outlook stable

- S&P affirmed Ireland at AA-; Outlook Stable

BANKS: Brussels is planning to lay out a raft of proposals in a bid to make it easier for EU banks to offload soured loans as it anticipates the risk of a pandemic-related wave of corporate distress. A European Commission paper due to be published in December will discuss ideas including boosting secondary markets for buying and selling non-performing loans (NPLs) and creating a network of national bad banks across the EU. It will also seek to tackle anomalies in the bank capital regime for distressed assets. (FT)

U.S.

FISCAL: President-elect Joe Biden intends to nominate a team of liberal and centrist economic advisers to serve alongside planned Treasury Secretary nominee Janet Yellen, people familiar with his plans said Sunday, as he prepares to confront the economic fallout from the coronavirus pandemic. Mr. Biden has chosen Neera Tanden, head of the Center for American Progress, a center-left think tank, to serve as director of the Office of Management and Budget. (WSJ)

ECONOMY: Spending online on Black Friday this year surged nearly 22% to hit a new record, according to data from Adobe Analytics, as the Covid pandemic pushed more people to shop from the sofa and avoid crowded stores and malls. Consumers spent $9 billion on the web the day after Thanksgiving, up 21.6% year over year, according to Adobe, which analyzes website transactions from 80 of the top 100 U.S. online retailers. This makes Black Friday 2020 the second-largest online spending day in history in the United States, behind Cyber Monday last year, Adobe said. Cyber Monday this year is slated to become the largest digital sales day ever, with spending reaching between $10.8 billion and $12.7 billion, which would represent growth of 15% to 35% from a year earlier. (CNBC)

ECONOMY: Traffic at stores on Black Friday fell by 52.1% compared with last year, as Americans by and large eschewed heading to malls and queuing up in lines for shopping online, according to preliminary data from Sensormatic Solutions. For the six key weeks of the holiday season this year, traffic in retail stores is expected to be down 22% to 25% year over year, an earlier forecast by Sensormatic Solutions said. (CNBC)

CORONAVIRUS: Those who are traveling during the holiday weekend should quarantine and get tested for coronavirus if possible to "prevent further spread and further surge," according to the government's top infectious disease expert, Anthony Fauci. (Politico)

CORONAVIRUS: The Greater Los Angeles area, the U.S. county with the highest number of coronavirus cases and deaths, introduced a new stay-home order starting Monday through Dec. 20. The new measures are far less stringent than those imposed in the lockdown in March. They came just two days after the county of 10 million, the most populous in the country, banned outdoor dining as cases continued climbing. (BBG)

CORONAVIRUS: San Francisco was moved to the most restrictive tier by California following a jump in coronavirus cases, prompting a slew of new measures across the city. "I don't know how to be more clear -- this is the most dangerous time we've faced during this pandemic," said Mayor London Breed. (BBG)

POLITICS: The recount of presidential ballots in Wisconsin's two largest counties finished Sunday, reconfirming that President-elect Joe Biden defeated President Trump in the key swing state by more than 20,000 votes. (Washington Post)

POLITICS: A federal appeals court on Friday rejected an attempt from President Donald Trump's reelection campaign to keep alive its effort to undo the result of Pennsylvania's presidential election., The blistering opinion from a panel of judges on the U.S. Court of Appeals for the Third Circuit, all three of whom were nominated by Republican presidents, said that the Trump campaign's "claims have no merit." (CNBC)

POLITICS: President Trump told "Sunday Morning Futures" in his first interview since Election Day that the Department of Justice is "missing in action" regarding alleged election fraud. He went on to tell host Maria Bartiromo in the exclusive interview that he has "not seen anything" from the DOJ or the Federal Bureau of Investigation on investigating the 2020 election. "You would think if you're in the FBI or Department of Justice, this is the biggest thing you could be looking at," Trump said. "Where are they? I've not seen anything." "They just keep moving along and they go on to the next president," he continued. (FOX Business)

POLITICS: President Donald Trump, who has blamed his loss to President-elect Joe Biden on false claims that the U.S. voting system was "rigged," urged his supporters on Friday not to boycott two all-important Georgia runoff elections that will determine which party controls the Senate. (CNBC)

POLITICS: The Pennsylvania Supreme Court dismissed a Republican lawsuit seeking to invalidate the state's mail-in ballots on Saturday evening, the latest legal defeat for Donald Trump in his unprecedented effort to overturn the result of the 2020 election. (FT)

POLITICS: A Pennsylvania judge who tried to halt additional steps needed to certify the state's 2020 election results said the Pennsylvania legislature's expansion of mail-in voting, enacted over a year earlier with bipartisan support, was likely illegal. Commonwealth Court Judge Patricia McCullough's Nov. 25 order was blocked by the Pennsylvania Supreme Court while it considers the case, filed by state Republicans led by U.S. Representative Mike Kelly, on an expedited basis. Governor Tom Wolf and Secretary of State Kathy Boockvar, both Democrats, appealed the order to the state's top court. The case is unrelated to one brought by President Donald Trump's campaign, rejected by a federal appeals court on Friday, that sought to undo Pennsylvania's certification of President-elect Joe Biden's victory in the Keystone State. (BBG)

