-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessForward Rates Pricing +40bp in SARB Hikes Over 3-6m Period

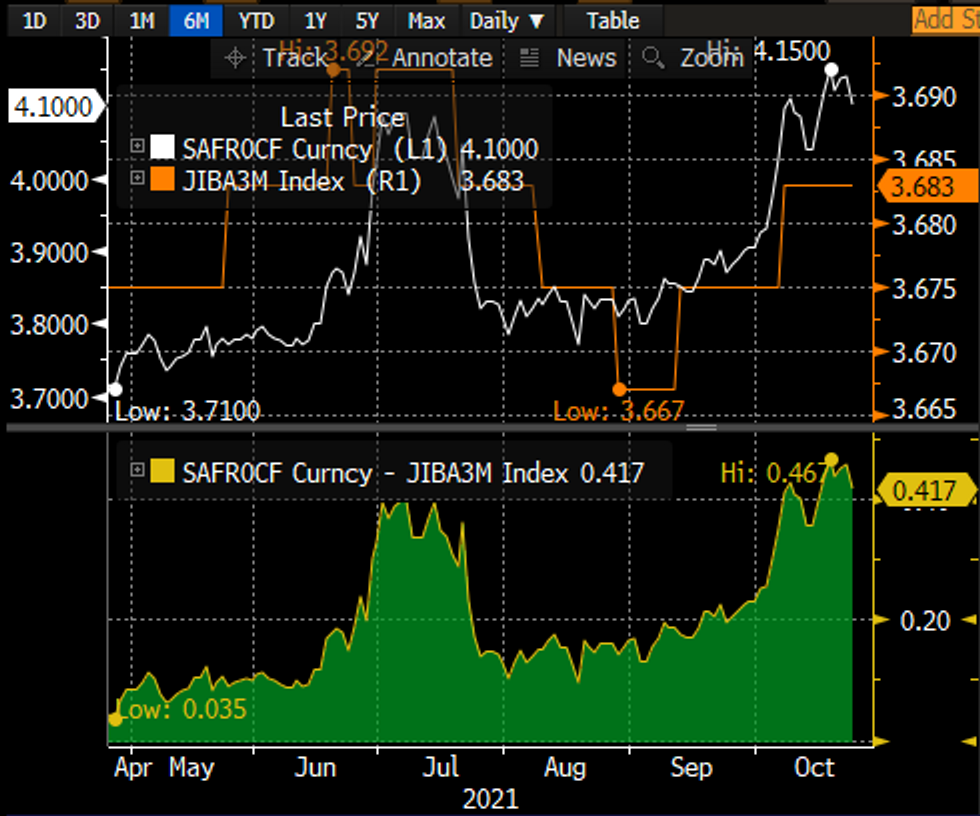

- 3x6 FRA-Jibar spreads currently stand at +41.7bp, having risen from +16.8bp at the start of September – broadly in line with the sharp move higher in oil prices. The SARB has kept policy accommodative and on hold at 3.5% since November 2020 and a divergence is (once again) appearing between local and international analysts – with the latter calling for a +25bp hike in November over concerns that the SARB is falling behind the curve in terms of policy normalisation.

- As seen in the spreads chart below, markets mispriced a hike in July following social unrest – which foreign analysts expected to force the SARB into hiking rates, despite broadly contained medium-term forecasts and a weak domestic demand impulse.

- This failed to materialise in July and may do so again in November with international

analysts expecting the oil crunch to force the SARB's hand once again. While

this time may be a closer call, we do not see this as our base case going into

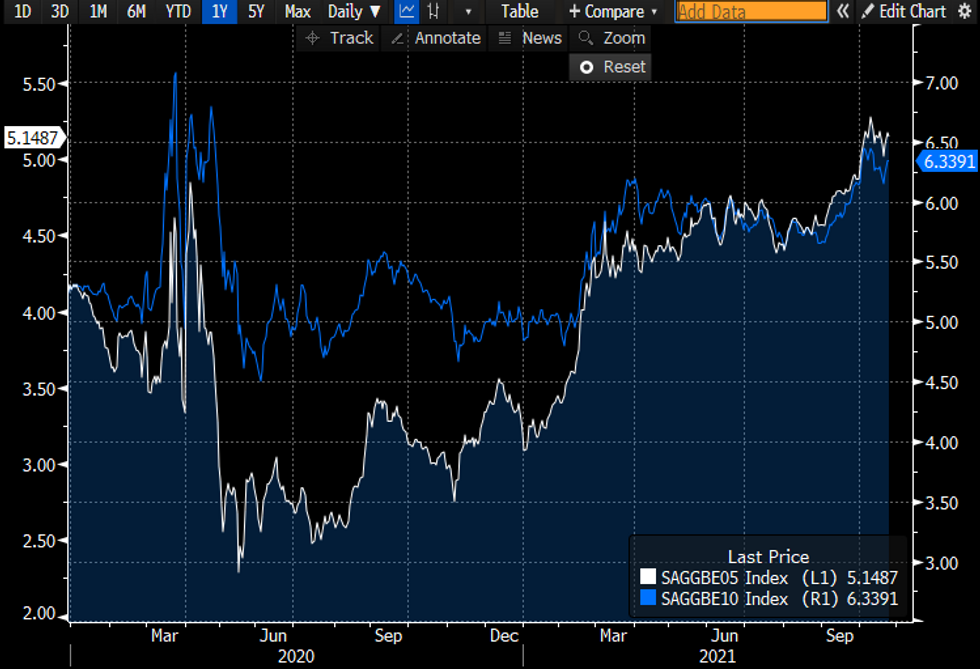

the next meeting. The rise in expectations has also been reflected in 5 &

10Y breakevens, which have risen +58-65bp since September, but shown faltering

upside momentum in October.

- * Going into the November meeting, Kganyago will be acutely aware of the impact of a hiking cycle on the fragile domestic recovery at a time when unemployment is so critically elevated. Moreover, both consumer and credit demand are expected to face headwinds in 2022 – making a hiking cycle rather unpalatable for SA's recovery prospects.

- While Kganyago's guidance at the prior SARB meeting acknowledged the possibility of upside revisions to the CPI forecasts on elevated oil prices – this is not something that can be addressed by hiking rates at this juncture. PPI data this week will be a critical benchmark to gauge, but it seems hard to argue that with CPI at 5.0% and PPI at 7.2-7.3% that the SARB would hamper the course of the recovery to hike at this stage – and may rather wait for early 2022 to assess whether a hike to temper passthrough from higher oil prices is necessary.

- Moreover, the focus on the medium-term disinflationary trajectory (2022 avg CPI 4.2%, 2023 4.3%) should be a dominant driving factor in the decision. This may be revised slightly higher at the next meeting, however. Any hikes delivered in 2022 would likely also be tactical, measured and inordinately data dependent between meetings, outside of an unforeseen spike in inflation pressures above the target range.

3x6 FRA-Jibar Spreads

3x6 FRA-Jibar Spreads

5 & 10Y Breakevens

5 & 10Y Breakevens

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.