OTHER

GLOBAL TRADE: Container shipping rates from China to Southeast Asia are surging due to a shortage of transportation space in the Asian region, the result of an uneven distribution of containers to meet surging shipping demand from Asia to Europe and the U.S. (Nikkei)

GLOBAL TRADE: Japan and India will tie up in the field of information and communications to counter China's growing influence on telecommunications and digital infrastructure, Japanese government officials said. (Nikkei)

GLOBAL TRADE: Telecoms providers must stop installing Huawei equipment in the UK's 5G mobile network from September, the government has said. The announcement comes ahead of a new law being unveiled on Tuesday, which bans the Chinese firm from the network. Digital Secretary Oliver Dowden said he was pushing for the "complete removal of high-risk vendors" from 5G networks. The new deadline falls earlier than expected, although maintaining old equipment will still be allowed. Huawei told the BBC it would not be commenting on the announcement. (BBC)

U.S./CHINA: The Global Times tweeted the following on Saturday: "Trump administration has repeatedly showed hostility & ambitions to contain China. Chinese people generally hold little hope that Sino-US relations will substantially improve under Biden. Surely any improvement is welcome, but people are mentally prepared for continuous tension." (MNI)

U.S./CHINA: The Trump administration is poised to add China's top chipmaker SMIC and national offshore oil and gas producer CNOOC to a blacklist of alleged Chinese military companies, according to a document and sources, curbing their access to U.S. investors and escalating tensions with Beijing weeks before President-elect Joe Biden takes office. (RTRS)

U.S./CHINA: The House is set to vote on bipartisan legislation that would impose restrictions on Chinese companies listed on U.S. exchanges, including requiring certification that they're not under control of a foreign government. The bill's sponsors say the aim is to ensure foreign companies traded in America are subject to the same independent audit requirements that apply to U.S. firms. In doing so, the measure threatens to boot Chinese companies, including behemoths like Alibaba Group Holding Ltd. and Baidu Inc., out of American stock markets. The Holding Foreign Companies Accountable Act (S. 945) will be considered Wednesday under a streamlined process that limits debate on the House floor, allows no amendments, and requires approval by two-thirds of members present and voting to pass. (BBG)

U.S./CHINA: China and the U.S. should let their practical needs, not ideology, determine the trajectory of bilateral relations, according to an editorial in the Global Times. While some Americans perceive China as a strategic adversary, China is a needed partner in addressing problems including the global control of Covid-19 pandemic, the newspaper said. The Biden administration should stop the Trump approach of blaming China for the failure in controlling the pandemic, the editorial said. (MNI)

GEOPOLITICS: The EU will call on the US to seize a "once-in-a-generation" opportunity to forge a new global alliance, in a detailed pitch to bury the tensions of the Trump era and meet the "strategic challenge" posed by China. A draft EU plan for revitalising the transatlantic partnership, seen by the Financial Times, proposes new co-operation on everything from digital regulation and tackling the Covid-19 pandemic to fighting deforestation. The paper, prepared by the European Commission, says the EU-US partnership needs "maintenance and renewal" if the democratic world is to assert its interests against "authoritarian powers" and "closed economies [that] exploit the openness our own societies depend on". (FT)

CORONAVIRUS: The UK is poised to become the first western country to approve a Covid-19 vaccine, with the independent regulator set to grant approval within days. Deliveries of the vaccine developed by BioNTech and Pfizer would begin within hours of the authorisation, according to Whitehall insiders. Individuals with knowledge of the process said the first injections could take place from December 7. (FT)

CORONAVIRUS: More data will be needed from AstraZeneca's coronavirus vaccine trials to determine the drug's safety and efficacy following concerns from experts in the U.S., scientists from the University of Oxford and the World Health Organization said on Friday. "There's always a problem in announcing scientific results by press release, and that is that you don't have all the data out there and people aren't able to really look and think about the data properly," Sir John Bell, the Regius professor of medicine at Oxford University, told CNBC's "Closing Bell" on Friday. (CNBC)

CORONAVIRUS: U.S. Surgeon General Jerome Adams said the federal government hopes to quickly review and approve requests from two drug makers for emergency approval of their Covid-19 vaccines. Pfizer Inc. is scheduled to submit an Emergency Use Authorization request on Dec. 10 for the vaccine it developed with Germany's BioNTech, followed by Moderna on Dec. 18, Adams said. (BBG)

CORONAVIRUS: United Airlines Holdings Inc. on Friday began operating charter flights to position doses of Pfizer Inc.'s Covid-19 vaccine for quick distribution if the shots are approved by regulators, according to people familiar with the matter. The initial flights are one link in a vast global supply chain being assembled to tackle the logistical challenge of distributing Covid-19 vaccines. Pfizer has been laying the groundwork to move quickly if it gets approval from the Food and Drug Administration and other regulators around the world. (WSJ)

HONG KONG: Hong Kong will suspend all face-to-face classes at kindergartens, primary and secondary schools in the city amid a rise in locally-transmitted cases of Covid-19. The suspension will start on Wednesday, the government said on Sunday. Schools will remain shut through the Christmas holidays begin, suggesting students won't return until 2021. (BBG)

JAPAN: Japan looks to begin distribution of COVID-19 vaccines by the March end of the fiscal year as clinical trials on a number of candidates move forward. (Nikkei)

JAPAN: The Bank of Japan has overtaken Japan's Government Pension Investment Fund as the largest shareholder of Japanese stocks, the Mainichi newspaper reported Sunday, citing estimates by analysts. The central bank's holdings of ETFs had a market value of 45.16 trillion yen ($433.9 billion) on Nov. 25, exceeding the GPIF's by about 30 billion yen, and accounting for about 7% of the market capitalization of companies on the Tokyo Stock Exchange's first section, Mainichi said. (BBG)

AUSTRALIA: A large number of South Australians are being urged to get a coronavirus test — even if they do not have symptoms — in the wake of an infected man leaving quarantine and visiting several shops and businesses in Adelaide last Sunday, the Australian Broadcasting Corp. reported. The man, in his 30s, is believed to have caught the virus through a casual contact at Flinders University. (BBG)

AUSTRALIA/CHINA: The Australian government is continuing its tough talk against Beijing's trade impositions with the trade minister, Simon Birmingham, giving the strongest indication yet that Canberra will take its complaints to the World Trade Organization. China first announced it believed Australian wine was being dumped in China in August and last week the Chinese ministry of commerce announced tariffs on Australian wine products that would double or triple prices making export trade "unviable". (Observer)

AUSTRALIA/CHINA: Treasury Wine Estates Ltd. unveiled an emergency plan to find new markets for its best-known labels after China imposed crippling anti-dumping duties of 169% on its wine over the weekend. (BBG)

AUSTRALIA/CHINA: Prime Minister Scott Morrison has strongly condemned a propaganda image shared by the Chinese Foreign Ministry on social media and demanded it be removed in a sharp escalation of Australia's dispute with China. The ministry shared the doctored image of alleged Australian war crimes in Afghanistan on Monday. The image purports to show a special forces soldier slitting the throat of an Afghan child with its head wrapped in an Australian flag. "Don't be afraid we are coming to bring you peace," words placed over the image state. (Sydney Morning Herald)

NEW ZEALAND: Statistics New Zealand publishes monthly employment indicators for October, on website. Seasonally adjusted filled jobs rise 0.5% m/m or ~11,420 to 2,206,949. Actual filled jobs rise ~27,600 m/m reflecting general election staff as well as growth in manufacturing, retail and hospitality. (BBG)

RBNZ: Transactions are now flowing through the Reserve Bank of New Zealand's Exchange Settlement Account System (ESAS) after an outage this morning. The Reserve Bank is now looking into the cause of the outage. (RBNZ)

SOUTH KOREA: At a press conference, Prime Minister Chung Sye-kyun said the government will maintain social-distancing rules in the greater Seoul area at level 2, which bans gatherings in high-risk facilities such as night clubs and karaoke bars, and prohibits restaurants from serving customers after 9 p.m. Outside the capital region, the restrictions will be raised to level 1.5 starting Tuesday. The higher level means eating and dancing at high-risk facilities will be barred, and restaurants and theaters will need to enforce distancing between tables and seats. (BBG)

SOUTH KOREA: South Korea's ruling party, government and presidential office agreed to reflect as much as 4t won of cash handout for owners of small businesses and mom-and-pop stores hit by coronavirus to 2021 budget plan, Chosun Ilbo newspaper reports, citing unidentified officials at the party. (BBG)

NORTH KOREA: The country has intensified virus prevention measures around its border areas, strengthening protocols and monitoring of movements, KCNA reported Sunday. (BBG)

CANADA: Justin Trudeau, already among the most enthusiastic champions of government spending, will deliver another dose of stimulus to shore up an economic recovery that's starting to creak amid a second wave of Covid-19 in Canada. Finance Minister Chrystia Freeland is expected to announce billions of additional funding in a fiscal update Monday, with dozens of new measures that could include topping up existing benefits to families and business along with teeing up money for infrastructure, daycare and climate change. (BBG)

MEXICO: Mexico's central bank should be able to resume its cycle of interest rate reductions after the first quarter of 2021 once the slowdown of inflation is confirmed, Deputy Governor Jonathan Heath said. "I definitely think that this easing cycle has not necessarily come to an end, which means there should be room up ahead," Heath said in a telephone interview on Friday. "There is a possibility after April, May -- and inflation numbers, they start coming down quite fast." (BBG)

BRAZIL: Brazil's two largest cities will be governed by centrists who defeated candidates backed by President Jair Bolsonaro in nationwide municipal elections, consolidating the return of more moderate political actors following a conservative wave that swept the country two years ago. Brazilians went to the polls on Sunday to choose mayors for Sao Paulo, Rio de Janeiro and 55 of the country's 5,500 municipalities whose first-round results in the Nov. 15 vote had been inconclusive. Polling stations opened at 7 a.m. and closed at 5 p.m. local time. (BBG)

RUSSIA: Russia's foreign ministry said in a statement on Friday that it had lodged an official protest with the United States over a naval incident in the Sea of Japan, which it said was a provocation designed to disturb the peace. Russia had said on Tuesday that one of its warships had caught and chased off a U.S. destroyer operating illegally in its territorial waters in the Sea of Japan. The U.S. Navy denied wrongdoing and accused Moscow of making excessive maritime claims. (RTRS)

ARGENTINA: Argentina played down the prospects of an early deal with the IMF to repay a controversial $44bn loan, as the country's year-old leftist government tries to build a domestic consensus on how to end its economic crisis. After successfully restructuring $65bn of foreign debt with private creditors in August, the government's attention has turned to talks with the IMF, which began this month. "We are fine," insisted Martín Guzmán, economy minister. "In a crisis in the context of a pandemic, the state plays an important role to protect the most vulnerable and co-ordinate actions to maintain stability." (FT)

IRAN: Iran vowed it won't "fall into the trap" of scuppering any future talks with the incoming Biden government following the assassination of a top nuclear scientist. "Iran's scientific and defense policies won't change because of the assassination of one scientist or general," government spokesman Ali Rabiei said in a statement Sunday posted on the government's official website. The Islamic Republic "shouldn't fall into the trap of linking the assassination to past nuclear negotiations," he said. (BBG)

IRAN: President Hassan Rouhani said Iran will respond to the killing of its top nuclear scientist "when the time is right," and accused Israel of an "act of terrorism" in a significant escalation of tensions in the Persian Gulf. Mohsen Fakhrizadeh, a senior nuclear scientist working for the Ministry of Defense, was assassinated Friday in a shootout and car bombing on the outskirts of Tehran. Promising "severe revenge," officials also pointed the finger at the U.S., potentially complicating President-elect Joe Biden's bid to revive the Iranian nuclear deal. (BBG)

IRAN: An opinion piece published Sunday by a hard-line Iranian newspaper urged Iran to attack the Israeli port city of Haifa if Israel carried out the killing of the scientist who founded the Islamic Republic's military nuclear program in the early 2000s. (Associated Press)

IRAN: U.N. Secretary-General Antonio Guterres urged restraint on Friday, a U.N. spokesman said, after an Iranian nuclear scientist long suspected by the West of masterminding a secret atomic weapons program was assassinated near Tehran. (RTRS)

MIDDLE EAST: Saudi Arabia has stepped up its efforts to resolve its more than three-year dispute with Qatar after US president Donald Trump's election defeat, according to people briefed on the talks. (FT)

EQUITIES: The chances that Jack Ma's Ant Group Co. will be able to revive its massive stock listing next year are looking increasingly slim as China overhauls rules governing the fintech industry, according to regulatory officials familiar with the matter. (BBG)

METALS: Brazilian miner Vale SA has received approval from environmental authorities in the northern state of Para to resume expansion activities at its Serra Leste mine, it said in a Friday securities filing. The expansion includes the refurbishment of a iron ore mill that is scheduled to bring the processing capacity of the installation to 10 million tonnes per year by early 2023, the company said. (RTRS)

OIL: A panel of OPEC+ ministers couldn't reach an agreement on whether to delay January's oil-output increase, leaving the matter unresolved before a full meeting of the cartel and its allies on Monday. Most participants in an informal online discussion on Sunday evening supported maintaining the production curbs at current levels into the first quarter, said a delegate. Yet while Russian Deputy Prime Minister Alexander Novak spoke in favor of postponing the supply hike that's currently scheduled to happen in the new year, the United Arab Emirates and Kazakhstan were opposed, said the delegate, asking not to be named because the talks were private. (BBG)

OIL: Iraq will not ask OPEC for exemption from a pact aimed at reducing output, and oil prices are expected to reach about $50 at the beginning of 2021, the al-Sabah state cited the oil minister as saying in a report on Sunday. The minister, Ihsan Abdul Jabbar, said the commitment of members to the deal would help boost oil prices and Iraq was not seeking exemption "fearing from new retreat in oil prices", the newspaper reported. (RTRS)

OIL: Islamic State claimed responsibility on Sunday for attacking the Siniya oil refinery in northern Iraq, according to a statement posted on the group's official channel. The statement said two Katyusha rockets were used in the attack. It gave no further details on any casualties. (RTRS)

OIL: Russia's Nord Stream 2 said on Saturday it planned to resume pipe-laying work on a 2.6 kilometre (1.62 mile) stretch of the stalled Moscow-backed gas pipeline to Europe in Germany's Exclusive Economic Zone. The 1,230 km pipeline under the Baltic Sea, which Moscow hopes will boost the amount of gas it can pump to Europe bypassing Ukraine, is nearly finished but a final stretch of about 120 km still needs to be laid. Work was halted last December when pipe-laying company Swiss-Dutch Allseas suspended operations after U.S. sanctions targeted companies providing vessels to lay the pipes. (RTRS)

OIL: Russia can probably get around the latest U.S. sanctions against Nord Stream 2 and complete the pipeline, industry executives and analysts of the controversial project say. (BBG)

CHINA

CORONAVIRUS: Wuhan, where the Coronavirus pandemic first broke out, reported three imported frozen food packaging samples tested positive for Covid 19, the city's health commission said in a statement on Saturday. Two of them samples were taken from frozen Brazilian beef stored in a refrigerated warehouse in the central Chinese city. A third sample from frozen Basa fish from Vietnam in another warehouse. (BBG)

ECONOMY: China's GDP growth may reach 8.1% as macroeconomic indicators have improved strongly each quarter, YiCai reported citing forecasts from the China Macroeconomy Forum at Renmin University. Policymakers should however be cautious as many extraordinary policies supporting the current economic rebound end next year, according to Liu Yuanchun, the Vice Dean of the state-run school with ties to PBOC. China needs to continue to expand domestic demand while maintaining ample supply and return to normalized macro control measures, the report said. (MNI)

YUAN: China urges the US to respect existing international rules and the multilateral trading system and stop its anti-subsidy investigation into the alleged undervaluation of the Chinese currency exchange rate, Chinese commerce authority said on Saturday, in response to the preliminary findings of the countervailing duty (CVD) case against China launched by the US Department of Commerce. (Global Times)

PBOC: China's overall credit growth in 2021 is likely to be marginal as the PBOC had signaled a more neutral policy approach, according to an editorial in the Economic Information Daily. The central bank's Q3 Monetary Policy Implementation Report focused on the importance of controlling the overall money supply, and the stabilization of the rising macro leverage ratio, the editorial said. The PBOC is likely to utilize multiple policy tools to ensure ample liquidity and stable market rates, and to match M2 money supply and the growth of social financing with nominal GDP growth, the Daily said. (MNI)

DEFAULTS: The head of one of China's largest state-owned manufacturers has said mismanagement by local governments is partly to blame for business failures that have prompted a cascade of bond defaults. The comments from Wang Min, president of XCMG Group, the country's biggest construction machinery business, came after China's multitrillion-dollar debt markets were rocked by defaults at government-backed companies, raising concerns about the wider financial system. "The fall of state firms isn't just a result of bad management, unclear strategy and inadequate entrepreneurship," said Mr Wang, in unusually frank remarks from a state-owned Chinese group, during an interview with the Financial Times. "It also has to do with government mismanagement that puts [unreasonable] performance targets on these companies." (FT)

DEFAULTS: Lithium is a necessary component for batteries to power everything from smartphones to electric vehicles. Even though China is ahead of the curve in this key sector, Tianqi Lithium, one of the largest global lithium producers in China, is on the brink of defaulting on a loan worth $1.884 billion. (Nikkei)

QDLP: China's forex regulator plans to raise quotas for outbound investment schemes - Qualified Domestic Limited Partnership (QDLP), Qualified Domestic Investment Enterprise – in Shanghai, Beijing and Shenzhen. Hainan free trade port and Chongqing to be added to the QDLP list. (Global Times)

OVERNIGHT DATA

CHINA NOV M'FING PMI 52.1; MEDIAN 51.5; OCT 51.4

CHINA NOV NON-M'FING PMI 56.4; MEDIAN 56.0; OCT 56.2

CHINA NOV COMPOSITE PMI 55.7; OCT 55.3

MNI DATA IMPACT: China Nov PMI Soars To 52.1, A 3-Year High

- China's November manufacturing Purchasing Manager Index jumped to 52.1 from 51.4 the previous month, registering the highest level since October 2017 - for more details please contact sales@marketnews.com.

JAPAN OCT, P INDUSTRIAL OUTPUT -3.2% Y/Y; MEDIAN -4.6%; SEP -9.0%

JAPAN OCT, P INDUSTRIAL OUTPUT +3.8% M/M; MEDIAN +2.4%; SEP +3.9%

JAPAN OCT RETAIL SALES +6.4% Y/Y; MEDIAN +6.2%; SEP -8.7%

JAPAN OCT RETAIL SALES +0.4% M/M; MEDIAN +0.5%; SEP -0.1%

JAPAN OCT DEPT STORE, SUPERMARKET SALES +2.9% Y/Y; MEDIAN +5.0%; SEP -13.9%

JAPAN OCT HOUSING STARTS -8.3% Y/Y; MEDIAN -8.7%; SEP -9.9%

JAPAN OCT ANNUALIZED HOUSING STARTS 0.802MN; MEDIAN 0.820MN; SEP 0.815MN

JAPAN OCT CONSTRUCTION ORDERS -0.1% Y/Y; SEP -10.6%

AUSTRALIA Q3 COMPANY OPERATING PROFIT +3.2% Q/Q; MEDIAN +4.0%; Q2 +15.8%

AUSTRALIA Q3 INVENTORIES -0.5% Q/Q; MEDIAN -0.7%; Q2 -2.9%

AUSTRALIA OCT PRIVATE SECTOR CREDIT +1.8% Y/Y; MEDIAN +1.9%; SEP +1.9%

AUSTRALIA OCT PRIVATE SECTOR CREDIT 0.0% M/M; MEDIAN +0.1%; SEP 0.0%

AUSTRALIA NOV MELBOURNE INSTITUTE INFLATION +1.4% Y/Y; OCT +1.1%

AUSTRALIA NOV MELBOURNE INSTITUTE INFLATION +0.3% M/M; OCT -0.1%

NEW ZEALAND NOV, F ANZ BUSINESS CONFIDENCE -6.9; FLASH -15.6

NEW ZEALAND NOV, F ANZ ACTIVITY OUTLOOK 9.1; FLASH 4.6

The New Zealand business sector is feeling increasingly upbeat. Business confidence is the highest since late 2017 – albeit still negative! Excellent vaccine news may have had something to do with the lift seen across the survey this month, and very likely the spending vibe associated with the still-buoyant housing market. Tests lie ahead for the economy, still – in particular, the fallout from struggling tourism businesses, significantly disrupted freight (we'll ask firms about that specifically in next month's survey), labour shortages in pockets, and volatility in trading partner economies. It's not all fun and games out there by any means – there are pockets of extreme hardship and stress. This shock has pulled the rug out completely from a small proportion of people while leaving most others unscathed. But there's no question that the New Zealand economy in aggregate has much more momentum than seemed likely only a few months ago. Monetary and fiscal policy have undoubtedly done their jobs this year. But it's worth remembering that both work by bringing forward spending from the future. There's no free lunch, and they need to be used judiciously. The true underlying momentum of the economy should become clearer over the next few months as the impact of one-offs fade, but the case for further life-support measures is becoming less clear by the day. And that's certainly something to celebrate. (ANZ)

SOUTH KOREA OCT INDUSTRIAL OUTPUT -2.2% Y/Y; MEDIAN +0.3%; SEP +8.1%

SOUTH KOREA OCT INDUSTRIAL OUTPUT -1.2% M/M; MEDIAN -1.7%; SEP +5.5%

SOUTH KOREA OCT CYCLICAL LEADING INDEX CHANGE +0.4; SEP +0.5

UK NOV LLOYDS BUSINESS BAROMETER -21; OCT -18

CHINA MARKETS

PBOC NET INJECTS CNY310BN VIA OMOS MON

The People's Bank of China (PBOC) injected CNY150 billion via 7-day reverse repos with rates unchanged at 2.2% on Monday. The PBOC also issued CNY200 billion through medium-term lending facilities (MLF) and kept the rate at 2.95%. This resulted in a net injection of CNY310 billion given the maturity of CNY40 billion repos today, according to Wind Information.

- The operation aims to maintain the liquidity stable in the banking system at the end of the month, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.2155% at 09:29 am local time from the close of 2.3676% on last Friday.

- The CFETS-NEX money-market sentiment index closed at 37 last Friday vs 33 last Thursday. A lower index indicates decreased market expectations for tighter liquidity.

PBOC SETS YUAN CENTRAL PARITY AT 6.5782 MON VS 6.5755

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5782 on Monday, compared with the 6.5755 set on Friday.

MARKETS

SNAPSHOT: China PMIs Beat, PBoC Uses Surprise MLF, News Flow Mixed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 201.91 points at 26444.04

- ASX 200 down 83.251 points at 6517.8

- Shanghai Comp. up 12.724 points at 3421.226

- JGB 10-Yr future down 5 ticks at 152.0, yield down 0bp at 0.031%

- Aussie 10-Yr future up 0.5 ticks at 99.105, yield down 0.5bp at 0.896%

- U.S. 10-Yr future unch. at 138-06, yield down 0.16bp at 0.836%

- WTI crude down $0.60 at $44.93, Gold down $18.99 at $1768.82

- USD/JPY down 22 pips at Y103.87

- UK REGULATOR SET TO APPROVE COVID-19 VACCINE THIS WEEK (FT)

- TRUMP TO ADD CHINA'S SMIC AND CNOOC TO DEFENSE BLACKLIST (RTRS SOURCES)

- EU PITCHES NEW POST-TRUMP ALLIANCE WITH US IN FACE OF CHINA CHALLENGE (FT)

- BREXIT MOOD MUSIC MIXED, FISHING ISSUES VS. OPTIMISM

- CHINA OFFICIAL PMIS BEAT, PBOC SURPRISES WITH MLF

- ANT IS SAID TO FACE SLIM CHANCE OF GETTING IPO DONE IN 2021 (BBG SOURCES)

BOND SUMMARY: Caught In The Middle Of Cross Currents

Sizable month-end rebalancing/duration extension estimates for Tsys cushioned the broader core global FI space in early dealing this week, as did the dip in crude oil prices, which provided some counter to the modest early uptick in e-minis and stronger than expected Chinese PMI data. Still, core FI markets stuck to tight ranges as Asia-Pac markets closed out the month of November.

- T-Notes unchanged, last printing at 138-06, with the contract sticking to a 0-02+ range overnight, on light volume. Cash Tsys are little changed across the curve. The space has seen little in the way of meaningful outright flows.

- Mixed local data has done little to move the needle for Aussie bonds, while broader macro headline flow remains light, making for a rangebound start to this week's Sydney trade as participants look to a busy local docket over the coming days. YM -1.0 XM unchanged. Swap spreads edge wider across most of the curve.

- JGB futures sit 5 ticks below settlement levels after softening in early Tokyo dealing this week, perhaps as participants keep one eye on the upcoming rounds of JGB supply. The latest round of BoJ Rinban ops seemingly has little in the way of notable impact on the space, despite a jump in the offer/cover ratio for the 25+ Year operations.

BOJ: Rinban Purchase Sizes Unchanged

The BoJ offers to buy a total of Y450bn of JGB's from the market, sizes unchanged from previous operations.

- Y420bn worth of JGBs with 3-5 Years until maturity

- Y30bn worth of JGBs with 25+ Years until maturity

EQUITIES: Struggling For Clear Direction At Month End

A mixed round of inputs re: COVID matters, stronger than expected Chinese PMI data, a surprise round of liquidity injections from the PBoC (via MLF), month-end related flow and mixed Brexit mood music left the broader equity space struggling for a clear sense of direction in early Asia-Pac trade.

- Monday represents the final session of a record-breaking month for global equities (in terms of gains), which means potential headwinds from rebalancing flows and hedging activity.

- E-minis initially focused on the positives from the weekend, before running out of steam given their proximity to their respective all-time highs, while a heavy Asia-Pac session for crude oil markets also provided a source of pressure. This saw the space more than reverse its early gains, trading lower as we moved through overnight dealing.

- The CSI 300 outperformed its regional peers, aided by the aforementioned liquidity injection from the PBoC and stronger than expected PMI prints, which allowed the broader index to push higher, even after RTRS sources reported that "the Trump administration is poised to add China's top chipmaker SMIC and national offshore oil and gas producer CNOOC to a blacklist of alleged Chinese military companies."

- Nikkei 225 -0.7%, Hang Seng -0.5%, CSI 300 +1.3%, ASX 200 -0.7%.

- S&P 500 futures -17, DJIA futures -187, NASDAQ 100 futures -11.

OIL: Oil Struggles As Cracks Appear In OPEC+ Pact Discussions

WTI & Brent are off worst levels but still sit some ~$0.60 lower vs. their respective settlement levels as we move towards European hours.

- The OPEC+ JMMC meeting, held on Sunday, seemingly resulted in a lack of cohesion among participating nations, with source reports pointing to the failure of Russia, Kazakhstan & the UAE re: backing an extension of the current production quotas through the early part of '21.

- Reporters have noted that the full OPEC ministerial gathering will begin at 14:00 Vienna time on Monday, with the OPEC+ ministerial meeting set to get underway on Tuesday (providing the existing timetable holds).

GOLD: Next Support Eyed, With ETFs Shedding Exposure

The recent pressure on bullion extended into the first trading session of the new week, with spot shedding ~$16/oz to last deal around $1,770/oz after bottoming out just above the 50% retracement of the March to August rally, located at $1,763.5/oz. The continued leg lower in known ETF gold holdings has been the dominant theme in recent sessions, even with the DXY trading on the backfoot and limited movement for U.S. real yields.

FOREX: JPY Bid On Equity Sell-Off, CHF Buoyed By Referendum Results, GBP Gains On Brexit Sentiment

Initial pressure on safe haven currencies faded away as e-minis and equity benchmarks in Japan, Australia, Hong Kong & South Korea shed gains and turned red, with focus on the proximity of all-time highs in e-minis, heavy start to the week for crude oil and month-end flows. JPY recovered, further aided by a round of purchases vs. the greenback into the Tokyo fix, even as it is a Gotobi day in Japan. USD struggled to shake off its earlier weakness, after the DXY printed worst levels since mid-2018.

- CHF was the best G10 performer after Swiss voters taking part in the weekend referendums rejected two proposals to (1) make multinational companies liable for human rights/environmental abuses committed abroad & (2) ban funding of weapons producers. The allowed the SNB to avoid shedding ~CHF20bn in equities held as part of its reserves.

- GBP garnered strength with Brexit sentiment swaying towards the positives. Over the weekend, UK Foreign Sec Raab said that a Brexit deal could be struck as soon as this week, even as fishing rights remain a key sticking point.

- Oil-tied CAD & NOK came under pressure as oil traded on a softer footing. The Antipodeans firmed up in early trade, with NZD/USD printing best levels since mid-2018 & AUD/USD narrowing in on a key bull trigger/Sep 1 high. Both crosses shed gains later in the session, with the rapidly escalating Sino-Australian friction weighing on local sentiment. Worth noting that in the absence of notable headline flow the $0.7400 level in AUD/USD may display a degree of magnetism, with A$777mn worth of options with strikes at that figure due to expire today.

- CNH strength evaporated despite the release of above-forecast official PMI readings out of China, with the m'fing gauge indicating that expansion in the sector accelerated to the fastest pace since Sep 2017.

- USD/KRW edged away from cycle lows after South Korea raised the level of social restrictions outside of greater Seoul area, while local industrial output unexpectedly shrank on a M/M basis.

- Today's data highlights include U.S. MNI Chicago PMI, flash German & Italian CPIs, Canadian building permits & current a/c balance. Central bank speaker slate features ECB's Lagarde, Fed's Barkin & BoE's Tenreyro.

FOREX OPTIONS: Expiries for Nov30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1800(E502mln), $1.1900(E808mln), $1.1950-65(E511mln), $1.2000(E402mln)

- USD/JPY: Y102.00($790mln-USD puts), Y103.00($882mln-USD puts), Y104.00($572mln), Y105.25($576mln)

- AUD/USD: $0.7400(A$777mln-AUD calls)

- USD/CNY: Cny6.50($515mln)

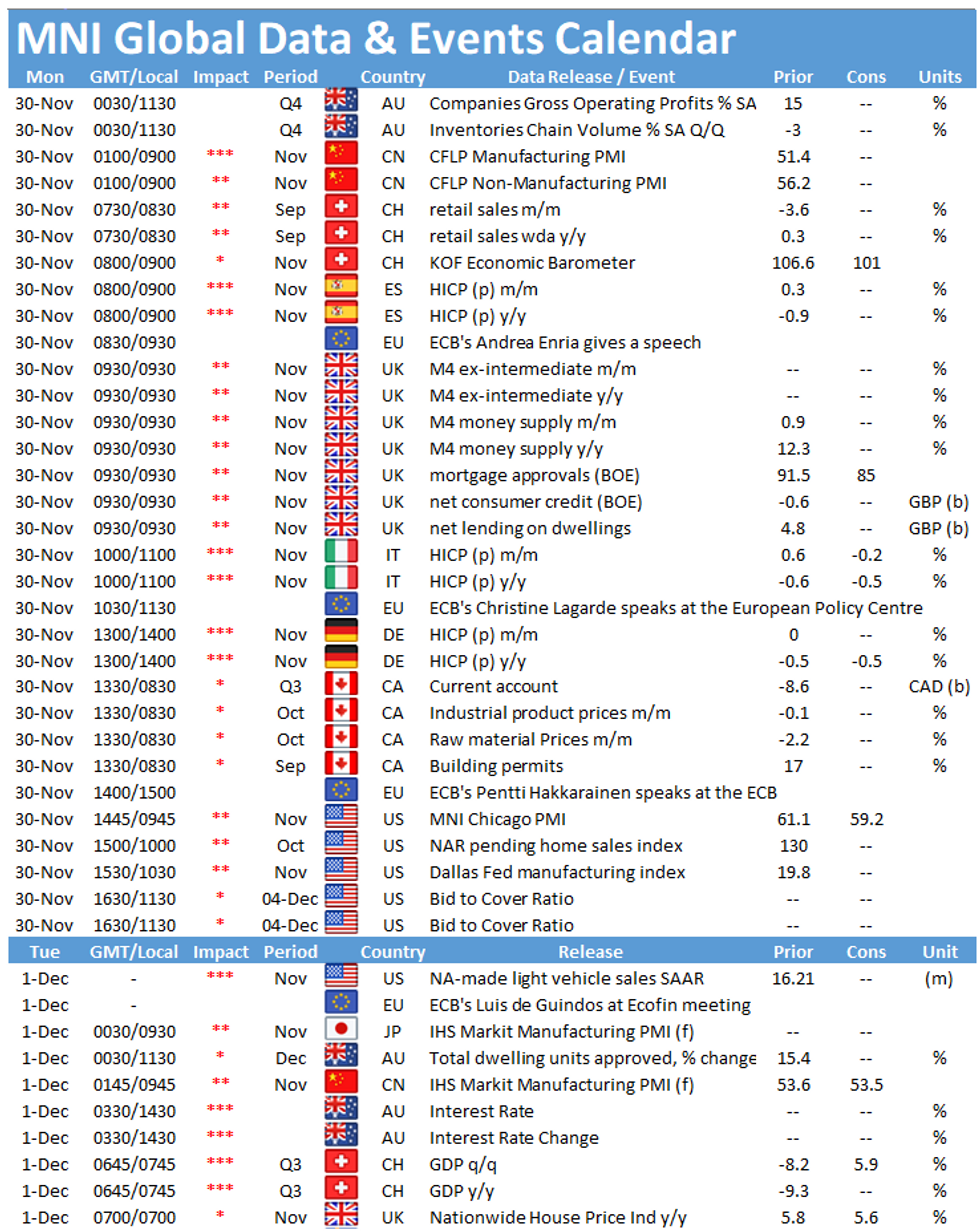

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.